2010 Market Expectations

Only 20 eligible YTD folks beat the benchmark S&P 500 and that's pretty impressive considering the IFT limitations placed on us. A HUGE congrats go out to BigJohn who placed number 1 for 2009 and is a consistent winner, beating the S&P 500 in 2008 and placing YTD 14th 2007.

I have to admit I'm not overly optimistic about 2010's market. Based on previous Bear markets my expectations are the S&P 500 will trade between Fibonacci's 1020-1230. Still, although I expect a side-ways market, that doesn't mean there isn't a lot of money to be made with just a few well-timed IFTs.

Here is a look at the Market Carpet for Bonds. As you know it's ugly out there and I see no signs of the pain letting up till perhaps late May-July based on Bond Seasonality showing these are the months when Yields tend to fall. From AGG's all time low to high we've retraced roughly 23.6% and my expectations are we will eventually visit the 38.2% before the pain stops (if it does.)

The last time I posted the American Market Carpet it was all in the green. The (39, 1) slow stochastic for the Transports, the Mid-Caps, and the Vix have left their embedded levels and turned yellow. Troublesome is watching our leader the Transports open and close below the rising wedge.

Sometimes I like to use Price Performance Percentage charts to directly compare markets with each other and identify when one market will overtake another. Colored in pink, the S&P 600 serves as a loose comparison with our S-Fund. If you look at the 3 month chart you can see where it bottomed out far below the other markets in November, yet gained much ground in the second half of December.

With the I-fund's Market Carpet all eyes are on the Dollar. My ADI (Axial-Drifter-Intermediate) system placed the I-fund on a sell 18 Dec. I'll point out some seasonal information suggests a bias for the dollar to gain against the Euro & Yen in Jan & Feb and I don't have high expectations for the I-fund during the first quarter of 2010. For the USD, we know all charts eventually pull back to their 20MA so I'm waiting to see how our dollar reacts at this level.

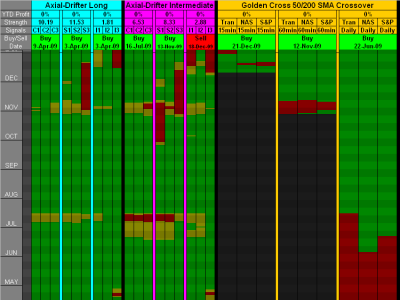

Lastly, I've done some tweaking to the Triad's spreadsheet, hopefully it's a little easier to read.

Cheers... Jason