I’ll be the first to admit I find it difficult to wrap my brain around the I-fund because tracking the various overseas markets & their currencies are well outside my comfort zone. Still, I can’t just stay stupid forever, so I’m slowly building a foundation. For now, most of my I-fund analysis consists of using the S&P 500 as a leading indicator for the world markets, and monitoring the strength of the U.S. Dollar.

<O

With June almost upon us, you may have notice the I-fund has been king of the TSP playground. On up days it has outpaced C & S while on down days it has had smaller losses than the other stock funds. A good portion of this trait (I have no idea just how much) has been a direct result of the weakening dollar. Well duh? The point of all this is I’ll be watching the dollar more than usual because as long as the dollar remains weak, I believe the I-fund will give us the best opportunity to make money.

<O

Props to Here’s14U who showed me how to compare two ticker symbols side-by-side. In laymen’s terms, this is a chart of EFA verses $USD. What this does is give us an easy way to see who is winning the battle. It also allows us to use a trendline & slow stochastics to quickly identify changes.

<O

I got bored last night, so I threw up a chart of the dollar and played connect the dots. I’m going to go out on a limb here and say that 80.9 will be minor resistance and 83 will be major big time holly crapola resistance.

<O

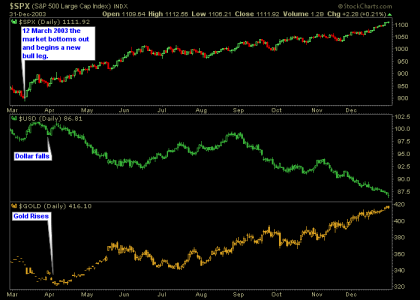

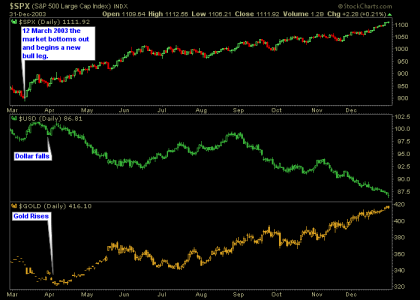

Last week Tom talked about the dollar and how the markets can still climb while the dollar declines. Here is an historical example from March 2003 followed by a look at March 2009. Please don’t infer the same exact thing that happened in 2003 will happen today, it’s just an example.

<O

Amazingly enough, the 930 descending triangle is still in play.

<O

On the 15-Day Performance chart, there is a potential trend change for AGG, while the 45 & 90 trends remain intact.

<O

Cheers

<O

<O

With June almost upon us, you may have notice the I-fund has been king of the TSP playground. On up days it has outpaced C & S while on down days it has had smaller losses than the other stock funds. A good portion of this trait (I have no idea just how much) has been a direct result of the weakening dollar. Well duh? The point of all this is I’ll be watching the dollar more than usual because as long as the dollar remains weak, I believe the I-fund will give us the best opportunity to make money.

<O

Props to Here’s14U who showed me how to compare two ticker symbols side-by-side. In laymen’s terms, this is a chart of EFA verses $USD. What this does is give us an easy way to see who is winning the battle. It also allows us to use a trendline & slow stochastics to quickly identify changes.

<O

I got bored last night, so I threw up a chart of the dollar and played connect the dots. I’m going to go out on a limb here and say that 80.9 will be minor resistance and 83 will be major big time holly crapola resistance.

<O

Last week Tom talked about the dollar and how the markets can still climb while the dollar declines. Here is an historical example from March 2003 followed by a look at March 2009. Please don’t infer the same exact thing that happened in 2003 will happen today, it’s just an example.

<O

Amazingly enough, the 930 descending triangle is still in play.

<O

On the 15-Day Performance chart, there is a potential trend change for AGG, while the 45 & 90 trends remain intact.

<O

Cheers

<O