09/30/25

After last week's pullback, stocks are making their way back toward their highs after a two day rally left them just short. Nvidia and big tech led the way. Weakness in the dollar and a decline in yields helped stocks regain some of last week's losses. There is still some work to be done, but the trend has not broken and barring a disaster today, September may be another check mark for the bulls.

There is the issue of the potential government shutdown, but the stock market has ignored these in the past, knowing a deal will eventually be made. Maybe we see a short shutdown that brings on some jitters, but political gamesmanship rarely disturbs the markets unless it impacts monetary policy.

One thing it could impact is the September jobs report. We are supposed to get the September jobs report on Friday, but if a budget deal is not made, the BLS has said there will not be a jobs report released.

These jobs reports have been come little more than a first Friday of the month trading opportunity as we know revisions could completely change the numbers down the road. Still, not getting a report would be different.

I'm sure I show some of political colors now and then, but that is not my intent. This may be hyperbolic but the divide between our political parties probably cannot get worse without it escalating beyond repair, and I have to wonder if that is part of the reason why one of the hottest sectors in the market right now are the precious metals?

Gold, yes boring gold, is at an all time high and moving up almost daily lately. And silver is nearing a 14 year high.

We could say that it is because the dollar is falling, and while the dollar is down this year, it has actually been flat over the last 6 months while those metals have broken out and taken flight. So, that is a bit of an eye opener that something could be amiss.

Meanwhile, the stock market has been barely blinking. The S&P 500 / C-fund just made an all time high last week, and it seems to be heading toward a new one. That tells me that investors are ignoring the chaos in D.C. and looking at the potential for AI and tech advancement, economic growth, and a monetary policy that just keeps on giving. It could all be smoke and mirrors for all we know, but the stock market can usually sniff out trouble before we see it, and it hasn't smelled it yet.

Yes, it's tough to say why gold and stocks are soaring, but one place that is usually a good place to check is the bond market. The bond market is much larger than the stock market - believe it or not - and bond traders and investors tend to be more savvy than stocks market participants. With the 10-Year Treasury Yield up recently but hitting resistance near 4.2%, it is still trending lower, but it is not too low, nor too high in my opinion.

If we want to compare the current yield to the COVID crash, then it is obviously quite higher now, but it was higher 25 years ago and if not for the financial crisis where the Fed Funds Rate was pinned near 0% for years, the yield may be in this area that seems about right.

Translation, the bond market doesn't seem too worried about the political theater either. Should we be?

It's the last day (or morning) to make an allocation change for September. After noon ET today, it will become an October transfer.

The DWCPF (S-fund) was up yesterday and it closed somewhere in the middle of yesterday's high and low of the day. That's indecision. Retracing some of last week's losing candlesticks is typical action but now it needs to find a direction because investors were not going all in yesterday as they backed off from the highs. The chart looks fine but referencing the drama above, what will happen to yields and stocks if there is a shut down? Probably nothing, but if there is a market that has been needing an excuse to pull back, this is it.

ACWX (I-fund) led on the upside yesterday thanks to the dollar's loss yesterday. There's no denying that this chart is bullish with little signs of giving up, but can the melt up survive the historical volatility of October without some bruises?

BND (bonds / F-fund) rallied on lower yields. Now that it is back on top of that gap, I think we can say that gap fill has been satisfied. Technically it is still open, but there is also a partially open gap above as well.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

After last week's pullback, stocks are making their way back toward their highs after a two day rally left them just short. Nvidia and big tech led the way. Weakness in the dollar and a decline in yields helped stocks regain some of last week's losses. There is still some work to be done, but the trend has not broken and barring a disaster today, September may be another check mark for the bulls.

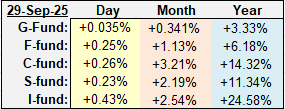

| Daily TSP Funds Return More returns |

There is the issue of the potential government shutdown, but the stock market has ignored these in the past, knowing a deal will eventually be made. Maybe we see a short shutdown that brings on some jitters, but political gamesmanship rarely disturbs the markets unless it impacts monetary policy.

One thing it could impact is the September jobs report. We are supposed to get the September jobs report on Friday, but if a budget deal is not made, the BLS has said there will not be a jobs report released.

These jobs reports have been come little more than a first Friday of the month trading opportunity as we know revisions could completely change the numbers down the road. Still, not getting a report would be different.

I'm sure I show some of political colors now and then, but that is not my intent. This may be hyperbolic but the divide between our political parties probably cannot get worse without it escalating beyond repair, and I have to wonder if that is part of the reason why one of the hottest sectors in the market right now are the precious metals?

Gold, yes boring gold, is at an all time high and moving up almost daily lately. And silver is nearing a 14 year high.

We could say that it is because the dollar is falling, and while the dollar is down this year, it has actually been flat over the last 6 months while those metals have broken out and taken flight. So, that is a bit of an eye opener that something could be amiss.

Meanwhile, the stock market has been barely blinking. The S&P 500 / C-fund just made an all time high last week, and it seems to be heading toward a new one. That tells me that investors are ignoring the chaos in D.C. and looking at the potential for AI and tech advancement, economic growth, and a monetary policy that just keeps on giving. It could all be smoke and mirrors for all we know, but the stock market can usually sniff out trouble before we see it, and it hasn't smelled it yet.

Yes, it's tough to say why gold and stocks are soaring, but one place that is usually a good place to check is the bond market. The bond market is much larger than the stock market - believe it or not - and bond traders and investors tend to be more savvy than stocks market participants. With the 10-Year Treasury Yield up recently but hitting resistance near 4.2%, it is still trending lower, but it is not too low, nor too high in my opinion.

If we want to compare the current yield to the COVID crash, then it is obviously quite higher now, but it was higher 25 years ago and if not for the financial crisis where the Fed Funds Rate was pinned near 0% for years, the yield may be in this area that seems about right.

Translation, the bond market doesn't seem too worried about the political theater either. Should we be?

It's the last day (or morning) to make an allocation change for September. After noon ET today, it will become an October transfer.

The DWCPF (S-fund) was up yesterday and it closed somewhere in the middle of yesterday's high and low of the day. That's indecision. Retracing some of last week's losing candlesticks is typical action but now it needs to find a direction because investors were not going all in yesterday as they backed off from the highs. The chart looks fine but referencing the drama above, what will happen to yields and stocks if there is a shut down? Probably nothing, but if there is a market that has been needing an excuse to pull back, this is it.

ACWX (I-fund) led on the upside yesterday thanks to the dollar's loss yesterday. There's no denying that this chart is bullish with little signs of giving up, but can the melt up survive the historical volatility of October without some bruises?

BND (bonds / F-fund) rallied on lower yields. Now that it is back on top of that gap, I think we can say that gap fill has been satisfied. Technically it is still open, but there is also a partially open gap above as well.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.