czapor1967

Market Tracker

- Reaction score

- 3

I'm giving it a shot, I just moved all into the "C" fund... woot!!!

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

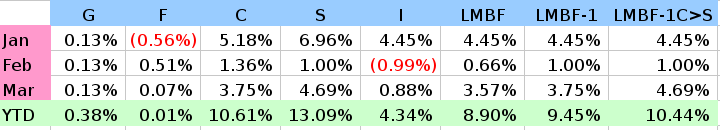

That's the problem with analysing these mechanical systems. Does it really mean anything? All I can say is that both LMBF & LMBF-1 have been outperforming me this year. I'm thinking of spliting the difference and going in 50:50 CS today.Well that's not very encouraging :worried:

Tho you may have nagging feelings about moving to the C Fund, it's the move to make. With possible furloughs on the gov't horizon and doubts about this rise being sustained, mechanical investing like this strategy ignores the news.

I made my interfund transfer request this morning so it will be in effect for Feb 28th. LBMF-1 in force.

Happy investing ya'll!

P.S. I have a buyer for my house and I will be retiring probably the end of April. Tho I will stop contributing to my TSP, I will stay invested and managing my money.

The best fund is S so LMBF-1 goes into the S Fund by noon eastern tomorrow. We are doing this today because the markets will be closed this Friday for Good Friday. Thursday is the last chance you have to make an IFT in March.

Have you heard of the 1st of the month strategy...the 1st has been the most positive day for the markets...thought you would have a take on that...in day before then take profits next day... once a month...hardly any market exposure for as much success this strategy seems to be

Yes, Frixxxx pointed that out in this thread here: http://www.tsptalk.com/mb/longer-term-fund-strategies/15018-alternate-lmbf-methods.html#post391788.Have you heard of the 1st of the month strategy...the 1st has been the most positive day for the markets...thought you would have a take on that...in day before then take profits next day... once a month...hardly any market exposure for as much success this strategy seems to be