It's the last week of the first quarter, the final stretch and SPX is down -.39% YTD. This leaves us with a 4-day opportunity to finish above the zero line, can do it?

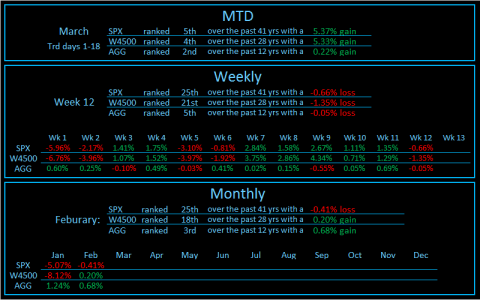

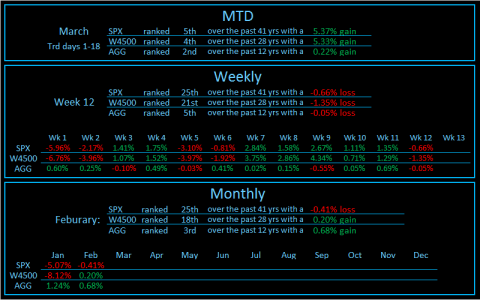

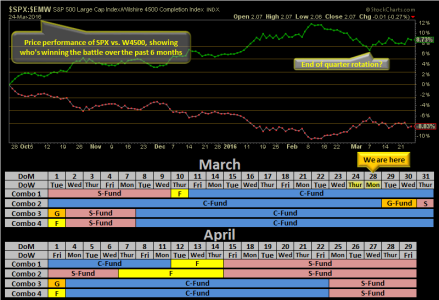

With the first 18 trading days of March behind us, we're on track for an SPX/W4500 5-7% finish for the month. Week 12's loss snapped the previous 5-week winning streak for SPX/W4500, but it wasn't a substantial lose when you consider that on the weekly timeframe, we made both higher highs and a higher lows than the previous week.

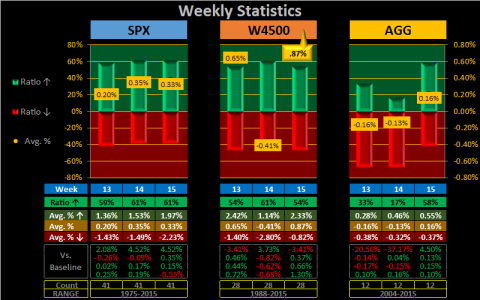

Here's a review of what's happened this March, last week, and last month.

__Month to Date, SPX/W4500/AGG are all ranked in the top 5

__Week 12 saw a below average performance for SPX/W4500, and although it did close the week down, it was an above average performance for AGG

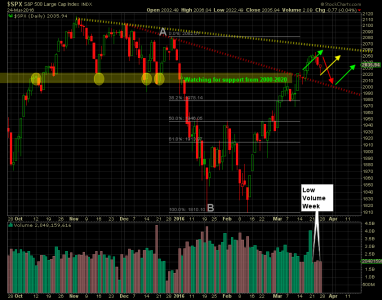

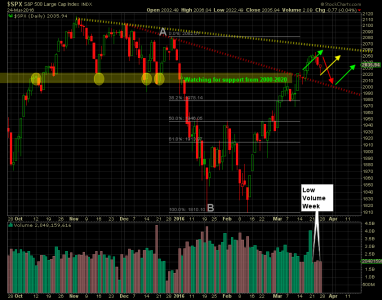

For the S&P 500, over the past 4 days:

1) We did not get the flat-to-positive close, but volume on SPX was low, so at this point I don't think the sellers have truly stepped in to take the markets down.

2) We did not push into the 2065 area, but we did push higher just shy of 2057.

3) What I don't want is to close below SPX 2015, which is the lowest close over the past 8 sessions.

4) Because we pulled back 2 days earlier than I expected, I've added a yellow arrow, this is where I'll expect the next rally to begin on Monday.

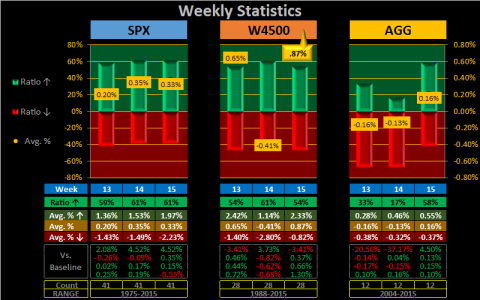

For week 13's stats:

__ SPX has the best winning ratio at 59% and is mostly above the baseline averages (6th best of the quarter)

__ W4500 has a below baseline 54% winning ratio, but makes up for it in all other areas (2th best of the quarter)

__ AGG has a significant way-below baseline 33% winning ratio (9th best of the quarter)

__ Note: For the next 2 weeks, AGG's stats stink, but it does pick up performance in weeks 15-16.

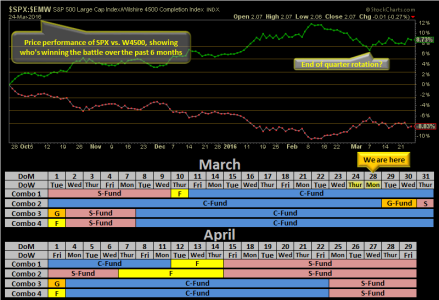

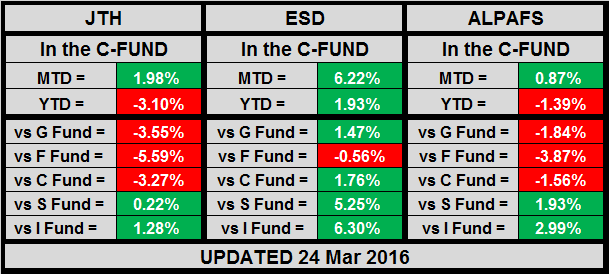

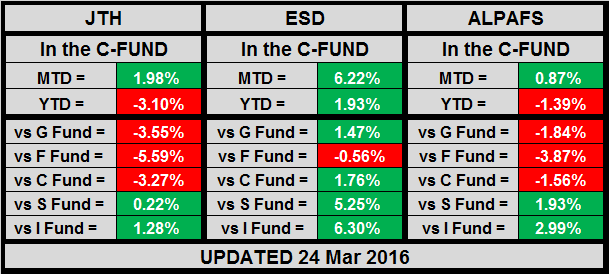

JTH-ESD (Evolving Statistical Data): ESD is currently in the C-Fund, is 6.22% MTD and 1.93% YTD.

__ 24 Mar: No changes, ESD is projected to be in the F-Fund on 12 April. Since entering the C-Fund 10 days ago, the performance gap between the C & S funds is negligible, with the C-Fund leading by .24%

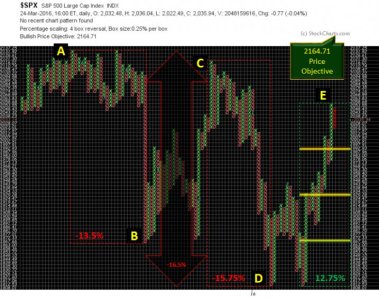

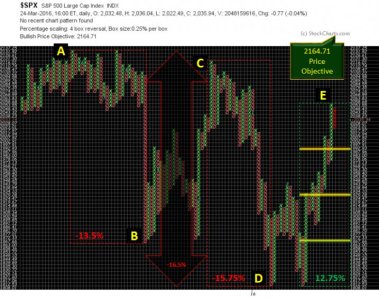

JTH-ALPAFS (Advanced Point & Figure System): ALPAFS is currently in the C-Fund, is .87% MTD and -1.39% YTD.

__ 24 Mar: I consider these conditions to be healthy retracements, all indexes remain bullish.

_________1) All indexes have created a column of Os

_________2) SPX/NDX lead over W4500/TRAN

_________3) W4500/TRAN have signaled a High Pole Warning (indicating more than half of the previous upwave was been lost)

_________4) The index closest to a bearish reversal is W4500, which would need to pullback 1.5% to flip over to a sell signal.

Here's a simple 4-day chart on the 30-minute timeframe, illustrating potential for a trend change.

For myself, I’m currently in the C-Fund, 1.98% MTD and -3.10% YTD

Trade hard...Jason

With the first 18 trading days of March behind us, we're on track for an SPX/W4500 5-7% finish for the month. Week 12's loss snapped the previous 5-week winning streak for SPX/W4500, but it wasn't a substantial lose when you consider that on the weekly timeframe, we made both higher highs and a higher lows than the previous week.

Here's a review of what's happened this March, last week, and last month.

__Month to Date, SPX/W4500/AGG are all ranked in the top 5

__Week 12 saw a below average performance for SPX/W4500, and although it did close the week down, it was an above average performance for AGG

For the S&P 500, over the past 4 days:

1) We did not get the flat-to-positive close, but volume on SPX was low, so at this point I don't think the sellers have truly stepped in to take the markets down.

2) We did not push into the 2065 area, but we did push higher just shy of 2057.

3) What I don't want is to close below SPX 2015, which is the lowest close over the past 8 sessions.

4) Because we pulled back 2 days earlier than I expected, I've added a yellow arrow, this is where I'll expect the next rally to begin on Monday.

For week 13's stats:

__ SPX has the best winning ratio at 59% and is mostly above the baseline averages (6th best of the quarter)

__ W4500 has a below baseline 54% winning ratio, but makes up for it in all other areas (2th best of the quarter)

__ AGG has a significant way-below baseline 33% winning ratio (9th best of the quarter)

__ Note: For the next 2 weeks, AGG's stats stink, but it does pick up performance in weeks 15-16.

JTH-ESD (Evolving Statistical Data): ESD is currently in the C-Fund, is 6.22% MTD and 1.93% YTD.

__ 24 Mar: No changes, ESD is projected to be in the F-Fund on 12 April. Since entering the C-Fund 10 days ago, the performance gap between the C & S funds is negligible, with the C-Fund leading by .24%

JTH-ALPAFS (Advanced Point & Figure System): ALPAFS is currently in the C-Fund, is .87% MTD and -1.39% YTD.

__ 24 Mar: I consider these conditions to be healthy retracements, all indexes remain bullish.

_________1) All indexes have created a column of Os

_________2) SPX/NDX lead over W4500/TRAN

_________3) W4500/TRAN have signaled a High Pole Warning (indicating more than half of the previous upwave was been lost)

_________4) The index closest to a bearish reversal is W4500, which would need to pullback 1.5% to flip over to a sell signal.

Here's a simple 4-day chart on the 30-minute timeframe, illustrating potential for a trend change.

For myself, I’m currently in the C-Fund, 1.98% MTD and -3.10% YTD

Trade hard...Jason