___

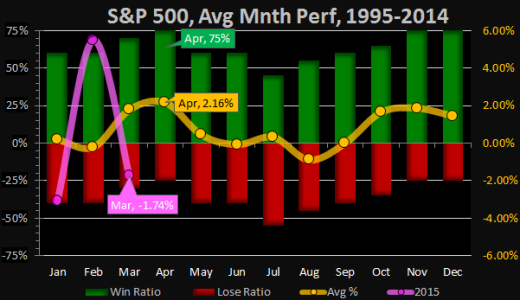

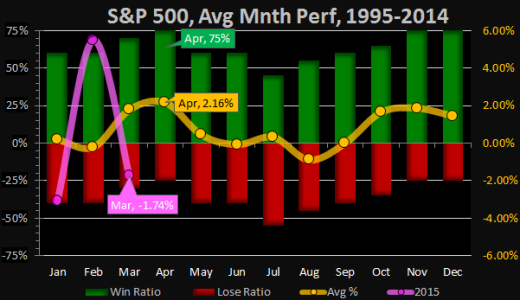

March was not a good month. For the S&P 500, March closed down -1.74% this is below the 1.78% average returns, for all months of March, ranks 18th over the past 21 years, and 56th over the past 66 years.

For the shorter 20-year trend, we'll compare the month of April against the other 11 months of the year

___

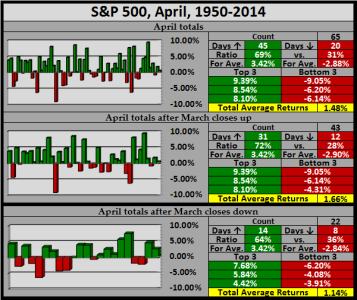

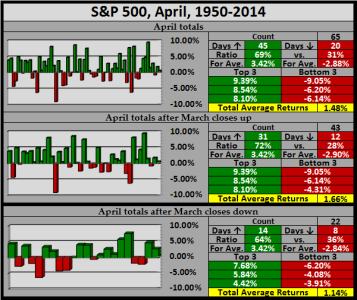

Digging further down into the data, we'll compare April with an up/down March from 1950-2014

___

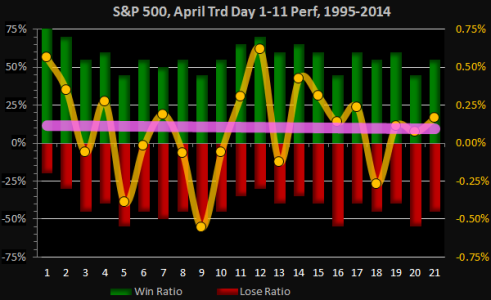

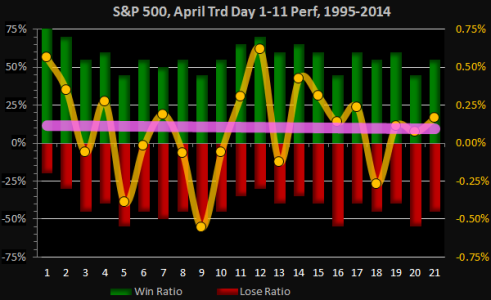

For April, we have trading days 1-21

___

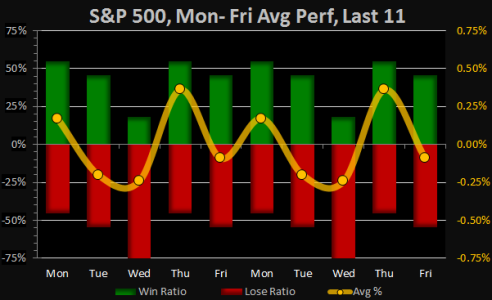

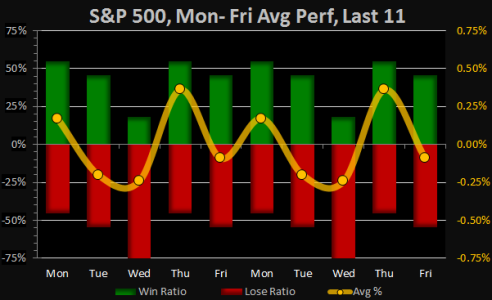

For the last 11 Monday through Fridays

___

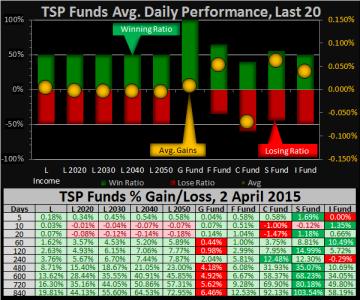

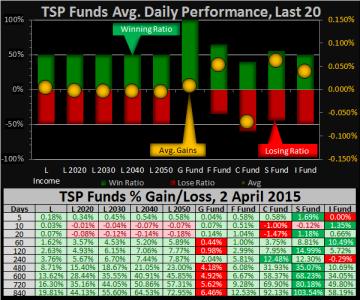

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

I-Fund leads 6.93% YTD but the 20-day average returns for all the funds are very low

___

Previously stated on 3/17/2015 "Optimistically speaking, it is my belief both seasonality and the charts are getting aligned and this gives us potential momentum for the S&P 500 to make a mid-April run for 2175-2225, that's a 4-6 percent move. Conversely, a close back below 2040 will make me re-evaluate the price action."

At this juncture, to meet the minimum 2175 price target, we'd need to gain 5.22% over the course of the next 9 trading days. In the right environment, this could easily happen, but we'll need to see buyers step in with conviction. Conversely, we've not broken below 2040, thus sellers haven't stepped in with conviction either.

Off the cuff…the last 8 of 10 Aprils closed up

Take care..Jason

March was not a good month. For the S&P 500, March closed down -1.74% this is below the 1.78% average returns, for all months of March, ranks 18th over the past 21 years, and 56th over the past 66 years.

For the shorter 20-year trend, we'll compare the month of April against the other 11 months of the year

- We show a 75% winning ratio, which is above average, ranking in a 3-way tie for 1st

- We show 2.16% average returns, which is above average, ranking 1st

- We show 3.79% average positive returns, which is above average, ranking 5th

- We show -2.73% average negative returns, which is above average, ranking 3rd

- In the shorter 20-year trend, April is an excellent performer, within the confines of this data, I'd rank April as the best month of the year

___

Digging further down into the data, we'll compare April with an up/down March from 1950-2014

- We show the last 65 months of April have an average 69% winning ratio and 1.48% average returns

- For the 43 years when March closed up, April has a 72% winning ratio with 1.66% average returns

- For the 22 years when March closed down, April has a 64% winning ratio with 1.14% average returns

- Although April is a strong month, within the confines of this data, April's winning ratio and average returns show a drop in performance

___

For April, we have trading days 1-21

- The average 21-day winning ratio is 58%

- The cumulative 21-day average return is 2.20%

- I've added a pink 21-day linear line to show the overall direction of prices

___

For the last 11 Monday through Fridays

- Mondays has a 55% winning ratio with .17% average returns (2nd best day)

- Tuesdays has a 45% winning ratio with -.20% average returns (2nd worst day)

- Wednesdays has a 18% winning ratio with -.24% average returns (worst day)

- Thursdays has a 55% winning ratio with .36% average returns (best day)

- Fridays has a 45% winning ratio with -.09% average returns (3rd worst day)

- If I added up all the average returns, the total is -.01% below average and is reflective of the markets performance over the past 11 weeks

___

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

- S-Fund ranks 1st with a 55% winning ratio and .06% average returns

- F -Fund ranks 2nd with a 65% winning ratio and .05% average returns

- I-Fund ranks 3rd with a 50% winning ratio and .04% average returns

- C-Fund ranks 4th with a 40% winning ratio and -.07% average returns

I-Fund leads 6.93% YTD but the 20-day average returns for all the funds are very low

___

Previously stated on 3/17/2015 "Optimistically speaking, it is my belief both seasonality and the charts are getting aligned and this gives us potential momentum for the S&P 500 to make a mid-April run for 2175-2225, that's a 4-6 percent move. Conversely, a close back below 2040 will make me re-evaluate the price action."

At this juncture, to meet the minimum 2175 price target, we'd need to gain 5.22% over the course of the next 9 trading days. In the right environment, this could easily happen, but we'll need to see buyers step in with conviction. Conversely, we've not broken below 2040, thus sellers haven't stepped in with conviction either.

Off the cuff…the last 8 of 10 Aprils closed up

Take care..Jason