Stocks were up big on Friday morning once again led by big tech, and while the Nasdaq did close with a strong gain, the stock market retreated off the morning highs, erasing most, if not all, of the big early gains. Bonds and the F-fund were also down as yields remain stubbornly high. It's the biggest week of the quarter for big tech earnings as 5 of the Magnificent 7 companies report this week.

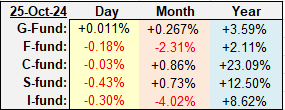

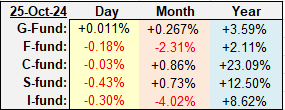

Daily TSP Funds Return (More returns)

Those pesky rising bond yields are starting to put some pressure on stocks as the early decline in yields turned into another rally by the close on Friday, pushing the 10-year Treasury Yield back up over 4.23%. Here's the intraday chart from Friday of both the S&P 500 and the 10-year yield, and clearly they were working against each other.

The 10-year Yield is back up near two and half month highs, meanwhile the Fed has been lowering interest rates, so something's not right here. Is the economy gaining that much strength that the bond market is moving against the Fed's new trend? The Fed actually tends to follow the 2-year Yield, which is below the Fed Fund's rate, but like the 10-year yield, look at the move it has made this month.

The dollar has also been rebounding sharply putting pressure on some prices, but particularly the I-fund, which is down 4.0% in October.

Stronger than expected economic growth and sticky inflation is not terrible news for stocks, but it is going to be a potential roadblock to the pace at which the Fed lowers interest rates.

The rotation into small caps has been taking a pause lately as the Russell 2000 (IWM) has pulled back sharply from its recent highs, and it is now testing some key support levels after being down 6 of the last 7 days. Is this a buying opportunity, or has the move higher in yields hurt the premise of the rotation?

Tesla was the first of the Magnificent 7 earnings to be released and they have been up big since reporting, helping give the Nasdaq a boost. Once again, here's the schedule for the remaining Mag 7's earnings releases - usually after the bell on the date shown. Tesla is the smallest of the Mag 7 stocks so these remaining six, five of which report this week, have the potential to make or break this coming week.

Admin Note: The forum has a new address / URL of forum.tsptalk.com. It's a big change and it may take some getting used to, but it is the latest and greatest forum software from what I can tell.

As for the website's new servers, the move was completed this past weekend. It should not impact anything on your end but we know with change comes unexpected results so if you see any issues we'd appreciate an email pointing to the error condition. Please send the email to support at our website address -- don't want the bots to see the email address.

The SPY (S&P 500 / C-fund) had a negative reversal day on Friday. There have actually been several of them lately, and that's not the best sign, although there are other example on this chart where stocks just resumed the upside soon afterward. However, all of the those negative kangaroo tails and large black candlestick reversals on this chart tells us that the late money is selling, and they are generally considered the smarter money. The 20-day EMA is trying to hold and this is an historically positive week for stocks, but the chart needs to hold here or the cracks will become more serious.

We talked about the small caps of the Russell 2000 above, and the small caps of the DWCPF (S-fund) are in a similar situation as this clings to some key support. Retesting the breakout level is normal action but aggressively breaking below it would be bad news. There's plenty of other support below so it wouldn't be a deal breaker for the market, but it would put a dent in any accounts holding the S-fund.

The I-fund: The EFA tracking ETF was down 0.34% on Friday, ACWX was down 0.25%, and the "ex USA ex China ex Hong Kong Index" was down 0.09%. The final return for the I-fund was -0.30% -- about what we'd expect, in between the three.

BND (Bonds / F-fund) was up early, and down late - playing off those rallying yields, just like the stock market. One open gap was filled last week (blue), and there is another open gap near 72.80. The trend is clearly down now, but how much higher can bond yields go if the Fed is going to continue to cut rates? The next Fed meeting is right after election day.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Daily TSP Funds Return (More returns)

Those pesky rising bond yields are starting to put some pressure on stocks as the early decline in yields turned into another rally by the close on Friday, pushing the 10-year Treasury Yield back up over 4.23%. Here's the intraday chart from Friday of both the S&P 500 and the 10-year yield, and clearly they were working against each other.

The 10-year Yield is back up near two and half month highs, meanwhile the Fed has been lowering interest rates, so something's not right here. Is the economy gaining that much strength that the bond market is moving against the Fed's new trend? The Fed actually tends to follow the 2-year Yield, which is below the Fed Fund's rate, but like the 10-year yield, look at the move it has made this month.

The dollar has also been rebounding sharply putting pressure on some prices, but particularly the I-fund, which is down 4.0% in October.

Stronger than expected economic growth and sticky inflation is not terrible news for stocks, but it is going to be a potential roadblock to the pace at which the Fed lowers interest rates.

The rotation into small caps has been taking a pause lately as the Russell 2000 (IWM) has pulled back sharply from its recent highs, and it is now testing some key support levels after being down 6 of the last 7 days. Is this a buying opportunity, or has the move higher in yields hurt the premise of the rotation?

Tesla was the first of the Magnificent 7 earnings to be released and they have been up big since reporting, helping give the Nasdaq a boost. Once again, here's the schedule for the remaining Mag 7's earnings releases - usually after the bell on the date shown. Tesla is the smallest of the Mag 7 stocks so these remaining six, five of which report this week, have the potential to make or break this coming week.

Admin Note: The forum has a new address / URL of forum.tsptalk.com. It's a big change and it may take some getting used to, but it is the latest and greatest forum software from what I can tell.

As for the website's new servers, the move was completed this past weekend. It should not impact anything on your end but we know with change comes unexpected results so if you see any issues we'd appreciate an email pointing to the error condition. Please send the email to support at our website address -- don't want the bots to see the email address.

The SPY (S&P 500 / C-fund) had a negative reversal day on Friday. There have actually been several of them lately, and that's not the best sign, although there are other example on this chart where stocks just resumed the upside soon afterward. However, all of the those negative kangaroo tails and large black candlestick reversals on this chart tells us that the late money is selling, and they are generally considered the smarter money. The 20-day EMA is trying to hold and this is an historically positive week for stocks, but the chart needs to hold here or the cracks will become more serious.

We talked about the small caps of the Russell 2000 above, and the small caps of the DWCPF (S-fund) are in a similar situation as this clings to some key support. Retesting the breakout level is normal action but aggressively breaking below it would be bad news. There's plenty of other support below so it wouldn't be a deal breaker for the market, but it would put a dent in any accounts holding the S-fund.

The I-fund: The EFA tracking ETF was down 0.34% on Friday, ACWX was down 0.25%, and the "ex USA ex China ex Hong Kong Index" was down 0.09%. The final return for the I-fund was -0.30% -- about what we'd expect, in between the three.

BND (Bonds / F-fund) was up early, and down late - playing off those rallying yields, just like the stock market. One open gap was filled last week (blue), and there is another open gap near 72.80. The trend is clearly down now, but how much higher can bond yields go if the Fed is going to continue to cut rates? The next Fed meeting is right after election day.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.html

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: