-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why are you afraid of the I fund?

- Thread starter 99percent

- Start date

exnavyew

TSP Pro

- Reaction score

- 361

If I recall correctly Tom mentioned in early Jan that the I-fund merited watching.

Now that it's made a 4-month run I'm afraid of 'buying the peak'. But then again with Europe QE and the U.S. market near all time highs it's worth a look. One pet peeve I have with the I-fund is not being able to track it in real time accurately. However for TSP purposes that really shouldn't matter I suppose. It simply bugs me.

Now that it's made a 4-month run I'm afraid of 'buying the peak'. But then again with Europe QE and the U.S. market near all time highs it's worth a look. One pet peeve I have with the I-fund is not being able to track it in real time accurately. However for TSP purposes that really shouldn't matter I suppose. It simply bugs me.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

The I Fund was scary for me also...for many years.

However, I do remember that several years ago it did beat the pants off of all the rest of the funds, so "Every Dog Has His Day".

We might have a phobia over the I fund because ever since the Great Recession...the US was the "QE Leader" while other countries tried "Austerity". Result: S and C Funds generally outperformed the I Fund.

Seems Bernanke and our Fed were right all along...QE first, then ease out and perhaps gradually incorporate "Austerity" someday (lol).

So now that Europe is ditching Austerity and going "QE" while Chine regularly tries its own stimulus...and WE are starting to unwind ours, it is likely that this could be THE YEAR for the I Fund.

Remember...your fear is the brick that builds the wall that others climb up over you on.

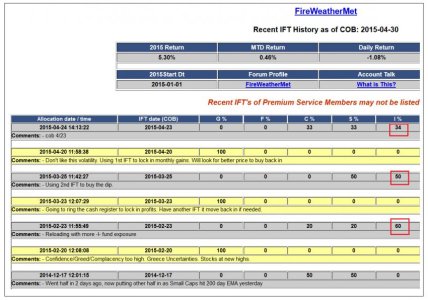

Anyway...to try to get rid of my fear...this year when I have gone from 100% G into stocks...I have been mixing my exposure to the I fund...anywhere from a third to a little over a half...the rest in C and/or S. (below).

No one says you have to always put all your eggs in one basket.:smile:

However, I do remember that several years ago it did beat the pants off of all the rest of the funds, so "Every Dog Has His Day".

We might have a phobia over the I fund because ever since the Great Recession...the US was the "QE Leader" while other countries tried "Austerity". Result: S and C Funds generally outperformed the I Fund.

Seems Bernanke and our Fed were right all along...QE first, then ease out and perhaps gradually incorporate "Austerity" someday (lol).

So now that Europe is ditching Austerity and going "QE" while Chine regularly tries its own stimulus...and WE are starting to unwind ours, it is likely that this could be THE YEAR for the I Fund.

Remember...your fear is the brick that builds the wall that others climb up over you on.

Anyway...to try to get rid of my fear...this year when I have gone from 100% G into stocks...I have been mixing my exposure to the I fund...anywhere from a third to a little over a half...the rest in C and/or S. (below).

No one says you have to always put all your eggs in one basket.:smile:

Last edited:

99percent

TSP Strategist

- Reaction score

- 5

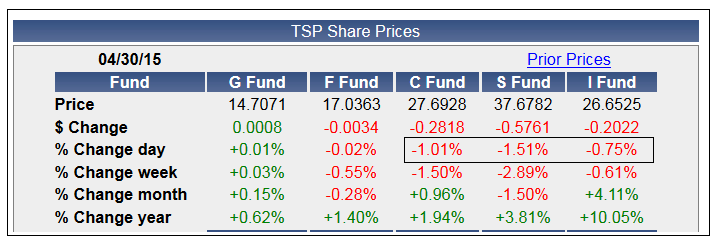

Today EFA finished up 1.1% but I fund is down due to fair value I guess. That's why no one trusts it. It can go the other way too.

Yeah, it's that "fair value" thing I don't get. Not enough ambition to study it! lol

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

Today EFA finished up 1.1% but I fund is down due to fair value I guess. That's why no one trusts it. It can go the other way too.

Yeah...I hear you.

Some smart @$$ thing Birch would say might be "yeah...keep on worrying over the I Fund...your bricks of worry is building me a higher wall to climb up on"

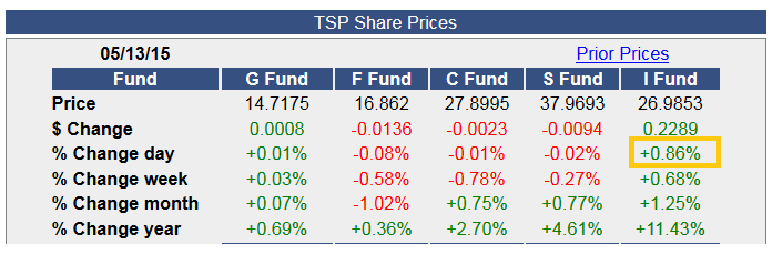

But maybe another way to look at it "going the other way" is yesterdays action (below).

I fund got priced better than its daily action and lost much less than the other funds.

One thing I'm starting to figure out is its not just how big a funds "Up" days are, but also its "Down" days.

All that averaged in...its that "% Change month" and "% Change Year" number that matters most.:blink:

RealMoneyIssues

TSP Legend

- Reaction score

- 101

FV, no other reason... Been burned too many times

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

He was some kind of a Technician I think? Gilligan might be able to do it, he started a thread in the "I" Fund Forum all about FV.

http://www.tsptalk.com/mb/the-i-fund/3111-what-fv-how-does-work.html

http://www.tsptalk.com/mb/the-i-fund/3111-what-fv-how-does-work.html

FogSailing

Market Veteran

- Reaction score

- 61

Good post. You could be right about the European QE...or not. I'm concerned about how long it's been since we've had a real correction. I can't shake the feeling that there are stronger long term structural forces at work here. I've decided to listen to my gut and am on the sidelines for now. Now that I've said that and gone all risk averse...enjoy the surge in the I fund that will probably occur and make the rest of you rich. I'll never be the smart money. :cheesy:

FS

FS

Frixxxx

Moderator

- Reaction score

- 131

Ebb and 350Z were really good, and we could catch some good IFT's when they weren't limited.We used to have a Member that could figure the FV out mathematically on a daily basis, BUT I forget his Screen Name? Hhuuummm?View attachment 33581

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

That's it 350Z is the one I remember did the daily calculations! 350zCommTechEbb and 350Z were really good, and we could catch some good IFT's when they weren't limited.

Cactus

TSP Pro

- Reaction score

- 38

Then it's time for a rest while C & S catch up, right?I am too! But damn, it just tore up April.

Actually my aversion to the I Fund is the same as for the F Fund. You can't tell by looking at the market what you are going to get at the end of the day. Add to that the fact that when I do enter those funds I usually end up regretting it and taking a ride down you can see why I prefer to toggle between S & G.

FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

exnavyew

TSP Pro

- Reaction score

- 361

[h=1]How international small-caps spice up a retirement portfolio[/h]How international small-caps spice up a retirement portfolio - MarketWatch

I look at the %month and %quarter. The I fund just does a better job lately. My previous S fund was basically stalled or waffling over the same time period. But don't get me wrong. If anything weird happens Witt markets in general I will be running for the G fund.

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Valkyrie

TSP Pro

- Reaction score

- 220

The Dollar Still Has Room to Fall

"After peaking at more than 100, the U.S. Dollar Index suffered a big pullback.

And with traders looking to sell the dollar into strength, I said we could see a

short-term decline down to around 94. If things got particularly nasty, I said

the dollar index could fall all the way to 88."

Last week, the dollar index reached our first downside target. And it's

likely that we'll see our second target soon...

Take a look at this updated chart of the dollar index plotted with its

Moving Average Convergence Divergence (MACD) momentum indicator and the Full

Stochastic Oscillator indicator – another measure of momentum...

"After peaking at more than 100, the U.S. Dollar Index suffered a big pullback.

And with traders looking to sell the dollar into strength, I said we could see a

short-term decline down to around 94. If things got particularly nasty, I said

the dollar index could fall all the way to 88."

Last week, the dollar index reached our first downside target. And it's

likely that we'll see our second target soon...

Take a look at this updated chart of the dollar index plotted with its

Moving Average Convergence Divergence (MACD) momentum indicator and the Full

Stochastic Oscillator indicator – another measure of momentum...

Similar threads

- Replies

- 0

- Views

- 280

- Replies

- 9

- Views

- 481