January has been a good month to be holding stock funds. The I-fund surged in price (+2.63%) this week and now outperforms the C-fund for January. This month's market leader, the S-fund, had the lowest return among the TSP stock funds over the last four days, with two days of modest negative daily returns. Negative returns of less than 0.3% are hard to complain about when the S-fund is up more than 5% in less than four weeks.

The first week with President Trump in office eased the mind of the bulls further. His financial friendly environment was already being priced in before he took office, but he surprised the market with an easier tone on tariffs than initially expected. Before Covid, his position about tariffs was the market's obsession in his first term. I'd expect more of that in the first few months of his second term.

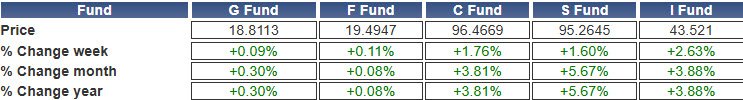

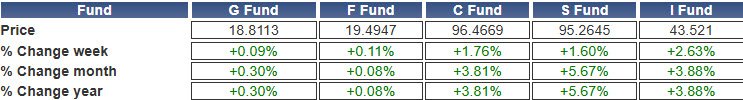

Here are the weekly, monthly, and annual TSP fund returns for the week ending January 24:

The market has bounced back quickly from its mid-January dip, and that has some members in the TSP Talk AutoTracker taking profits this week. The 53 non-premium members who made IFTs last week allocated an average of 49.3% to the G-fund. Eighteen of those 53 members moved to 100% G-fund, including MRJ, the top performer of January so far. MRJ spent their third and final IFT of January on Friday to move to 100% G-fund. In doing so they have locked in a January gain of more than 7.37%. The S-fund's return is 5.67% so far in January.

The underinvested welcome a pull-back. Stocks got more expensive quickly and new buyers would need to buy the C-fund near its all-time highest price. However, the optimism generally surrounding the market is capable of fueling it higher. For this, I have favored the mixed TSP allocations that hold enough G-fund to put to work if the market gets cheaper while keeping foot in stocks funds as to not completely be left behind if the market climbs relentlessly.

If you're not a subscriber yet, sign up for the Last Look Report to get daily IFT updates from TSP Talk AutoTracker investors.

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The first week with President Trump in office eased the mind of the bulls further. His financial friendly environment was already being priced in before he took office, but he surprised the market with an easier tone on tariffs than initially expected. Before Covid, his position about tariffs was the market's obsession in his first term. I'd expect more of that in the first few months of his second term.

Here are the weekly, monthly, and annual TSP fund returns for the week ending January 24:

The market has bounced back quickly from its mid-January dip, and that has some members in the TSP Talk AutoTracker taking profits this week. The 53 non-premium members who made IFTs last week allocated an average of 49.3% to the G-fund. Eighteen of those 53 members moved to 100% G-fund, including MRJ, the top performer of January so far. MRJ spent their third and final IFT of January on Friday to move to 100% G-fund. In doing so they have locked in a January gain of more than 7.37%. The S-fund's return is 5.67% so far in January.

If you're not a subscriber yet, sign up for the Last Look Report to get daily IFT updates from TSP Talk AutoTracker investors.

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: