Last week's market action prompted several TSP Talk AutoTracker investors to readjust their TSP allocations. The week began with a tariff-induced sell-off after President Trump announced 25% tariffs on both Canada and Mexico over the weekend. The S and I-funds lost more than 1% on the day, while the C-fund was not far behind with a 0.75% decline. However, agreements to postpone these tariffs for a month revived investor confidence, leading to a rebound over the next three trading days.

Despite this recovery, January’s jobs report triggered a late-week downturn, pushing the C and S-funds into negative territory for the week. The job numbers were unimpressive, but they remained stable enough to support the expectation that the Federal Open Market Committee (FOMC) could maintain elevated borrowing rates for a longer period.

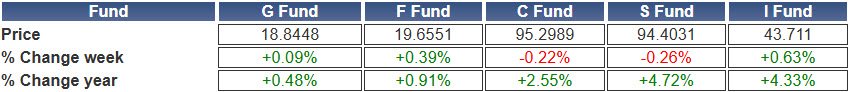

Here are the weekly, monthly, and annual TSP fund returns for the week ending February 7:

AutoTracker Member Activity

Over the last five trading days, 53 non-premium AutoTracker members made Interfund Transfers (IFTs). Six members utilized two or more IFTs during the week. The following breakdown highlights the shifts in their allocations:Average Allocation of These 53 Members on January 31st:

- G: 45.2%

- F: 2.1%

- C: 19.3%

- S: 30.6%

- I: 2.8%

Average Allocation of These 53 Members at Close of Business on February 7th:

- G: 33.8%

- F: 4.7%

- C: 12.4%

- S: 39.1%

- I: 5.0%

S-Fund Sees the Biggest Inflows Despite Underperformance

The S-fund experienced the highest inflow of allocations, despite underperforming all other TSP funds for the week. This trend persisted daily, regardless of morning price action.A likely explanation is the S-fund’s outperformance of the C-fund for the year, which has increased its popularity. While the C-fund led in 2024, investors shifting into the S-fund are now rising in the 2025 TSP Talk AutoTracker standings. Members who have maintained a 100% S-fund allocation since the start of the year are currently tied for 22nd place among more than a thousand AutoTracker participants.

Interestingly, half of the 21 members outperforming the S-fund for the year are currently in the G-fund. However, their average allocations still reflect a preference for small-cap stocks, with 40.5% in the S-fund and 9.5% in the C-fund.

Top Performers of the Week

Despite the S-fund’s prominence at the top of the standings, it was a select few F and I-fund investors who managed to post gains for the week. Notably, three of the top four AutoTracker members in the 2025 standings also secured three of the four best returns of the week:Top Performers of the Week:

- cmil1212 (2): +1.82%

- $VIX(dragon)CSIFG: +1.62%

- bjean (4): +0.87%

- MRJ (1): +0.83%

All four of these top performers had one strategy in common: they increased their stock exposure during Monday’s sell-off. Notably, cmil1212 used three IFTs throughout the week and is now locked into the G-fund for the remainder of the month.

Stay Ahead with the Last Look Report

Want to see these IFTs in real-time and to help you make your final TSP investment decisions? Subscribe to the Last Look Report to stay informed on market trends, AutoTracker moves, and key trading insights 30 minutes before the TSP deadline.Subscribe Now

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.