- Reaction score

- 2,481

U.S. Retirement Funds, Heavy on Stocks, Brace for Losses

A sustained downturn could squeeze state and local government budgets

https://www.wsj.com/articles/u-s-re...9cp5ytgtxnm&reflink=desktopwebshare_permalink

A sustained downturn could squeeze state and local government budgets

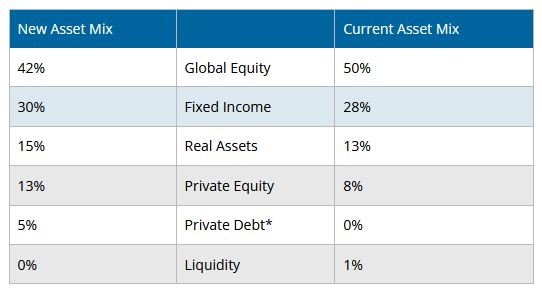

At the nation’s largest pension fund, the California Public Employees’ Retirement System, total reported holdings have fallen to $475 billion as of March 2 from $482 billion at the end of January. The S&P 500’s total return was minus 2.71% during the same period. Roughly half of the California worker fund is in stocks.

https://www.wsj.com/articles/u-s-re...9cp5ytgtxnm&reflink=desktopwebshare_permalink