-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Alternate LMBF methods

- Thread starter Cactus

- Start date

Cactus

TSP Pro

- Reaction score

- 38

I'll start by describing a simplification I call the Last Month Best Fund Minus 1 Day (LMBF-1) method. What I didn't like about LMBF is that you are in a different fund on the 1st day of the month every time you make an IFT. That happens quite frequently (9 - 10 a year) with this method. Being prone to errors, I wanted to be in a fund the whole month so my return is simply the monthly return for that fund. Monthlies are easily verifiable.

My solution was basically to throw out the last day of the month when figuring out the best fund. I did that so I can make any needed IFT by noon on the last day of the month instead of the first day of the following month. This way you are in the same fund the whole month instead of day 1 being different. You also have the emotional benefit of using a precious IFT at the end of the month instead of the beginning in case you later decide to bail out of this method (not recommended).

I back-tested this method and compared it to the LMBF. As you can see from the 2 tables below, this didn't have a large effect on the fund chosen, though there are some, but it did have a surprisingly large effect on the rate of return. What a difference a day makes.

At first I thought throwing out the last day of the month removed some kind of End-Of-Month effect in choosing the best fund but this doesn't appear to be strictly the case. The biggest difference in fund chosen/year is 3 with an average of 1.33/year. There are 3 years (2006, 2008, 2009) with 3 differences. Two of those years (2006 & 2009) have return differences on the order of 10%, which is the largest we see, but 2008 has a return difference of less that 1% which is among the smallest.

It looks like another factor for the larger returns come from already being in the chosen fund as we enter the new month. Does the FRTIB/Blackrock give us some kind of dividend on the 1st of the month? I do remember a couple of years ago folks trying to take advantage of this day 1 effect. I think it was positive 2 times out of 3. Hmmm.

Another interesting difference is that there are fewer total negative months for LMBF-1 (24 vs. 33) and every year has an equal or fewer number of negative months. This should help in the psychology of sticking with a method long term but isn't itself responsible for greater returns. The big loser year, 2008, only had 2 negative months for LMBF-1 and 3 for LMBF.

Other things to note are the LMBF did produce better results than LMBF-1 for 2 years out of 9 (2007 & 2011). The total return for 2004 - 2012 are 102.50% for LMBF and 163.51% for LMBF-1. Those are the only years I have complete daily data for. I wish I could go back to year 2000 at least, but this does give us 9 years of data to look at and consider.

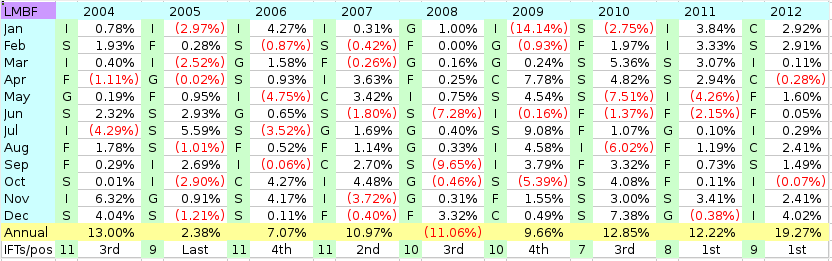

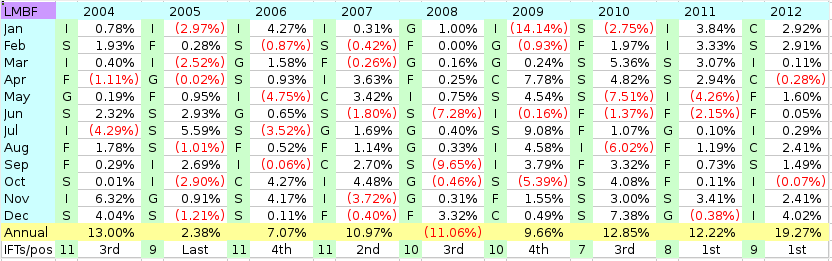

Table 1: LMBF Returns

Note: IFTs/pos represents the number of IFTs in a year and the annual position relative to the 5 TSP Funds respectively. Both methods beat all 5 TSP funds for the last 2 years, but that is only 2 years out of 9.

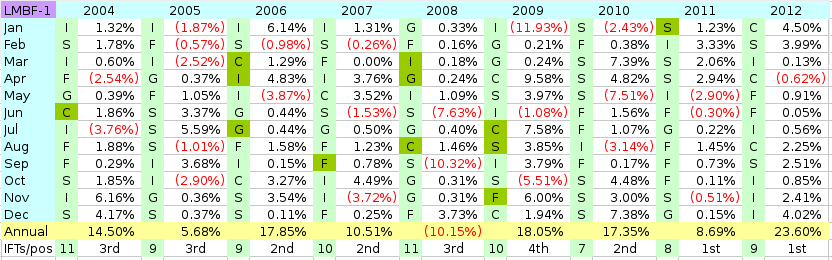

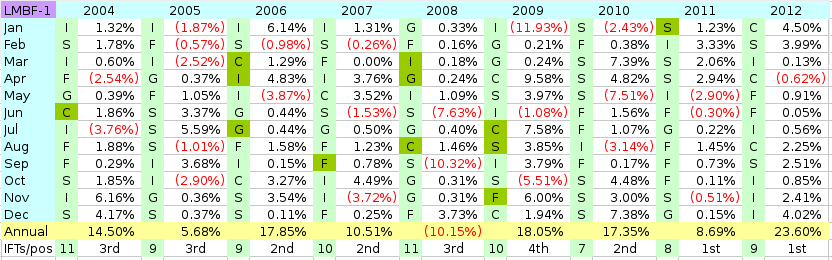

Table 2: LMBF-1 Returns

Note: The olive colored fund blocks represents months where the LMBF-1 chose a different fund from LMBF.

LMBF-1 does look like an interesting modification to pursue. The way it works, again is: 1) Determine the best fund on the penultimate (next to last) day of the month, 2) Make any necessary IFT before Noon Eastern, 3) come back next month and do it again.

I will track the LMBF-1 here and compare it to the LMBF as well as any others that interest me throughout the year.

My solution was basically to throw out the last day of the month when figuring out the best fund. I did that so I can make any needed IFT by noon on the last day of the month instead of the first day of the following month. This way you are in the same fund the whole month instead of day 1 being different. You also have the emotional benefit of using a precious IFT at the end of the month instead of the beginning in case you later decide to bail out of this method (not recommended).

I back-tested this method and compared it to the LMBF. As you can see from the 2 tables below, this didn't have a large effect on the fund chosen, though there are some, but it did have a surprisingly large effect on the rate of return. What a difference a day makes.

At first I thought throwing out the last day of the month removed some kind of End-Of-Month effect in choosing the best fund but this doesn't appear to be strictly the case. The biggest difference in fund chosen/year is 3 with an average of 1.33/year. There are 3 years (2006, 2008, 2009) with 3 differences. Two of those years (2006 & 2009) have return differences on the order of 10%, which is the largest we see, but 2008 has a return difference of less that 1% which is among the smallest.

It looks like another factor for the larger returns come from already being in the chosen fund as we enter the new month. Does the FRTIB/Blackrock give us some kind of dividend on the 1st of the month? I do remember a couple of years ago folks trying to take advantage of this day 1 effect. I think it was positive 2 times out of 3. Hmmm.

Another interesting difference is that there are fewer total negative months for LMBF-1 (24 vs. 33) and every year has an equal or fewer number of negative months. This should help in the psychology of sticking with a method long term but isn't itself responsible for greater returns. The big loser year, 2008, only had 2 negative months for LMBF-1 and 3 for LMBF.

Other things to note are the LMBF did produce better results than LMBF-1 for 2 years out of 9 (2007 & 2011). The total return for 2004 - 2012 are 102.50% for LMBF and 163.51% for LMBF-1. Those are the only years I have complete daily data for. I wish I could go back to year 2000 at least, but this does give us 9 years of data to look at and consider.

Table 1: LMBF Returns

Note: IFTs/pos represents the number of IFTs in a year and the annual position relative to the 5 TSP Funds respectively. Both methods beat all 5 TSP funds for the last 2 years, but that is only 2 years out of 9.

Table 2: LMBF-1 Returns

Note: The olive colored fund blocks represents months where the LMBF-1 chose a different fund from LMBF.

LMBF-1 does look like an interesting modification to pursue. The way it works, again is: 1) Determine the best fund on the penultimate (next to last) day of the month, 2) Make any necessary IFT before Noon Eastern, 3) come back next month and do it again.

I will track the LMBF-1 here and compare it to the LMBF as well as any others that interest me throughout the year.

Hallatauer

TSP Strategist

- Reaction score

- 6

Interesting to see how one day makes such a difference. I'm really surprised how 12 times LMBF-1 chose a different fund 12 times. I wouldn't have thought 1 day difference would ever cause that except once or twice in 10 years. What external force happens at the end of the month/1st of the month to cause this difference... we'll probably never know. Being a long term investor, in both TSP and personal stock accounts, I never took a one day change as significant.

Thanks for taking the time to run the numbers and produce this info.

Thanks for taking the time to run the numbers and produce this info.

JTH

TSP Legend

- Reaction score

- 1,158

Interesting to see how one day makes such a difference. I'm really surprised how 12 times LMBF-1 chose a different fund 12 times. I wouldn't have thought 1 day difference would ever cause that except once or twice in 10 years. What external force happens at the end of the month/1st of the month to cause this difference... we'll probably never know. Being a long term investor, in both TSP and personal stock accounts, I never took a one day change as significant.

Thanks for taking the time to run the numbers and produce this info.

That's one of the problems with with many self-created systems traders create. Sometimes they manipulate the data just enough to get the desired results (often by just a day.) This is why I stress the importance of long/multiple time frame based back-testing. More than a few times we've seen members post how great their system is, then when it goes to crap, they suddenly disappear from the forum...

craigerv

Market Tracker

- Reaction score

- 3

I agree with JTH. When designing a medium-term system, if one day makes a large difference in the result, it is unlikely to reproduce that result. Over time I can only assume that it will regress to a mean. Why not try the LMBF+/-(1-28) and see which date gives you the best return? If you tabulated that for 50 years I think you'd find that the results are fairly similar. It's the same system and acts on the same performance no matter which day you start unless you can align it with some other trend or logic. If you can statistically demonstrate the first day of any month is likely to be positive, then it may be an effect worth pursuing.

Cactus

TSP Pro

- Reaction score

- 38

Yes, I think you are right. This could easily be a fluke of the small time span chosen and better results could be achieved over different days of the month in different time spans. I think it does show that one day can make can make large difference in your annual return, which surprised me, but maybe even that is merely a factor of a volatile market which we've had during this time.I agree with JTH. When designing a medium-term system, if one day makes a large difference in the result, it is unlikely to reproduce that result. Over time I can only assume that it will regress to a mean. Why not try the LMBF+/-(1-28) and see which date gives you the best return? If you tabulated that for 50 years I think you'd find that the results are fairly similar. It's the same system and acts on the same performance no matter which day you start unless you can align it with some other trend or logic. If you can statistically demonstrate the first day of any month is likely to be positive, then it may be an effect worth pursuing.

Running the numbers with +/1 1-28 days is a good idea but better suited to a program than a spreadsheet. I'm too error prone with a spreadsheet which is why I thought of trying this to begin with.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Thanks for testing this system out, Cactus. There is the possibility that better results were achieved for a very simple reason: because you were in the stronger fund on the first day of the month rather than waiting for day #2 to be invested in the stronger fund. Frixx'x chart has a lot to say about that, doesn't it?

You may very well be on to something important here. A nine year total return of 163.5% compared to 102.5% is nothing to sneeze at.

Keep up the good work,

JR

You may very well be on to something important here. A nine year total return of 163.5% compared to 102.5% is nothing to sneeze at.

Keep up the good work,

JR

Cactus

TSP Pro

- Reaction score

- 38

Yes, it does. I like his chart. The fact that he is using the S&P500 gives him a wider time range of data to look at. That's a big plus. I'm looking at the TSP funds and we only have daily data for that going back to mid 2003. After that you're dealing with monthlies back to inception.Thanks for testing this system out, Cactus. There is the possibility that better results were achieved for a very simple reason: because you were in the stronger fund on the first day of the month rather than waiting for day #2 to be invested in the stronger fund. Frixx'x chart has a lot to say about that, doesn't it?

Cactus

TSP Pro

- Reaction score

- 38

OK,here are the monthly returns as of 1/30/13.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 30-Jan-2013 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.12%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (0.63%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"]5.45%[/TD]

[TD="bgcolor: #99CC00, align: right"]6.49%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]4.77% [/TD]

The best fund is S so LMBF-1 goes into the S Fund by noon eastern tomorrow. We'll see tomorrow how that compares with LMBF.

As for me, I think S has topped and is set for a pullback, but hey, I'm just recording the system here not putting my money on the line.

[TD="bgcolor: #FFFF99, align: left"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: left"] 30-Jan-2013 [/TD]

[TD="bgcolor: #CCFFCC, align: right"]0.12%[/TD]

[TD="bgcolor: #CCFFCC, align: right"] (0.63%) [/TD]

[TD="bgcolor: #CCFFCC, align: right"]5.45%[/TD]

[TD="bgcolor: #99CC00, align: right"]6.49%[/TD]

[TD="bgcolor: #CCFFCC, align: right"]4.77% [/TD]

The best fund is S so LMBF-1 goes into the S Fund by noon eastern tomorrow. We'll see tomorrow how that compares with LMBF.

As for me, I think S has topped and is set for a pullback, but hey, I'm just recording the system here not putting my money on the line.

seven

Rising Member

- Reaction score

- 1

I guess I've been doing somewhere between LBMF & LBMF-1. Being 12 or 13hrs ahead of the east coast it gets hard to do on the right day & I've been doing it a day early for awhile. It has worked out pretty good as I got a 20.75% return for 2012 so I think I'll just go ahead declare myself full on LBMF-1 (for now at least).

Sensei

TSP Pro

- Reaction score

- 27

I guess I've been doing somewhere between LBMF & LBMF-1. Being 12 or 13hrs ahead of the east coast it gets hard to do on the right day & I've been doing it a day early for awhile. It has worked out pretty good as I got a 20.75% return for 2012 so I think I'll just go ahead declare myself full on LBMF-1 (for now at least).

Sounds like maybe we're in the same part of the world. I stay up way past my bedtime though. ZZZzzz...

seven

Rising Member

- Reaction score

- 1

That's awsome, seven! You beat LMBF for 2012 which itself had an impresive return. Did you by any chance follow the method for 2011? LMBF beat LMBF-1 hansomely that year, but it's the long term results that count.

No, but I'm glad you asked as that got me looking closer into my history & I realized I didn't actually follow LMBF for all of 2012.

I was a new hire in 2011 and started in Lifecycle fund through Q1 of 2012 which is when I found out about LMBF. Initially, I was trying a modified version of LMBF I thought of, but I decided it was more work & didn't seem worth it so I gave up on it pretty quick. So, I've probably only been doing LMBF (or LMBF-1) for about 7 or 8 months.

Hallatauer

TSP Strategist

- Reaction score

- 6

I went a day early a la LMBF-1 tho I had the same thought you had about the S Fund having a good run up... but the point of being mechanical is to ignore these signs and just follow the method. I'll take the +0.92 rise in the S Fund today instead of missing it like the non LBMF-1ers did.

Cactus

TSP Pro

- Reaction score

- 38

Yep, LMBF & LMBF-1 are both tracking The S Fund for Feb, but LMBF-1 benefited this time from getting on board a day earlier. It will be interesting to see how many times that happens this year.

You are right, Hallatauer, that the point of these types of methods is to follow them mechanically instead of inserting our own logic into them. I guess I'm still in the mode of analyzing them. :cheesy:

You are right, Hallatauer, that the point of these types of methods is to follow them mechanically instead of inserting our own logic into them. I guess I'm still in the mode of analyzing them. :cheesy:

Cactus

TSP Pro

- Reaction score

- 38

OK,here are the monthly returns as of 2/27/13.

[TD="bgcolor: #FFFF99, align: center"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] 27-Feb-2013 [/TD]

[TD="bgcolor: #CCFFCC"]0.12%[/TD]

[TD="bgcolor: #CCFFCC"]0.43%[/TD]

[TD="bgcolor: #99CC00"]1.44%[/TD]

[TD="bgcolor: #CCFFCC"]0.91%[/TD]

[TD="bgcolor: #CCFFCC"] (1.46%) [/TD]

The best fund is C so LMBF-1 goes into the C Fund by noon eastern tomorrow. And to think just yesterday the F Fund was in the lead. What a difference a day makes. :blink: We'll have to see if this trend continues tomorrow for LMBF.

[TD="bgcolor: #FFFF99, align: center"] Date [/TD]

[TD="bgcolor: #FFFF99, align: center"] G FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] F FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] C FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] S FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] I FUND [/TD]

[TD="bgcolor: #FFFF99, align: center"] 27-Feb-2013 [/TD]

[TD="bgcolor: #CCFFCC"]0.12%[/TD]

[TD="bgcolor: #CCFFCC"]0.43%[/TD]

[TD="bgcolor: #99CC00"]1.44%[/TD]

[TD="bgcolor: #CCFFCC"]0.91%[/TD]

[TD="bgcolor: #CCFFCC"] (1.46%) [/TD]

The best fund is C so LMBF-1 goes into the C Fund by noon eastern tomorrow. And to think just yesterday the F Fund was in the lead. What a difference a day makes. :blink: We'll have to see if this trend continues tomorrow for LMBF.

Sensei

TSP Pro

- Reaction score

- 27

Very interesting. When I see the C fund outperforming the S fund, it gives me bearish thoughts. Or it could mean that there is a rally ahead and the small caps have some catching up to do. Whatever the case may be, I doubt the C fund will string two months in a row as the top performer. Nevertheless, the system is what it is. Thanks for keeping it up.

BTW, do you have it on the auto tracker?

BTW, do you have it on the auto tracker?

Hallatauer

TSP Strategist

- Reaction score

- 6

Tho you may have nagging feelings about moving to the C Fund, it's the move to make. With possible furloughs on the gov't horizon and doubts about this rise being sustained, mechanical investing like this strategy ignores the news.

I made my interfund transfer request this morning so it will be in effect for Feb 28th. LBMF-1 in force.

Happy investing ya'll!

P.S. I have a buyer for my house and I will be retiring probably the end of April. Tho I will stop contributing to my TSP, I will stay invested and managing my money.

I made my interfund transfer request this morning so it will be in effect for Feb 28th. LBMF-1 in force.

Happy investing ya'll!

P.S. I have a buyer for my house and I will be retiring probably the end of April. Tho I will stop contributing to my TSP, I will stay invested and managing my money.

Similar threads

- Replies

- 6

- Views

- 709