___

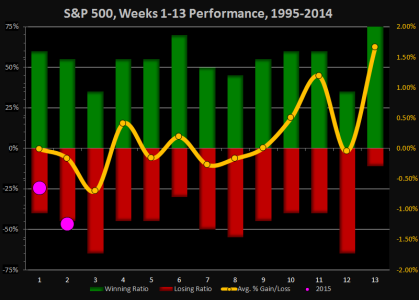

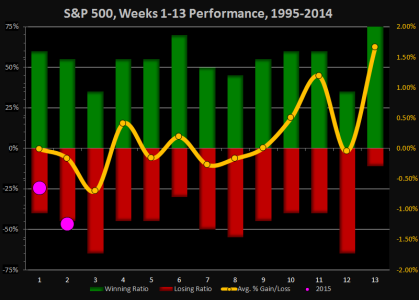

The pink circle represents our progress for 2015, this will give us an idea of where we fall within the statistical average. Week 2 closed down -1.24%

There are 52 weeks this year, for week 3

___

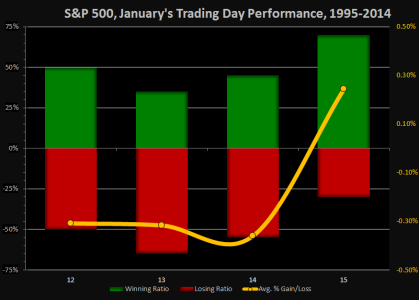

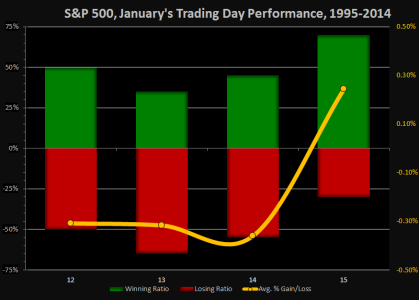

Week 3 has trading days 12-15 (Monday is a holiday)

___

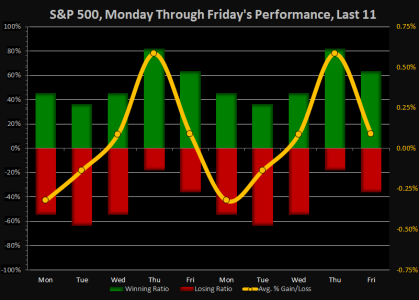

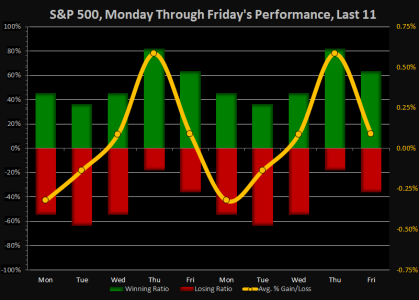

For the last 11 Monday through Fridays

___

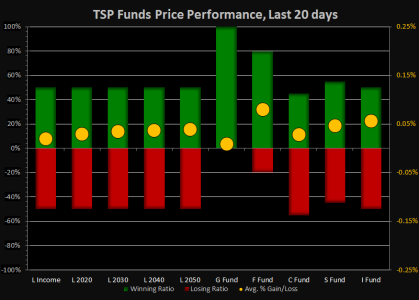

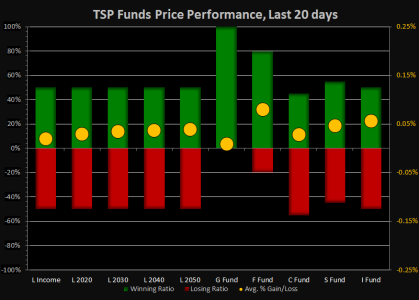

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

___

For anyone who has been following these stat blogs they might be wondering if the work? I believe they do, but only if they are applied properly and in the right context. Stats cannot predict the future but what they can do is tell us how the current price action compares with historical percentage price performance. Sometimes the stat cycles are in alignment with the current cycles of price action, while other times they aren't. It's sort of like being on a sail boat, where the waters produce large & small waves of prices, while the stats (much like the trend) provides the wind for your sails.

Over the past 2 weeks (judging on average gains only)

Since the trading day stats are misaligned, I'm more inclined to believe that week 3's poor historical performance may not play its traditional role. After all, we've already had some substantial downsliding price action so (under bull market conditions) it would be difficult to fathom another dreadful week. But, we'll just have to see how it works out, this is one of those rare times where Options X finished last Friday and is followed by a market holiday on Monday. Either ways, I'll still have 2 IFTs to play with, so I'm just chilling & waiting for another window of opportunity to open up.

Trade hard…Jason

The pink circle represents our progress for 2015, this will give us an idea of where we fall within the statistical average. Week 2 closed down -1.24%

There are 52 weeks this year, for week 3

- We show a 35% winning ratio, which is in the bottom 20%, ranking in a 2-way tie for 49th

- We show -.70% average gains, which is in the bottom 20%, ranking 50th

- We show 1.10% average positive gains, which is in the bottom 20%, ranking 48th

- We show -1.68% average negative gains, which is above average, ranking 20th

___

Week 3 has trading days 12-15 (Monday is a holiday)

- First 3 days show a weak winning ratio with weak average gains

- Friday shows a strong performance

___

For the last 11 Monday through Fridays

- Mondays show a 45% winning ratio, with -.32% average gains

- Tuesdays show a 36% winning ratio, with -.14% average gains

- Wednesdays show a 45% winning ratio, with .09% average gains

- Thursdays show a 82% winning ratio, with .58% average gains

- Fridays show a 64% winning ratio, with .09% average gains

___

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

- F-Fund has the strongest winning ratio with 80% and the strongest average gains with .08%

- C-Fund has the worst winning ratio with 45% and the worst average gains with .03%

- S-Fund has the 2nd strongest winning ratio with 55% and the 2nd strongest average gains with .05%

- I-Fund has the 3rd best winning ratio with 50% and the 2nd best average gains with -.06%

___

For anyone who has been following these stat blogs they might be wondering if the work? I believe they do, but only if they are applied properly and in the right context. Stats cannot predict the future but what they can do is tell us how the current price action compares with historical percentage price performance. Sometimes the stat cycles are in alignment with the current cycles of price action, while other times they aren't. It's sort of like being on a sail boat, where the waters produce large & small waves of prices, while the stats (much like the trend) provides the wind for your sails.

Over the past 2 weeks (judging on average gains only)

- The weekly stats have been accurate 2 of 2 times

- The Trading day stats have been accurate 4 of 11 times (the cycles are misaligned)

- The Monday through Friday stats were accurate 7 of 10 times

Since the trading day stats are misaligned, I'm more inclined to believe that week 3's poor historical performance may not play its traditional role. After all, we've already had some substantial downsliding price action so (under bull market conditions) it would be difficult to fathom another dreadful week. But, we'll just have to see how it works out, this is one of those rare times where Options X finished last Friday and is followed by a market holiday on Monday. Either ways, I'll still have 2 IFTs to play with, so I'm just chilling & waiting for another window of opportunity to open up.

Trade hard…Jason