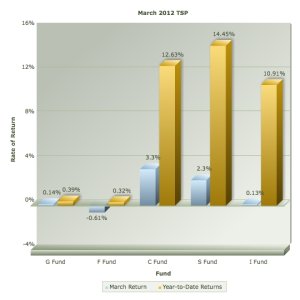

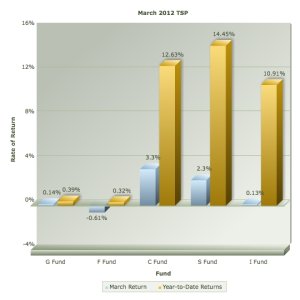

The TSP's C fund is the big winner in the monthly returns for March 2012 with a return of 3.3%. For the year, this fund is now up 12.63%. So far in 2012, the biggest returns have come from the S fund with a year-to-date return of 14.45%. (See the 2012 monthly TSP returns table)

So far, 2012 has been a very good year for the Thrift Savings Plan. The fund with the lowest rate of return is the F fund with a year-to-date return of 0.32%. The G fund is in the same ballpark with a return of 0.39% so far this year. Conservative investors who have put most of their money into the G fund may want to take a look at the lifecycle income fund.

While those who are retired or are nearing retirement do not want to take a risk with their finances, and the G fund is considered to be virtually risk-free, another factor to take into account is that inflation will consume much of the value of your investments in the G fund. In many years, the G fund will not match the actual rate of inflation so that your purchasing power goes down as the value of the dollar declines. With at least some of your investments in stocks, you have a chance of at least keeping up with inflation and, over time, you are likely to come out ahead. Many TSP investors do not like the idea of investing in the stock market as it is very volatile but, when viewing the return rate for the underlying TSP stock funds over a longer period of time, you will see that those that invest in the stock market have a better rate of return overall.

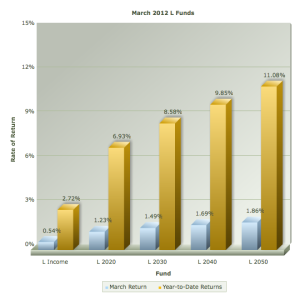

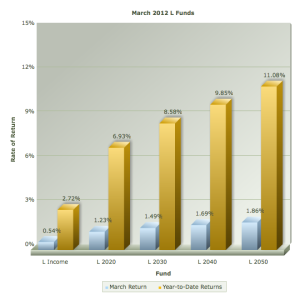

The L Income fund has returned 2.72% so far this year. It has also provided better returns than the G fund for five out of the last six years (See the TSP annual returns table) The L Income fund provides a chance for a greater return than the G fund and arguably has less risk than just investing in G fund bonds as about 20% of the L Income assets are invested in the underlying TSP stock funds. Of course, each person has to make their own decisions about how to define "risk" and how to invest their own money.

Here is how the underlying TSP funds performed in March 2012 and for the year-to-date:

Here is how the lifecycle funds performed in March and so far in 2012:

Investors Moving Money Around in the TSP

Unlike most investors today who are continuing to move money into bond funds, TSP investors are moving money out of the G fund and into stock funds (although TSP investors are still moving money into the F fund which is a broad index bond fund so its results may feel the impact of inflation).

In February, almost $1.3 billion was moved from the G fund. At the same time, money was moved into the F fund ($439 million), the C fund ($98 million), and the S fund ($466 million). Another $366 million was moved into the L funds. In all likelihood, these investors sense that with the Federal Reserve continuing to print money, inflation will start growing faster throughout our economy. When this happens, the value of bond funds often does not keep up with inflation so stocks may be a better investment.

Among CSRS participants, 50% of their TSP funds are in the G fund. This percentage is down from the 54% who had their money in the G fund back in September of 2011 but up considerably from the 38% who had money in the G fund back in 2006.

Number of TSP Participants

The number of people investing in the Thrift Savings Plan is continuing to grow. There are now more than 4.5 million investors in the TSP. For comparison purposes, back in 2000, there were approximately 2.5 million TSP investors.

How Much Money Is There in the TSP?

And, if you were wondering why the TSP is sometimes an attractive target for those in Congress who would like to have more money to spend or to be able to help some of their more favored statistics, the amount of money in the TSP continues to grow.

Are You Giving Away Free Money?

At the end of February, there was $308 billion in all of the TSP funds. 86.1% of those in FERS are participating in the Thrift Savings Plan. The other 13.9%, through ignorance or by choice, are apparently willing to pass up the opportunity to make a little more money from their federal employment. Here is why a FERS employee is passing up free money by not participating in the TSP:

So far, 2012 has been a very good year for the Thrift Savings Plan. The fund with the lowest rate of return is the F fund with a year-to-date return of 0.32%. The G fund is in the same ballpark with a return of 0.39% so far this year. Conservative investors who have put most of their money into the G fund may want to take a look at the lifecycle income fund.

While those who are retired or are nearing retirement do not want to take a risk with their finances, and the G fund is considered to be virtually risk-free, another factor to take into account is that inflation will consume much of the value of your investments in the G fund. In many years, the G fund will not match the actual rate of inflation so that your purchasing power goes down as the value of the dollar declines. With at least some of your investments in stocks, you have a chance of at least keeping up with inflation and, over time, you are likely to come out ahead. Many TSP investors do not like the idea of investing in the stock market as it is very volatile but, when viewing the return rate for the underlying TSP stock funds over a longer period of time, you will see that those that invest in the stock market have a better rate of return overall.

The L Income fund has returned 2.72% so far this year. It has also provided better returns than the G fund for five out of the last six years (See the TSP annual returns table) The L Income fund provides a chance for a greater return than the G fund and arguably has less risk than just investing in G fund bonds as about 20% of the L Income assets are invested in the underlying TSP stock funds. Of course, each person has to make their own decisions about how to define "risk" and how to invest their own money.

Here is how the underlying TSP funds performed in March 2012 and for the year-to-date:

Here is how the lifecycle funds performed in March and so far in 2012:

Investors Moving Money Around in the TSP

Unlike most investors today who are continuing to move money into bond funds, TSP investors are moving money out of the G fund and into stock funds (although TSP investors are still moving money into the F fund which is a broad index bond fund so its results may feel the impact of inflation).

In February, almost $1.3 billion was moved from the G fund. At the same time, money was moved into the F fund ($439 million), the C fund ($98 million), and the S fund ($466 million). Another $366 million was moved into the L funds. In all likelihood, these investors sense that with the Federal Reserve continuing to print money, inflation will start growing faster throughout our economy. When this happens, the value of bond funds often does not keep up with inflation so stocks may be a better investment.

Among CSRS participants, 50% of their TSP funds are in the G fund. This percentage is down from the 54% who had their money in the G fund back in September of 2011 but up considerably from the 38% who had money in the G fund back in 2006.

Number of TSP Participants

The number of people investing in the Thrift Savings Plan is continuing to grow. There are now more than 4.5 million investors in the TSP. For comparison purposes, back in 2000, there were approximately 2.5 million TSP investors.

How Much Money Is There in the TSP?

And, if you were wondering why the TSP is sometimes an attractive target for those in Congress who would like to have more money to spend or to be able to help some of their more favored statistics, the amount of money in the TSP continues to grow.

Are You Giving Away Free Money?

At the end of February, there was $308 billion in all of the TSP funds. 86.1% of those in FERS are participating in the Thrift Savings Plan. The other 13.9%, through ignorance or by choice, are apparently willing to pass up the opportunity to make a little more money from their federal employment. Here is why a FERS employee is passing up free money by not participating in the TSP:

"As a FERS participant, you receive matching contributions on the first 5% of pay that you contribute each pay period. As the table below shows, the first 3% of pay that you contribute will be matched dollar-for-dollar; the next 2% will be matched at 50 cents on the dollar. Contributions above 5% of your pay will not be matched. If you stop making regular employee contributions, your matching contributions will also stop."

2012 has been a very good year, so far, for TSP investors. Good luck with making solid decisions with your future retirement investments!