For the seventh time in eight sessions, the broader market advanced. And while the trading session saw significant buying pressure early on, sellers made their presence known before the first hour of trading was complete. The selling wasn't intense, but it did come in waves and it was persistent in spite of several attempts to take the market higher. Near the end of the trading day stocks were in the red, but shortly before the close the bulls took the averages back above the neutral line. In the final minutes of trading a flurry of selling pressure took the market back down, but not enough to prevent another positive close.

This morning, the August ADP Employment Change revealed that private payrolls had increased by 91,000, which was a bit lower than estimates. It did little to sway trading however.

Here's today's charts:

NAMO backed off a bit today, while NYMO inched a bit higher. Both are at high levels and could be near their apex; especially given today's up and down action.

NAHL and NYHL ebbed a bit higher, but also suggest this market may be slowing down on the upside.

TRIN dropped back into a buy condition, while TRINQ mostly remained where it was yesterday. They still look relatively neutral, but with a bullish bias.

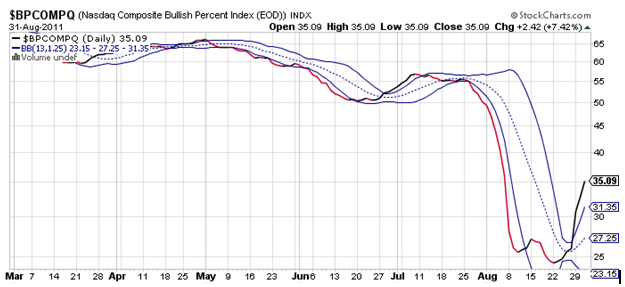

Up a bit more for BPCOMPQ. It's an intermediate term indicator and still looks bullish. I didn't mention it yesterday, but it is no longer suggesting an oversold market now that it's above 30.

So all signals are back to buy conditions, but NAMO and NYMO suggest we could be seeing at least some sideways action if not outright selling pressure soon. And while the longer term looks good according to these charts, if this is still a bear market the bulls could be in for a surprise decline in the not so distant future. It's not a prediction, just a possibility.