Flip the script...

Friday's -1.77% loss was the worst close over the past 42 sessions, going back to the 18-Dec-2024 -2.95% loss.

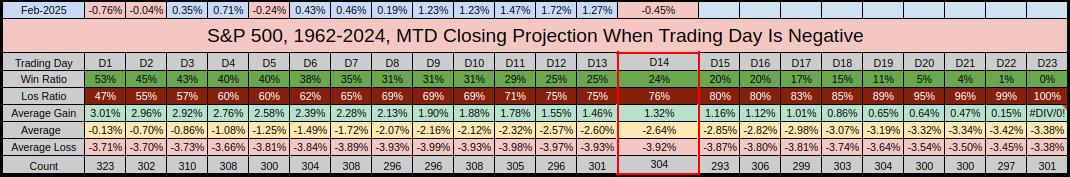

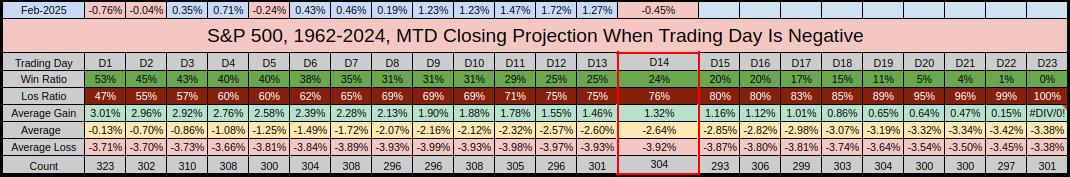

Not that it's been a stellar month to begin with, but this is also the 3rd time Feb MTD has gone into the red.

As a word of caution, from the previous 63-years (or 765 months) when trading day 14 was down MTD, the monthly win ratio was 24%.

But....we're only down -.45% MTD, so if Monday's Trading Day 15 can put us back in the green, then the monthly win ratio rises to 86%

While Friday's recent close below January's close was disappointing, we still have some good indications of a strong year.

Both the Feb High/Low is higher than the Jan High/Low. I highlighted some of these stats recently in my Acct-Talk.

In the meantime, priority #1 is for Feb to maintain a higher low. If we do go lower, then we'll have an outside month which is highlighted in Chart 2 of the February Blog.

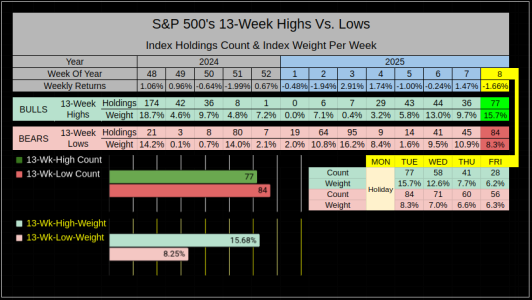

If you saw Friday's price action, you might be hard-pressed to believe the Index just put in a fresh 52-Week High on 19-Feb. Was this a final push before an exhaustive collapse? Good question, (heck if I know) but at the moment I'm looking for clues, so I've focused on the smaller 13-Week Time Frame.

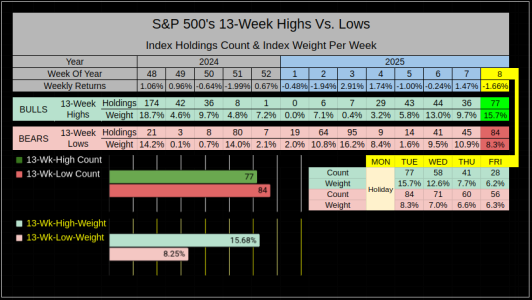

For Week-8, the Bears had a slight edge with 84 new 13-Week Lows, but the Bulls had nearly twice an edge in index weight. The bulls had a weighted 15.68% from new 13-Week Highs. If I looked at this chart, I'd tell you the Bulls won the week, but this wasn't reflected in the -1.66% WTD loss for the index.

Having said that, this chart is still a work in progress, so I need to keep an eye out for erroneous user-caused errors.

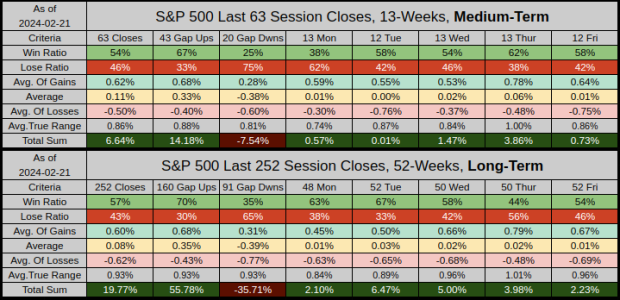

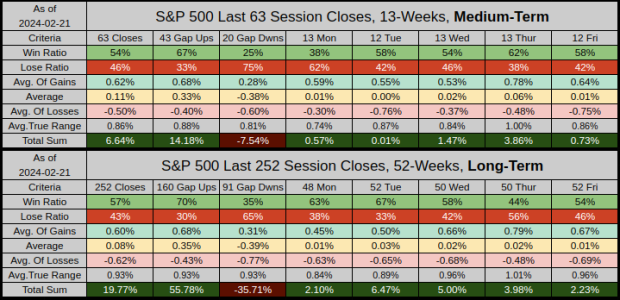

Last 6 Tuesday closed up, while the last 5 Friday have closed down.

Looking at the 252 session table, it appears the first 3 days of the week are best, then we float down on Thur/Fri.

One thing I'd like to highlight that's not shown. The stronger the opening gap-down, the more likely we'll close down.

___From 252-sessions, our worst 34 openings range from -.25% to -3.65% with a win ratio of 15% (5 of 34 closed positive).

______The average of those 34 openings was -.70% and the average close was -.75%

______The close was worse than the opening 17 times, so "in theory" buyers have a 50% shot at getting a lower end-of day entry than the opening.

Just one week left to close out February, stay healthy and thanks for reading...Jason

Friday's -1.77% loss was the worst close over the past 42 sessions, going back to the 18-Dec-2024 -2.95% loss.

Not that it's been a stellar month to begin with, but this is also the 3rd time Feb MTD has gone into the red.

As a word of caution, from the previous 63-years (or 765 months) when trading day 14 was down MTD, the monthly win ratio was 24%.

But....we're only down -.45% MTD, so if Monday's Trading Day 15 can put us back in the green, then the monthly win ratio rises to 86%

While Friday's recent close below January's close was disappointing, we still have some good indications of a strong year.

Both the Feb High/Low is higher than the Jan High/Low. I highlighted some of these stats recently in my Acct-Talk.

In the meantime, priority #1 is for Feb to maintain a higher low. If we do go lower, then we'll have an outside month which is highlighted in Chart 2 of the February Blog.

If you saw Friday's price action, you might be hard-pressed to believe the Index just put in a fresh 52-Week High on 19-Feb. Was this a final push before an exhaustive collapse? Good question, (heck if I know) but at the moment I'm looking for clues, so I've focused on the smaller 13-Week Time Frame.

For Week-8, the Bears had a slight edge with 84 new 13-Week Lows, but the Bulls had nearly twice an edge in index weight. The bulls had a weighted 15.68% from new 13-Week Highs. If I looked at this chart, I'd tell you the Bulls won the week, but this wasn't reflected in the -1.66% WTD loss for the index.

Having said that, this chart is still a work in progress, so I need to keep an eye out for erroneous user-caused errors.

Last 6 Tuesday closed up, while the last 5 Friday have closed down.

Looking at the 252 session table, it appears the first 3 days of the week are best, then we float down on Thur/Fri.

One thing I'd like to highlight that's not shown. The stronger the opening gap-down, the more likely we'll close down.

___From 252-sessions, our worst 34 openings range from -.25% to -3.65% with a win ratio of 15% (5 of 34 closed positive).

______The average of those 34 openings was -.70% and the average close was -.75%

______The close was worse than the opening 17 times, so "in theory" buyers have a 50% shot at getting a lower end-of day entry than the opening.

Just one week left to close out February, stay healthy and thanks for reading...Jason

Last edited: