Sunday Brief

14 November 2010

14 November 2010

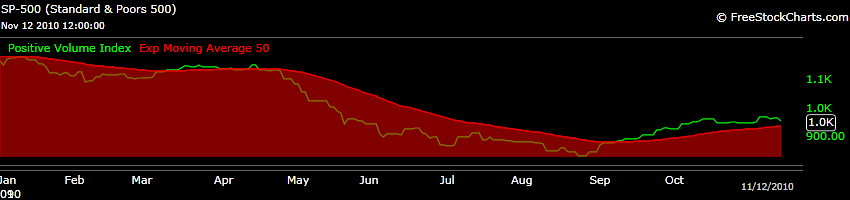

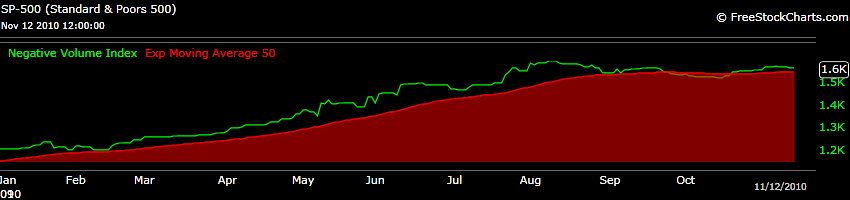

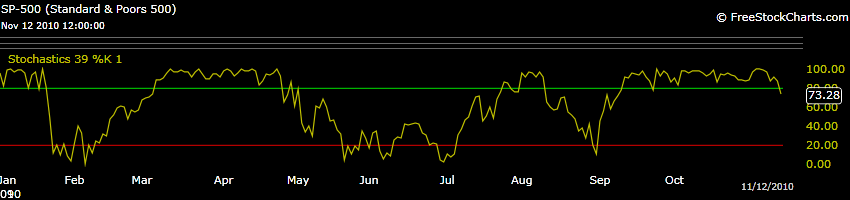

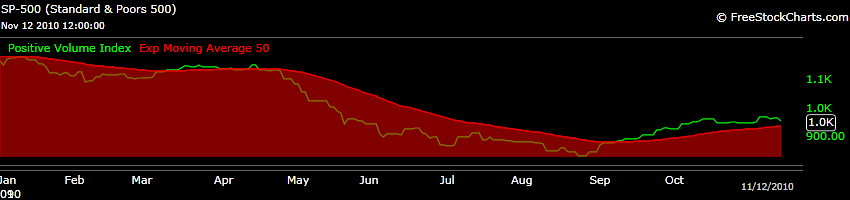

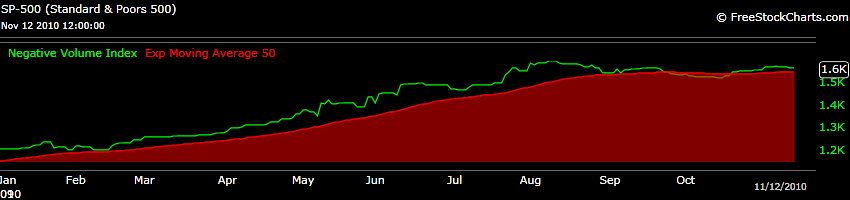

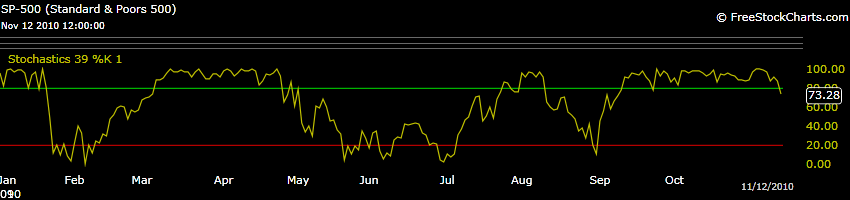

Not much to report this week, my expectations remain the same until the trend proves otherwise. Expounding on last week's chart (YTD Daily) here are some bearish observations you may find interesting. The PVI (Positive Volume Index) is a measurement of the movement in positive volume, I tend to call it the dumb money rushing in. When compared to the May peak, we can see the PVI has been declining. Meanwhile the NVI (Negative Volume Index) has been running down-to-flat since the August peak, telling me the smart volume has been having a hard time committing to this market. Lastly, the last three times the slow 39,1 Stochastic turned below 80, it led to a decent pullback. You can see we've just turned below 80 again, if you still have 2 IFTs, you're in a better positon than I am!

Here's a 3 month Price Performance Chart. My goal will be to catch the Russell 2000 in a pullback to the yellow box somewhere 4% to 6.5% from the recent top. If I can catch that bounce, then I may use my last IFT to jump 100% into the S-Fund, from my current 85% C-Fund allocation

Take care & trade safe...Jason