James48843

TSP Talk Royalty

- Reaction score

- 905

So I have been watching the world markets, and here , on Sunday evening, things are shaping up to be pretty crazy this coming week. Markets don’t like uncertainty, and boy, do we have a lot of balls flying around right now.

In the USA, a potentially slowing economy, and rising interest rates set the backdrop to everything. That alone would be enough to begin to question our direction. But there is a whole lot more building in for consideration this coming week.

The news on Friday that the US Justice Department recognizes multiple felonies by “individual -1” is shocking, for starters. It means that things are potentially much less stable ahead.

Add to that, multiple companies reporting lower expectations moving forward; a sagging auto sales picture with plant closings back in the news.

In Europe, France is on fire and it’s affecting the retail economy there.

Britain is supposed to vote on a Brexit on Tuesday, and it now looks as if the votes may not be there in Parliament, meaning the UK government could fall by Tuesday night. At best it will be an uncomfortable Brexit, at worst it could mean the collapse of May’s term as Prime Minister and a hard Brexit and damage to their nation.

We still are having problems in Asia, tariff wars with China; and we are shut out of the TPP deal that many are continuing to work towards.

And NAFTA is to be replaced with a new agreement that nobody has details on yet, and the whole dynamic in Washington is about to change, with hearings, etc.

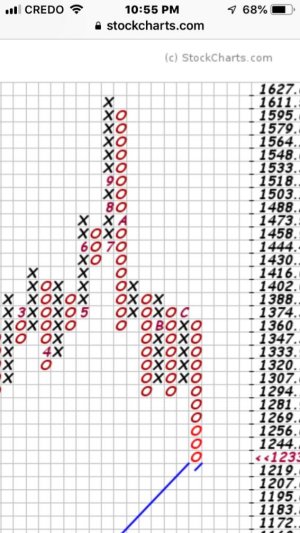

Wake me up when the world settles down a bit. I’m thinking we’ve got at least 10% downside more to go before we find a rally point.

Good luck!

Sent from my iPhone using TSP Talk Forums

In the USA, a potentially slowing economy, and rising interest rates set the backdrop to everything. That alone would be enough to begin to question our direction. But there is a whole lot more building in for consideration this coming week.

The news on Friday that the US Justice Department recognizes multiple felonies by “individual -1” is shocking, for starters. It means that things are potentially much less stable ahead.

Add to that, multiple companies reporting lower expectations moving forward; a sagging auto sales picture with plant closings back in the news.

In Europe, France is on fire and it’s affecting the retail economy there.

Britain is supposed to vote on a Brexit on Tuesday, and it now looks as if the votes may not be there in Parliament, meaning the UK government could fall by Tuesday night. At best it will be an uncomfortable Brexit, at worst it could mean the collapse of May’s term as Prime Minister and a hard Brexit and damage to their nation.

We still are having problems in Asia, tariff wars with China; and we are shut out of the TPP deal that many are continuing to work towards.

And NAFTA is to be replaced with a new agreement that nobody has details on yet, and the whole dynamic in Washington is about to change, with hearings, etc.

Wake me up when the world settles down a bit. I’m thinking we’ve got at least 10% downside more to go before we find a rally point.

Good luck!

Sent from my iPhone using TSP Talk Forums