<o> </o>And who’s winning the race under Bear Market Rules?

<o></o>

Note: As of last Friday I’m 100% F-fund, out of IFTs, and watching for the next swing low in stocks.

<o></o>

I’ll be the first to admit I lack patience. Combine this with a lack of discipline, throw in a dash of poor timing and presto you’re number 197 on the tracker. Somewhere there is a lab full of blind monkeys outperforming me and one little overlooked Turtle.

That Turtle I’m referring to is AGG (loosely translated as the F-fund) and although it is often overlooked that doesn’t mean it shouldn’t be a respected tool in our limited arsenal.

<o></o>

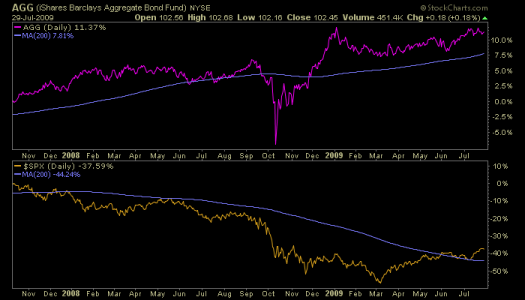

Case in point, here is a price performance chart starting from the S&P 500’s peak on 07/11/2007 through today. Now we could pick a number of different timeframes and get different results, but I’m rigging this chart to pimp up the Turtle.

In less than 2 years AGG is up 11.58% while the S&P 500 is down a miserable -37.89%

Over the last 10 years the F-Fund outperformed the G-Fund 5 times and tied 2 times. Now I should point out it’s hard to trade this fund on a short term basis. Most of us know AGG doesn’t track well with the F-Fund over a day to day basis and over a week or two you could practically flip a coin to determine if you’re going to exit with a profit.

As for the recent price action, I had to throw my ascending triangle from the previous blog in the crapper. But the good news is we are still within a trading range and the last swing low was slightly higher. If stocks break down in late August, than I would expect a break to the upside above 103.00

<o></o>

On the weekly chart, I’m watching 101.60 and counting on that level to be solid support. If we fall through that level then I won’t consider it again until we bounce off a previous swing low.

<o></o>

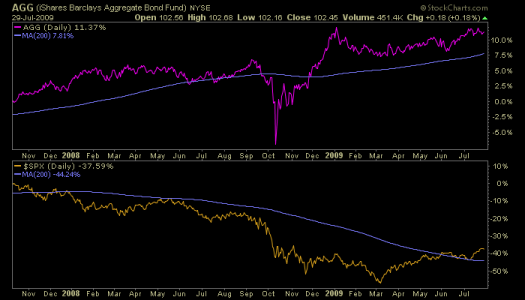

Lastly, here is a MONTHLY price performance chart with AGG vs. $SPX represented as one line. The yellow line represents the point in time when AGG began out performing the S&P 500. After that point in time, from September 2008’s peak, the S&P 500 fell 636 points to the devils 666.79 bottom in March 2009. I'm sorry to say my AGG chart only goes back 6 years, but nevertheless I hope you get the point I'm trying to make.

<o></o>

Thanks for your time… Jason

<o></o>

Note: As of last Friday I’m 100% F-fund, out of IFTs, and watching for the next swing low in stocks.

<o></o>

I’ll be the first to admit I lack patience. Combine this with a lack of discipline, throw in a dash of poor timing and presto you’re number 197 on the tracker. Somewhere there is a lab full of blind monkeys outperforming me and one little overlooked Turtle.

That Turtle I’m referring to is AGG (loosely translated as the F-fund) and although it is often overlooked that doesn’t mean it shouldn’t be a respected tool in our limited arsenal.

<o></o>

Case in point, here is a price performance chart starting from the S&P 500’s peak on 07/11/2007 through today. Now we could pick a number of different timeframes and get different results, but I’m rigging this chart to pimp up the Turtle.

In less than 2 years AGG is up 11.58% while the S&P 500 is down a miserable -37.89%

Over the last 10 years the F-Fund outperformed the G-Fund 5 times and tied 2 times. Now I should point out it’s hard to trade this fund on a short term basis. Most of us know AGG doesn’t track well with the F-Fund over a day to day basis and over a week or two you could practically flip a coin to determine if you’re going to exit with a profit.

As for the recent price action, I had to throw my ascending triangle from the previous blog in the crapper. But the good news is we are still within a trading range and the last swing low was slightly higher. If stocks break down in late August, than I would expect a break to the upside above 103.00

<o></o>

On the weekly chart, I’m watching 101.60 and counting on that level to be solid support. If we fall through that level then I won’t consider it again until we bounce off a previous swing low.

<o></o>

Lastly, here is a MONTHLY price performance chart with AGG vs. $SPX represented as one line. The yellow line represents the point in time when AGG began out performing the S&P 500. After that point in time, from September 2008’s peak, the S&P 500 fell 636 points to the devils 666.79 bottom in March 2009. I'm sorry to say my AGG chart only goes back 6 years, but nevertheless I hope you get the point I'm trying to make.

<o></o>

Thanks for your time… Jason