NewsFeeder

Headline News

- Reaction score

- 4

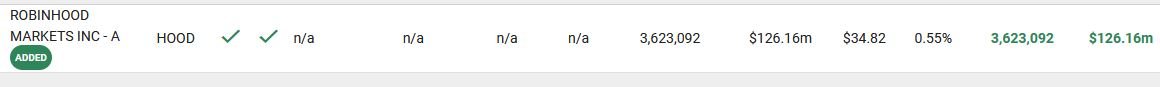

Robinhood nears its biggest trade of all, an IPO, after wild year

Robinhood turned the brokerage industry on its head by offering zero-fee commissions and is expected to soon go public in a big deal, not without controversy.

More @ CNBC...

Robinhood turned the brokerage industry on its head by offering zero-fee commissions and is expected to soon go public in a big deal, not without controversy.

More @ CNBC...