We are in month #2 of what many call "Sell in May and go away" or "The worst 6 months." It's a phenomenon where on April 30th investors sell their stocks and buy bonds. The question is does it work? As with any statistical data the answer is "it depends." The problem with all these calender-based trading events is that it's really easy to manipulate the data to the perspective you want to convey. When you hear stats being floated around you have to ask yourself a few questions.

1. Who is the source, do they have an agenda, what positions are they holding?

2. What methods were used to calculate the stat, was it cumulative, average, mean, linear, or compounded?

3. What range of time (or price) was used, did they backtest the results over multiple random samples, or cherry pick a bull/bear market?

The TSP.Gov PIP is a great example, and I'll tell you why. I haven't contributed to this account in years, so you'd think I'd be able to easily calculate my PIP and it should match whats listed on my TSP account. Well, the few times I've tried, the numbers I come up with are lower than what they list. Are they floating my numbers higher? I don't know, but I do know if I'm too stupid to figure it out than I should be smart enough to not to trust that number. If you look below, I've posted the definition of the PIP from the TSP.GOV website. A couple things strike my ignorant self as somewhat odd. The word "modified" WTF does that mean? How about the word "Estimate" you mean to tell me they can't nail down an exact number with their own modified formula?

"Personal Investment Performance (PIP) — The rate of return earned by your entire account during the 12-month period ending on the date indicated on your annual statement or on your Account Balance page of the TSP website. The PIP is a time-weighted return that has been calculated using a modified-Deitz method (a method used by many financial institutions and an industry standard). The PIP adjusts for the distorting effects of cash flows into or out of your account. It is an estimate; therefore, your PIP may not be the same as the 12-month performance of the TSP funds, which are time-weighted" returns.

So you get my point, the point being that stats can be manipulated with ease. I tell you this in hopes that some of you will learn to be more guarded in what you hear because these markets are full of manipulative bastards trying to work their agendas against you. So back to the "Sell in May and go away" does it really work? To answer this question I have to separate stocks and bonds, and test them separately during these 6-month periods. While stocks & bonds do trade inversely to each other it's not a tit-for-tat relationship. Since I can't compare apples to oranges, I'm going to compare apples to apples, then oranges to oranges.

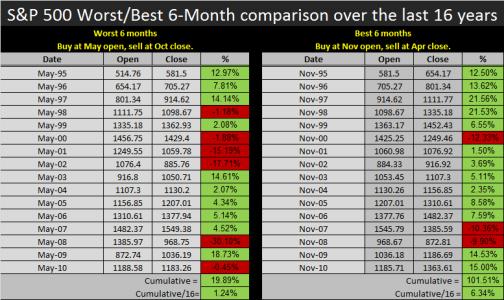

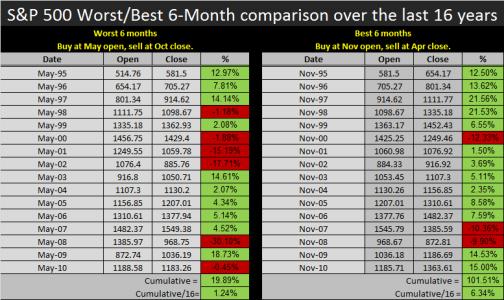

The first apple is the S&P 500 what most agree is the benchmark for which performance should be measured. I chose to go as far back as 1995 because this covers 2 bull markets, 2 bear markets, and the current bull market. This is usually the timeframe I use for much of the backtesting I do because it's a good sample of bull/bear data. So I'm going to test the worst 6 months and the best 6 months of the S&P 500 and see if the "Sell in May and go away" really is true. Well if you look at the stats below, you can see the Best 6 months of the S&P 500 clearly outperform the worst 6 months by 5 times, that's a stark difference. So now that we've shown over the last 16 years this has worked for the S&P 500, let's compare bonds against bonds to see if we get the same results.

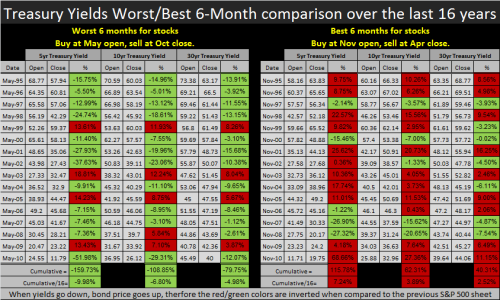

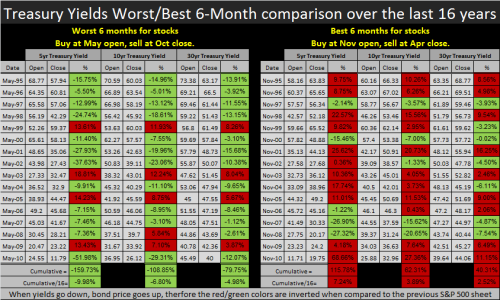

For the purpose of this comparison, I'm going to use yields. The main reason I'm using yields is because it's the only data I can get going back to 1995. Most of the Bond ETFs don't go back beyond 2003, but US Treasury Yields go back much further. For bonds, when yields go down, bond price goes up, so what we want to see is which 6 month yield (out performs) goes down furthest. To give you a better sample, I've chosen to use the 5, 10, and 30 year yields so we can paint a much broader picture. You can see this is interesting, during the worst 6 months for stocks, bonds clearly out performed the best 6 months for stocks, so it is indeed true (as this rudimentary study concludes) that over the last 16 years, "Sell in May and go away" has some truth to it!

Moving on to the Bond Spectrum, prices have appeared to hit overhead resistance and volume has seen a significant rise over the last week. One might get worried we're going to get a pullback here, but bonds have the momentum, and seasonality to carry us even higher if they so choose.

Some tidbits: "BlackRock Inc.'s (BLK) chief executive, Laurence Fink, said Friday that as the Federal Reserve exits its bond-buying program and investors seek to lower their risk, the private sector will move "huge" into U.S. Treasury debt issues. "

"Constrained from being put to economically useful purposes, global liquidity is finding its way into Treasuries."

Here's a really rare find, a video with Jeff Hirsch, editor of Stock Trader’s Almanac and Jeff Macke (formally of CNBC's Fast money.) This video is from May 2, it's a nice conversation about "Sell in May and go away."

Learn the trade...Jason

1. Who is the source, do they have an agenda, what positions are they holding?

2. What methods were used to calculate the stat, was it cumulative, average, mean, linear, or compounded?

3. What range of time (or price) was used, did they backtest the results over multiple random samples, or cherry pick a bull/bear market?

The TSP.Gov PIP is a great example, and I'll tell you why. I haven't contributed to this account in years, so you'd think I'd be able to easily calculate my PIP and it should match whats listed on my TSP account. Well, the few times I've tried, the numbers I come up with are lower than what they list. Are they floating my numbers higher? I don't know, but I do know if I'm too stupid to figure it out than I should be smart enough to not to trust that number. If you look below, I've posted the definition of the PIP from the TSP.GOV website. A couple things strike my ignorant self as somewhat odd. The word "modified" WTF does that mean? How about the word "Estimate" you mean to tell me they can't nail down an exact number with their own modified formula?

"Personal Investment Performance (PIP) — The rate of return earned by your entire account during the 12-month period ending on the date indicated on your annual statement or on your Account Balance page of the TSP website. The PIP is a time-weighted return that has been calculated using a modified-Deitz method (a method used by many financial institutions and an industry standard). The PIP adjusts for the distorting effects of cash flows into or out of your account. It is an estimate; therefore, your PIP may not be the same as the 12-month performance of the TSP funds, which are time-weighted" returns.

So you get my point, the point being that stats can be manipulated with ease. I tell you this in hopes that some of you will learn to be more guarded in what you hear because these markets are full of manipulative bastards trying to work their agendas against you. So back to the "Sell in May and go away" does it really work? To answer this question I have to separate stocks and bonds, and test them separately during these 6-month periods. While stocks & bonds do trade inversely to each other it's not a tit-for-tat relationship. Since I can't compare apples to oranges, I'm going to compare apples to apples, then oranges to oranges.

The first apple is the S&P 500 what most agree is the benchmark for which performance should be measured. I chose to go as far back as 1995 because this covers 2 bull markets, 2 bear markets, and the current bull market. This is usually the timeframe I use for much of the backtesting I do because it's a good sample of bull/bear data. So I'm going to test the worst 6 months and the best 6 months of the S&P 500 and see if the "Sell in May and go away" really is true. Well if you look at the stats below, you can see the Best 6 months of the S&P 500 clearly outperform the worst 6 months by 5 times, that's a stark difference. So now that we've shown over the last 16 years this has worked for the S&P 500, let's compare bonds against bonds to see if we get the same results.

For the purpose of this comparison, I'm going to use yields. The main reason I'm using yields is because it's the only data I can get going back to 1995. Most of the Bond ETFs don't go back beyond 2003, but US Treasury Yields go back much further. For bonds, when yields go down, bond price goes up, so what we want to see is which 6 month yield (out performs) goes down furthest. To give you a better sample, I've chosen to use the 5, 10, and 30 year yields so we can paint a much broader picture. You can see this is interesting, during the worst 6 months for stocks, bonds clearly out performed the best 6 months for stocks, so it is indeed true (as this rudimentary study concludes) that over the last 16 years, "Sell in May and go away" has some truth to it!

Moving on to the Bond Spectrum, prices have appeared to hit overhead resistance and volume has seen a significant rise over the last week. One might get worried we're going to get a pullback here, but bonds have the momentum, and seasonality to carry us even higher if they so choose.

Some tidbits: "BlackRock Inc.'s (BLK) chief executive, Laurence Fink, said Friday that as the Federal Reserve exits its bond-buying program and investors seek to lower their risk, the private sector will move "huge" into U.S. Treasury debt issues. "

"Constrained from being put to economically useful purposes, global liquidity is finding its way into Treasuries."

Here's a really rare find, a video with Jeff Hirsch, editor of Stock Trader’s Almanac and Jeff Macke (formally of CNBC's Fast money.) This video is from May 2, it's a nice conversation about "Sell in May and go away."

Learn the trade...Jason