The melt-up continues. I had hoped for a stronger move higher if for no other reason than to get a confirmed buy signal from the Seven Sentinels, but today's action, while bullish, wasn't enough to close to the deal.

There were no real catalysts to drive trading today so I'll go straight to the charts:

NAMO and NYMO remain in a buy condition, with NYMO not far from a 28 day trading high.

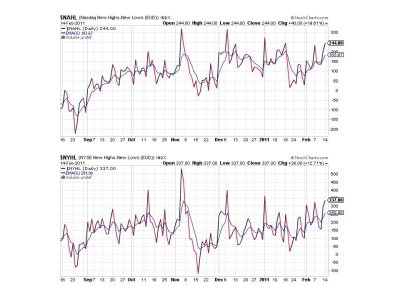

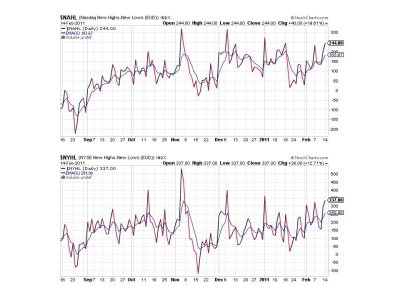

NAHL and NYHL are also flashing buys.

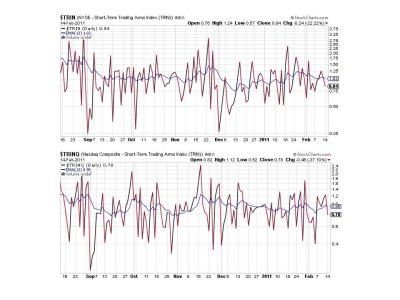

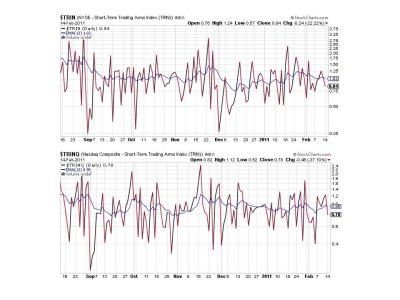

TRIN remains on a buy, while TRINQ flipped to a buy condition after being on a sell Friday.

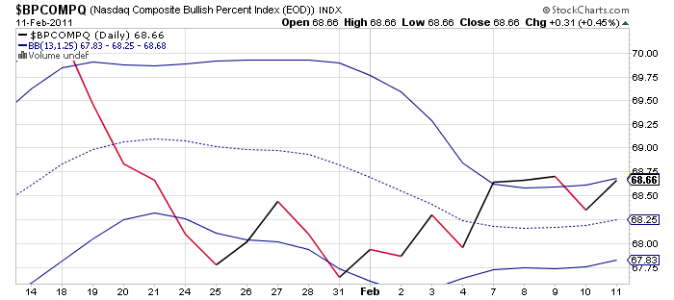

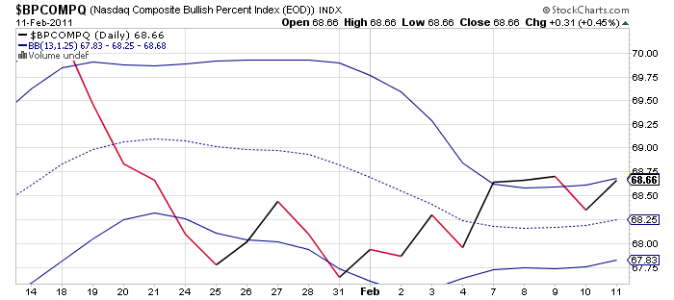

BPCOMPQ just missed moving to a buy signal today as it paused just below the upper bollinger band.

Since I believe the last sell signal to have been invalidated by the continued march higher, I need another signal in order to "officially" declare a new Seven Sentinels signal. If I move forward under that assumption, then the system should still be on a buy. But I can't simply change the system's "official" status in this way. I need another confirmed signal whether it be a buy or a sell. This is how most technicians would approach this situation whenever they receive a false signal. So while the system remains in the G fund, it does so only because I'm waiting for that next signal.

Since this is Options Expiration week, don't be surprised if we get some selling. But there certainly appears to be a floor under this market so it's probably another buying opportunity like so many other dips have been. I am not looking for a major decline as long as liquidity remains high, which it continues to be.

There were no real catalysts to drive trading today so I'll go straight to the charts:

NAMO and NYMO remain in a buy condition, with NYMO not far from a 28 day trading high.

NAHL and NYHL are also flashing buys.

TRIN remains on a buy, while TRINQ flipped to a buy condition after being on a sell Friday.

BPCOMPQ just missed moving to a buy signal today as it paused just below the upper bollinger band.

Since I believe the last sell signal to have been invalidated by the continued march higher, I need another signal in order to "officially" declare a new Seven Sentinels signal. If I move forward under that assumption, then the system should still be on a buy. But I can't simply change the system's "official" status in this way. I need another confirmed signal whether it be a buy or a sell. This is how most technicians would approach this situation whenever they receive a false signal. So while the system remains in the G fund, it does so only because I'm waiting for that next signal.

Since this is Options Expiration week, don't be surprised if we get some selling. But there certainly appears to be a floor under this market so it's probably another buying opportunity like so many other dips have been. I am not looking for a major decline as long as liquidity remains high, which it continues to be.