Last week, many participants in the TSP Talk AutoTracker anticipated market activity leading up to the Federal Open Market Committee (FOMC) meeting. Some saw the pre-meeting selling as an opportunity to increase stock exposure, expecting the Fed to reignite a rally. However, instead of sparking a rebound, the FOMC meeting accelerated the sell-off, leaving fully invested members exposed to losses.

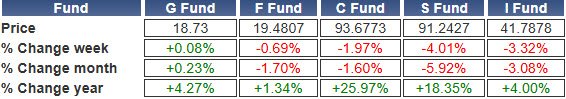

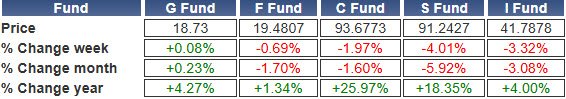

Here are the weekly, monthly, and annual TSP fund returns for the week ending December 20:

In total, 37 IFTs were made on Monday and Tuesday ahead of the FOMC meeting. Here's the average allocation of these members before their IFTs:

Even leading members, like Cash_Money, increased stock exposure. On Tuesday, Cash_Money moved entirely into the S-fund, reallocating half of their TSP from the G- and F-funds into stocks—a bold move ahead of the FOMC meeting.

This trust in the Fed turned out to be misplaced. The FOMC cut rates by 0.25% as suspected, yet the decision to do so was not unanimous according to Chairman Jerome Powell, meaning the rate cut was naively priced into the market with too much confidence. Powell also expressed the Fed will be more cautious going forward on the Fed fund rate decision.

The S-fund fell 4.39% on Wednesday alone. The C-fund fell 2.95%

Wednesday (Pre-Moves):

A standout example is of Beau435, who made the week’s best-timed move and emerged as December’s AutoTracker leader. On Thursday, Beau435 shifted entirely from the G-fund into the S-fund, commenting, “Moving to S, expecting a bounce now.” That move netted a 1.32% weekly gain, making Beau435 the top performer. Their December return now stands at 1.7%, leading all AutoTracker participants.

However, Beau435 didn’t leave their gains unprotected. By Friday morning, while markets were up, they moved 70% of their S-fund allocation back into the G-fund, locking in the bulk of their gains while retaining some exposure (30%) to the S-fund.

There remains plenty of optimism that the stock market will bounce back, and the S-fund has only become more of a favorite for TSP Talk investors. Yet the optimism leading into the FOMC meeting turned out to be misguided. TSP investors should heed this lesson from the TSP Talk AutoTracker, though some may find it difficult to reduce too much risk during the most seasonally favorable period of the year for stock price action.

The TSP Talk AutoTracker continues to offer fascinating insights into participant strategies and sentiment during volatile market periods. As members navigate risks and opportunities, the trends and outcomes provide valuable lessons for all TSP investors. Take part in this investment community by starting your own TSP Talk AutoTracker for free before 2025.

Get timely insights with the Last Look Report — delivered at 11:30 AM ET, just 30 minutes before the TSP trade deadline. Stay informed with the latest AutoTracker IFT moves, morning market trends, key headlines, and relevant forum discussions to help you make confident, last-minute investment decisions. Subscribe now and never miss a critical market move!

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Here are the weekly, monthly, and annual TSP fund returns for the week ending December 20:

Pre-FOMC Sentiment and Interfund Transfers (IFTs)

AutoTracker members often share comments when making interfund transfers (IFTs). Here are a few anonymous remarks from members increasing stock exposure early in the week:- “Positioning for Santa Rally.”

- “1st IFT in Dec to capture Santa Claus Rally.”

- “Powell doesn’t want to get fired! … Will kick off the start of the Santa rally?”

- “Tis the season for me to jump in?”

In total, 37 IFTs were made on Monday and Tuesday ahead of the FOMC meeting. Here's the average allocation of these members before their IFTs:

- G-fund: 60.5%

- F-fund: 3.6%

- C-fund: 12.6%

- S-fund: 19.6%

- I-fund: 1.1%

- G-fund: 28.2%

- F-fund: 4.7%

- C-fund: 21.7%

- S-fund: 41.3%

- I-fund: 0.1%

Even leading members, like Cash_Money, increased stock exposure. On Tuesday, Cash_Money moved entirely into the S-fund, reallocating half of their TSP from the G- and F-funds into stocks—a bold move ahead of the FOMC meeting.

This trust in the Fed turned out to be misplaced. The FOMC cut rates by 0.25% as suspected, yet the decision to do so was not unanimous according to Chairman Jerome Powell, meaning the rate cut was naively priced into the market with too much confidence. Powell also expressed the Fed will be more cautious going forward on the Fed fund rate decision.

The S-fund fell 4.39% on Wednesday alone. The C-fund fell 2.95%

Post-Sell-Off Adjustments

After Wednesday’s sell-off, the focus shifted to how AutoTracker participants responded. Between Thursday and Friday, there were 50 additional IFTs. Here’s how the average allocation of these members changed:Wednesday (Pre-Moves):

- G-fund: 32.2%

- F-fund: 6.6%

- C-fund: 24.9%

- S-fund: 30.8%

- I-fund: 1.0%

- G-fund: 32.3%

- F-fund: 0.8%

- C-fund: 16.3%

- S-fund: 45.3%

- I-fund: 1.5%

Small-Cap Optimism

Several members expressed optimism about the S-fund’s potential bounce due to its oversold condition. Those who shifted into the S-fund on Thursday reaped rewards on Friday when the fund gained 1.25%.A standout example is of Beau435, who made the week’s best-timed move and emerged as December’s AutoTracker leader. On Thursday, Beau435 shifted entirely from the G-fund into the S-fund, commenting, “Moving to S, expecting a bounce now.” That move netted a 1.32% weekly gain, making Beau435 the top performer. Their December return now stands at 1.7%, leading all AutoTracker participants.

However, Beau435 didn’t leave their gains unprotected. By Friday morning, while markets were up, they moved 70% of their S-fund allocation back into the G-fund, locking in the bulk of their gains while retaining some exposure (30%) to the S-fund.

Final Thoughts

There remains plenty of optimism that the stock market will bounce back, and the S-fund has only become more of a favorite for TSP Talk investors. Yet the optimism leading into the FOMC meeting turned out to be misguided. TSP investors should heed this lesson from the TSP Talk AutoTracker, though some may find it difficult to reduce too much risk during the most seasonally favorable period of the year for stock price action.

The TSP Talk AutoTracker continues to offer fascinating insights into participant strategies and sentiment during volatile market periods. As members navigate risks and opportunities, the trends and outcomes provide valuable lessons for all TSP investors. Take part in this investment community by starting your own TSP Talk AutoTracker for free before 2025.

Get timely insights with the Last Look Report — delivered at 11:30 AM ET, just 30 minutes before the TSP trade deadline. Stay informed with the latest AutoTracker IFT moves, morning market trends, key headlines, and relevant forum discussions to help you make confident, last-minute investment decisions. Subscribe now and never miss a critical market move!

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.