The action didn't change much today. We did get some token selling pressure followed by more dip buying, but overall the action was dull. And there was nothing worth noting in the news either.

So let's go to the charts:

NAMO and NYMO are not showing much movement, but do remain on sells.

NAHL picked up a bit, but remains on a sell, while NYHL moved a bit higher and managed to just barely trigger a buy.

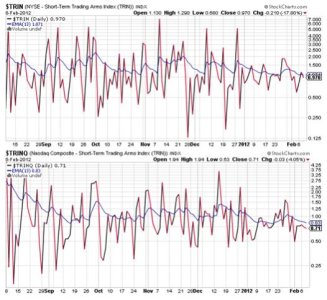

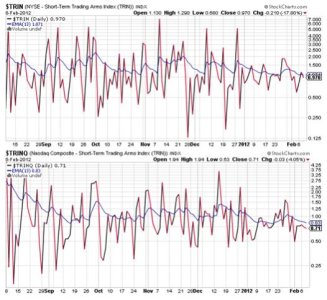

TRIN moved back to a buy today, while TRINQ remained on a buy. Neither is telling me much other than reflecting the light action.

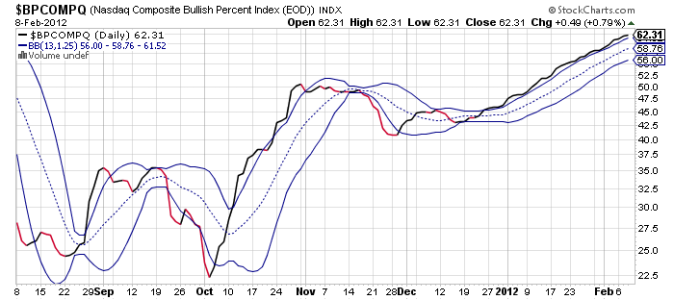

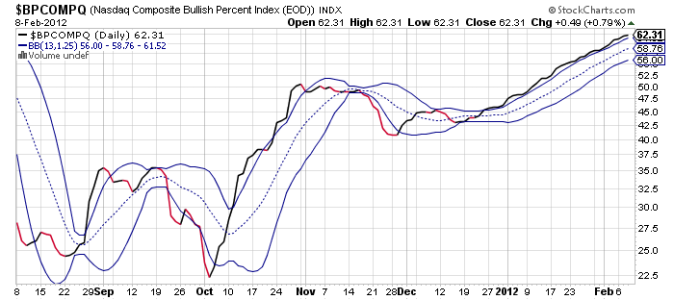

BPCOMPQ remains on a buy.

So the signals remain mixed and quiet, and that leaves the system in a buy condition.

While I have no real reason to be bearish let me reiterate what I said a couple of blogs ago that if we get any movement to the downside that results in moderate losses by the close the Seven Sentinels could trigger a sell signal. I am not suggesting that a sell is imminent, I only want folks to understand that it wouldn't take a hard move lower over multiple days to trigger one. So if you're using this system to help gauge entry and exit points, moderate selling pressure on volume could be a clue. But you'd have to take it at face value as the actual signal condition won't be known until after the close. Think about how you would want to approach that situation if and when it comes.

So let's go to the charts:

NAMO and NYMO are not showing much movement, but do remain on sells.

NAHL picked up a bit, but remains on a sell, while NYHL moved a bit higher and managed to just barely trigger a buy.

TRIN moved back to a buy today, while TRINQ remained on a buy. Neither is telling me much other than reflecting the light action.

BPCOMPQ remains on a buy.

So the signals remain mixed and quiet, and that leaves the system in a buy condition.

While I have no real reason to be bearish let me reiterate what I said a couple of blogs ago that if we get any movement to the downside that results in moderate losses by the close the Seven Sentinels could trigger a sell signal. I am not suggesting that a sell is imminent, I only want folks to understand that it wouldn't take a hard move lower over multiple days to trigger one. So if you're using this system to help gauge entry and exit points, moderate selling pressure on volume could be a clue. But you'd have to take it at face value as the actual signal condition won't be known until after the close. Think about how you would want to approach that situation if and when it comes.