This past week saw a pullback in the markets, which brought down the value of the Thrift Savings Plan (TSP) stock funds. As a result, the G-fund emerged as the top performer, posting a modest but positive return of 0.08%. Remarkably, no TSP Talk AutoTracker member managed to outperform this conservative fund.

Despite the market weakness, we observed a notable number of AutoTracker members shifting into a particular stock fund. This move could be strategic, as December is historically known for the "Santa Claus Rally," a period of increased stock market performance in the final days of the year. However, as Tom has highlighted in his commentary, December often experiences mid-month market dips—a trend we witnessed last week. This recent decline may have presented itself as a prime opportunity for swing traders to buy into the TSP stock funds at lower prices before the anticipated year-end rally.

In the TSP Talk AutoTracker, 55 Interfund Transfers (IFTs) were made over the week. The data shows that these members are favored the S-fund, which saw an average allocation of 51%. The G-fund followed with an average allocation of 25%, while the C-fund took the third spot at 16%.

Interestingly, the S-fund had the worst performance among the TSP funds last week, falling by 2.55%. Could this decline be the reason so many investors are eyeing the S-fund? The dip offers an attractive discount for those betting on a rebound during the Santa Claus Rally.

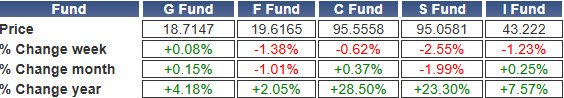

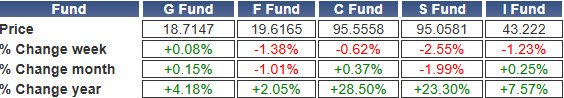

Here are the weekly, monthly, and annual TSP fund returns for the week ending December 12:

It’s worth noting that the S-fund surged 12% in November. Some investors might view this recent spike as a sign that the S-fund is now overvalued. On the other hand, others may see November’s strong performance as proof of the fund’s growth potential. This divergence in outlooks is what makes the S-fund an intriguing choice during this period.

As we move deeper into December, all eyes are on whether the Santa Claus Rally will materialize and lift the stock funds. Until then, the G-fund remains a safe harbor amid market uncertainty, but the potential for a rally might make this a strategic time for risk-tolerant investors to position themselves for year-end gains.

The Federal Open Market Committee is expected to cut rates by 25 basis points on Wednesday. This rate cut is priced into the market already, but in the following press conference Jerome Powell will enlighten the market on where the FOMC sees rate cuts going forward. How he communicates this could have market moving potential.

Not a member yet? Start Your TSP Talk AutoTracker account for free before 2025.

Top Performers of 2024

When it comes to risk tolerance, it's worth examining the standout performers of 2024. With just over two weeks left in the year, nine AutoTracker members have managed to surpass the returns of the C-fund.

Gitkrunk has held the number one position for some time and currently has a 2024 return of 33.73%. Gitkrunk's crown is not yet secure, CrabClaw is in second place with a 2024 return of 33.17%. The two top members are both fully invested in stock funds but are diversified differently.

Like the IFT trend we saw last week, the top nine hold an average S-fund allocation of 50%. Only two of the nine hold no S-fund shares. In contrast, only three of the nine hold any G-fund shares. Only one, Sign_Stealer, is completely in the G-fund protecting their 31% return from a pull-back.

These top performers are taking on the market. On Friday, both CrabClaw (2) and Cash_Money (3) followed the AutoTracker trend and added stock exposure while the market was down near the TSP trade deadline. Both members are diversified with the S-fund being there most held TSP fund.

Get timely insights with the Last Look Report — delivered at 11:30 AM ET, just 30 minutes before the TSP trade deadline. Stay informed with the latest AutoTracker IFT moves, morning market trends, key headlines, and relevant forum discussions to help you make confident, last-minute investment decisions. Subscribe now and never miss a critical market move!

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Despite the market weakness, we observed a notable number of AutoTracker members shifting into a particular stock fund. This move could be strategic, as December is historically known for the "Santa Claus Rally," a period of increased stock market performance in the final days of the year. However, as Tom has highlighted in his commentary, December often experiences mid-month market dips—a trend we witnessed last week. This recent decline may have presented itself as a prime opportunity for swing traders to buy into the TSP stock funds at lower prices before the anticipated year-end rally.

In the TSP Talk AutoTracker, 55 Interfund Transfers (IFTs) were made over the week. The data shows that these members are favored the S-fund, which saw an average allocation of 51%. The G-fund followed with an average allocation of 25%, while the C-fund took the third spot at 16%.

Interestingly, the S-fund had the worst performance among the TSP funds last week, falling by 2.55%. Could this decline be the reason so many investors are eyeing the S-fund? The dip offers an attractive discount for those betting on a rebound during the Santa Claus Rally.

Here are the weekly, monthly, and annual TSP fund returns for the week ending December 12:

It’s worth noting that the S-fund surged 12% in November. Some investors might view this recent spike as a sign that the S-fund is now overvalued. On the other hand, others may see November’s strong performance as proof of the fund’s growth potential. This divergence in outlooks is what makes the S-fund an intriguing choice during this period.

As we move deeper into December, all eyes are on whether the Santa Claus Rally will materialize and lift the stock funds. Until then, the G-fund remains a safe harbor amid market uncertainty, but the potential for a rally might make this a strategic time for risk-tolerant investors to position themselves for year-end gains.

The Federal Open Market Committee is expected to cut rates by 25 basis points on Wednesday. This rate cut is priced into the market already, but in the following press conference Jerome Powell will enlighten the market on where the FOMC sees rate cuts going forward. How he communicates this could have market moving potential.

Not a member yet? Start Your TSP Talk AutoTracker account for free before 2025.

Top Performers of 2024

When it comes to risk tolerance, it's worth examining the standout performers of 2024. With just over two weeks left in the year, nine AutoTracker members have managed to surpass the returns of the C-fund.

Gitkrunk has held the number one position for some time and currently has a 2024 return of 33.73%. Gitkrunk's crown is not yet secure, CrabClaw is in second place with a 2024 return of 33.17%. The two top members are both fully invested in stock funds but are diversified differently.

Like the IFT trend we saw last week, the top nine hold an average S-fund allocation of 50%. Only two of the nine hold no S-fund shares. In contrast, only three of the nine hold any G-fund shares. Only one, Sign_Stealer, is completely in the G-fund protecting their 31% return from a pull-back.

These top performers are taking on the market. On Friday, both CrabClaw (2) and Cash_Money (3) followed the AutoTracker trend and added stock exposure while the market was down near the TSP trade deadline. Both members are diversified with the S-fund being there most held TSP fund.

Get timely insights with the Last Look Report — delivered at 11:30 AM ET, just 30 minutes before the TSP trade deadline. Stay informed with the latest AutoTracker IFT moves, morning market trends, key headlines, and relevant forum discussions to help you make confident, last-minute investment decisions. Subscribe now and never miss a critical market move!

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: