This past week, non-premium investors in the TSP Talk AutoTracker were relatively unstirred by the week's volatility. Yet, the majority of IFTs were spent Friday during the calmest morning action of the week. Most of those Friday IFTs were used to move to the safety of the G-fund. After a week where all three TSP stock funds provided positive returns, what provoked a herd of TSP Talk investors out of them?

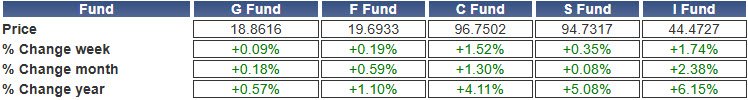

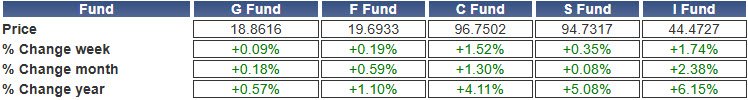

Here are the weekly, monthly, and annual TSP fund returns for the week ending February 14:

Interested in these AutoTracker sentiments and trends? You can get more, daily with the Last Look Report. Not familiar with the Last Look Report? Get five free reports here.

A Slow Start, Then a Rush to Safety

Before the week began, the 55 non-premium AutoTracker members who would go on to make IFTs were heavily weighted in TSP stock funds. They held an average of 71.1% of stock funds (C, S, and I) in their TSP. The S-fund was the most held fund among them with an average allocation of 40.7%. However, by the end of the week they would hold an average of 42.4% in stock funds, and their average S-fund allocation would drop to 16.2%.

The TSP stock funds were up Monday, and despite the C-fund outperforming, the S-fund saw the greatest increase in incoming money from the 8 members who made IFTs for the day. This was a continuation of a trend we noticed the previous week.

Then Tuesday morning small caps were showing weakness against large caps. Still the 7 who made IFTs opted to increase their S and I-fund allocations while decreasing their G and C-fund allocations.

U.S. stocks were down more than 0.8% near the TSP trade deadline on Wednesday. Jerome Powell and the latest Consumer Price Index deflated Fed fund rate cuts sentiment. This second day of losses in the S-fund finally pushed members out of the S-fund. Five of the 8 members who made IFTs dropped their S-fund holdings to 0%. All three members who increased their S-fund exposure (bought into weakness) were top 50 members.

Stocks reversed and rallied on Thursday. All three TSP stock funds accumulated gains over 1% for the day. Those who had moved to the G-fund the day prior missed the rebound, yet a new set of 9 AutoTracker members used their IFTs to decrease their S-fund exposure and increase their G and I-fund allocations.

Then Came Friday

Friday morning stocks were mostly flat, and the market remained relatively calm for the day. Yet, the AutoTracker traffic spiked. Twenty-four non-premium members made IFTs for the day and collectively dropped their stock exposure significantly. These 24 members increased their average G-fund exposure from 20.4% to 79.0%. Their average C-fund exposure dropped from 34.2% to 10.1%. Their average S-fund exposure dropped from 39.1% to only 6.8%. Seventeen of the 24 members moved to 100% G-fund. This wasn't just casual repositioning - five of these 17 retreats to the G-fund were from investors ranked in the Top 50 of the TSP Talk AutoTracker.

These seasoned investors recognized that Thursday's gains lacked follow-through on Friday and decided it was time to secure profits rather than risk a pullback.

A Lesson from the AutoTracker

The rush to G-fund was likely a strategic move rather than panic selling. With no strong continuation of Thursday’s rally, many traders saw an opportunity to lock in profits rather than ride out more volatility. They do risk missing out on potential gains next week but demonstrate a spatial awareness of the market. It doesn't have to take a sell-off or a rally to provoke an investment change. During a volatile and rudderless week of market action, it took a low volatile day for these investors to get a chance to lock in the week or month's gains and wait out their next buying opportunity.

Did you make a TSP investment decision last week? Please share your thoughts in the comments or on the forum!

Here are a few members who shared their investment thought process on the forum last week:

JTH 's Account Talk

WorkFE's Account Talk

Valkyrie's Account Talk

coolhand's Account Talk

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

* All of today's data is based off non-premium TSP Talk AutoTracker members. We try to keep the integrity of the Premium Services members pay for. That means keeping their members' IFTs between other Premium Members. Premium Members who also have TSP Talk AutoTracker accounts have access to the TSP Talk AutoTracker Standings that include all members.

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Here are the weekly, monthly, and annual TSP fund returns for the week ending February 14:

Interested in these AutoTracker sentiments and trends? You can get more, daily with the Last Look Report. Not familiar with the Last Look Report? Get five free reports here.

A Slow Start, Then a Rush to Safety

Before the week began, the 55 non-premium AutoTracker members who would go on to make IFTs were heavily weighted in TSP stock funds. They held an average of 71.1% of stock funds (C, S, and I) in their TSP. The S-fund was the most held fund among them with an average allocation of 40.7%. However, by the end of the week they would hold an average of 42.4% in stock funds, and their average S-fund allocation would drop to 16.2%.

The TSP stock funds were up Monday, and despite the C-fund outperforming, the S-fund saw the greatest increase in incoming money from the 8 members who made IFTs for the day. This was a continuation of a trend we noticed the previous week.

Then Tuesday morning small caps were showing weakness against large caps. Still the 7 who made IFTs opted to increase their S and I-fund allocations while decreasing their G and C-fund allocations.

U.S. stocks were down more than 0.8% near the TSP trade deadline on Wednesday. Jerome Powell and the latest Consumer Price Index deflated Fed fund rate cuts sentiment. This second day of losses in the S-fund finally pushed members out of the S-fund. Five of the 8 members who made IFTs dropped their S-fund holdings to 0%. All three members who increased their S-fund exposure (bought into weakness) were top 50 members.

Stocks reversed and rallied on Thursday. All three TSP stock funds accumulated gains over 1% for the day. Those who had moved to the G-fund the day prior missed the rebound, yet a new set of 9 AutoTracker members used their IFTs to decrease their S-fund exposure and increase their G and I-fund allocations.

Then Came Friday

Friday morning stocks were mostly flat, and the market remained relatively calm for the day. Yet, the AutoTracker traffic spiked. Twenty-four non-premium members made IFTs for the day and collectively dropped their stock exposure significantly. These 24 members increased their average G-fund exposure from 20.4% to 79.0%. Their average C-fund exposure dropped from 34.2% to 10.1%. Their average S-fund exposure dropped from 39.1% to only 6.8%. Seventeen of the 24 members moved to 100% G-fund. This wasn't just casual repositioning - five of these 17 retreats to the G-fund were from investors ranked in the Top 50 of the TSP Talk AutoTracker.

These seasoned investors recognized that Thursday's gains lacked follow-through on Friday and decided it was time to secure profits rather than risk a pullback.

A Lesson from the AutoTracker

The rush to G-fund was likely a strategic move rather than panic selling. With no strong continuation of Thursday’s rally, many traders saw an opportunity to lock in profits rather than ride out more volatility. They do risk missing out on potential gains next week but demonstrate a spatial awareness of the market. It doesn't have to take a sell-off or a rally to provoke an investment change. During a volatile and rudderless week of market action, it took a low volatile day for these investors to get a chance to lock in the week or month's gains and wait out their next buying opportunity.

Did you make a TSP investment decision last week? Please share your thoughts in the comments or on the forum!

Here are a few members who shared their investment thought process on the forum last week:

JTH 's Account Talk

WorkFE's Account Talk

Valkyrie's Account Talk

coolhand's Account Talk

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

* All of today's data is based off non-premium TSP Talk AutoTracker members. We try to keep the integrity of the Premium Services members pay for. That means keeping their members' IFTs between other Premium Members. Premium Members who also have TSP Talk AutoTracker accounts have access to the TSP Talk AutoTracker Standings that include all members.

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.