12/17/25

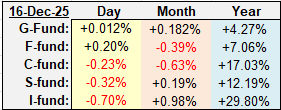

Stocks were down early on Tuesday, and the weaker than expected jobs report didn't help, but as we often see on Tuesdays, the trend reversed about halfway through the trading day, and while we didn't see a lot of of green, the indices closed well off their lows. Yields and the dollar were down, but small caps and the I-fund lagged anyway, and of course the F-fund rallied on the decline in yields.

The jobs report may have contributed to the morning sell off, but the futures were down sharply over night on Monday, well before the release of the Tuesday morning jobs report. As far as the data goes, it was a good news / bad news situation.

Bad news: The economy added 64K jobs in November, and that is not a very healthy gain

Good news: That 64K beat the analyst estimates by 15K to 40K, depending on whose estimate you are using

Bad news: The October report showed a loss of 105K jobs, which was a big miss of the estimated modest gain

Good news: It was caused by the government shutdown so we shouldn't see anything similar - at least not until the current budget expires on January 30

Bad news: The data over all is showing labor market weakness

Good news: This could keep the Fed on a dovish approach to interest rates (continue to cut?)

The Nasdaq broke its 3-day losing streak with the positive reversal yesterday and it hasn't had a 4-day losing streak since mid-April. Whether this was a sign of strength or an oversold index getting some relief remains to be seen, but Turnaround Tuesdays are real and we'll know soon enough if this starts some kind of late December rally. The market may need big tech to participate if we are going to get a year end rally. The charts still have some issues, but reversals at support are promising.

The S&P 500 (C-fund) turned around just in time, and at key support, so it remains in the right shoulder of the inverted head and shoulders pattern, and it closed above the 50 and 20-day EMA's. All good signs, but it must hold.

The PMO indicator is nearly falling below its moving average - not great, but the Stochastics is near a level that has triggered a relief rally each time n recent months, although the market has been struggling since that October 10 sell off - the first time this Stochastic fell below 20.

Yields and the dollar were down on the weaker than expected jobs data. I believe concerns about inflation are waning, but interesting. Powell has said that the tariffs were a one time increase in prices so they expect inflation to come down from 2.9% to 2.5% next year. However, the steady decline in the price of oil, now at a 4.5 year low, is putting more money in consumers' pockets and that's potentially inflationary. but the price is falling partly because of the economy slipping, which could send yields lower, so bonds are in an interesting position. Clear as mud? The bond market is considered the smarter money, so watch those yields to figure out what they are thinking.

The market leading Dow Transportation Index and the small caps of the Russell 2000 both pulled back yesterday. The IWM Russell ETF closed below the October peak, but I will give it some wiggle room since the late rally pushed it back above the October closing high (blue line.)

The Transports went parabolic and a pullback would not be unusual, but it is still attempting to hold that narrow trading channel.

The CPI report was supposed to come out tomorrow, but the release has been postponed until January.

The DWCPF Index (S-Fund) continues to form its right shoulder while holding above the 50-day average. This is perfectly good consolidating action, but support must continue to hold.

ACWX (I-fund) showed a crack by closing just below the narrow trading channel, but it is still legitimately above key levels that would keep the bulls in charge. Sub 64.50 and the bears could take over, but you'll probably know that for yourself without me telling you, if it happens. Otherwise, this is holding up just fine.

BND (bonds / F-fund) continues to bounce above and below that support line. I don't see yields moving too much lower, but we just don't want to see yields moving higher too quickly. That would give the stock and bond market some trouble.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks were down early on Tuesday, and the weaker than expected jobs report didn't help, but as we often see on Tuesdays, the trend reversed about halfway through the trading day, and while we didn't see a lot of of green, the indices closed well off their lows. Yields and the dollar were down, but small caps and the I-fund lagged anyway, and of course the F-fund rallied on the decline in yields.

| Daily TSP Funds Return More returns |

The jobs report may have contributed to the morning sell off, but the futures were down sharply over night on Monday, well before the release of the Tuesday morning jobs report. As far as the data goes, it was a good news / bad news situation.

Bad news: The economy added 64K jobs in November, and that is not a very healthy gain

Good news: That 64K beat the analyst estimates by 15K to 40K, depending on whose estimate you are using

Bad news: The October report showed a loss of 105K jobs, which was a big miss of the estimated modest gain

Good news: It was caused by the government shutdown so we shouldn't see anything similar - at least not until the current budget expires on January 30

Bad news: The data over all is showing labor market weakness

Good news: This could keep the Fed on a dovish approach to interest rates (continue to cut?)

The Nasdaq broke its 3-day losing streak with the positive reversal yesterday and it hasn't had a 4-day losing streak since mid-April. Whether this was a sign of strength or an oversold index getting some relief remains to be seen, but Turnaround Tuesdays are real and we'll know soon enough if this starts some kind of late December rally. The market may need big tech to participate if we are going to get a year end rally. The charts still have some issues, but reversals at support are promising.

The S&P 500 (C-fund) turned around just in time, and at key support, so it remains in the right shoulder of the inverted head and shoulders pattern, and it closed above the 50 and 20-day EMA's. All good signs, but it must hold.

The PMO indicator is nearly falling below its moving average - not great, but the Stochastics is near a level that has triggered a relief rally each time n recent months, although the market has been struggling since that October 10 sell off - the first time this Stochastic fell below 20.

Yields and the dollar were down on the weaker than expected jobs data. I believe concerns about inflation are waning, but interesting. Powell has said that the tariffs were a one time increase in prices so they expect inflation to come down from 2.9% to 2.5% next year. However, the steady decline in the price of oil, now at a 4.5 year low, is putting more money in consumers' pockets and that's potentially inflationary. but the price is falling partly because of the economy slipping, which could send yields lower, so bonds are in an interesting position. Clear as mud? The bond market is considered the smarter money, so watch those yields to figure out what they are thinking.

The market leading Dow Transportation Index and the small caps of the Russell 2000 both pulled back yesterday. The IWM Russell ETF closed below the October peak, but I will give it some wiggle room since the late rally pushed it back above the October closing high (blue line.)

The Transports went parabolic and a pullback would not be unusual, but it is still attempting to hold that narrow trading channel.

The CPI report was supposed to come out tomorrow, but the release has been postponed until January.

The DWCPF Index (S-Fund) continues to form its right shoulder while holding above the 50-day average. This is perfectly good consolidating action, but support must continue to hold.

ACWX (I-fund) showed a crack by closing just below the narrow trading channel, but it is still legitimately above key levels that would keep the bulls in charge. Sub 64.50 and the bears could take over, but you'll probably know that for yourself without me telling you, if it happens. Otherwise, this is holding up just fine.

BND (bonds / F-fund) continues to bounce above and below that support line. I don't see yields moving too much lower, but we just don't want to see yields moving higher too quickly. That would give the stock and bond market some trouble.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.