Another sell-off, another rally, but the bulls lost even more ground today in spite of the mixed close. And flight to quality was evident as the DOW closed up 0.54%, which the Nasdaq and S&P 500 closed down 0.94% and 0.06% respectively. The Wilshire 4500, which our S fund tracks, was down another hefty 1.71%, while the EAFE (I fund) managed to close up a very respectable 1.77%.

Stocks started off at the open in positive territory, thanks to a jobs report that showed the unemployment rate had dipped to 9.1%, which wasn't expected. July non-farm payrolls were up by 117,000, which beat estimates of 84,000, while the prior month payrolls was upwardly revised to 46,000 vice the original 18,000 that had been initially reported. Private payrolls jumped to 154,000, which was much better than the 100,000 that had been anticipated.

But once again, selling pressure overwhelmed any attempt to push up prices in spite of the decent unemployment report. A potential U.S. debt rating downgrade continues to weigh on sentiment and that's a stiff headwind at the moment.

Here's today's charts:

No indication that NAMO and NYMO are ready to turn. They dropped deeper into negative territory today.

Very bearish readings for NAHL and NYHL continue as well.

TRIN and TRINQ spiked back into buy conditions, but that hasn't meant much of late. In fact, TRIN is suggesting a moderately overbought condition as a result of the intra-day reversal today.

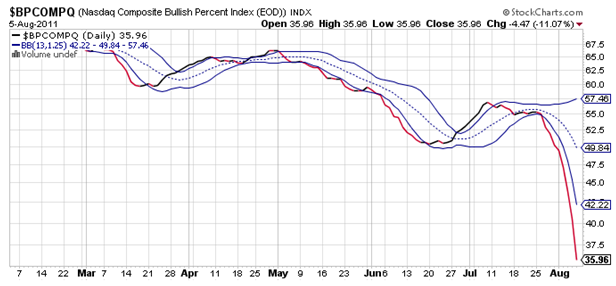

BPCOMPQ is in free-fall.

So the Seven Sentinels continue to paint a very bearish picture, and remain in an intermediate term sell condition.

It's very hard to see our gains evaporate like this in short order. And the lost decade appears to be extending its reach as a result. The only thing we can do is have a plan for recovery and execute it. Some will say don't add to your losses by sticking around, while others say you shouldn't sell into a panic sell-off. Neither group knows what's going to happen over the coming weeks or months, so following either strategy has associated risks.

I'd like to think we're near a bottom in any event, but I can't point to my charts and tell you that. Only that we're due for some relief. And that may not be good enough.

I'll be posting the latest tracker charts by Sunday evening and I'll be interesting to see what's changed, although I'm fairly certain the Top 50 will reflect a very conservative position at this point. This kind of damage will definitely shake things up quite a bit up and down the tracker.