02/20/26

It is getting tougher and tougher to write about this stock market which has been stuck in a range for months. Yesterday it was a narrow range of trading on the downside - almost an inverse image of Wednesday's action. Stocks were down but battled back late to keep the losses moderate. Small caps led with a small gain, and bonds were flat after a positive reversal.

Perhaps it is just that everyone knows that there is a lot at stake in the next week. The PCE Prices inflation data today is important, but perhaps the least influential of what is coming. The US is potentially on the brink of another conflict with Iran. Trump's State of the Union speech is next week, and from what I understand, the Supreme Court will not release a decision on tariffs on any of the upcoming suspected dates of 2/20, 2/23 or 2/24 because of that speech being on the night of the 24th. Also next week Nvidia will be the last Magnificent 7 company to release their quarterly earnings report.

That's a lot going on, and could be why stocks are churning sideways.

Well, there could be another reason. That is, it is a midterm election year and this is actually par for the course. As you will see below, midterm years are usually very good for the stock market, but they can also be very volatile with large drawdowns, so many investors and / or traders may be just in waiting mode.

What does AI say about these midterm years of the Presidential Cycle?

Midterm Election Years and S&P 500 Performance:

Historically, midterm election years have been marked by increased market volatility and average intra-year drawdowns of 18%, with the S&P 500 typically declining at some point before November. Since 1957, midterm years have seen the index fall into correction territory (a drop of 10% or more) in approximately 70% of cases.

Despite these short-term declines, midterm years have delivered positive full-year returns in about 87% of cases, with an average annual return exceeding 19%. This pattern reflects a common trend: market weakness in the first half of the year due to political uncertainty—especially when the sitting president’s party loses seats in Congress—is often followed by a strong rebound in the second half.

Key Historical Patterns:

Average intra-year drawdown: -18%

Average full-year return: Over 19%

Positive year frequency: ~87%

Strongest period post-midterm: November through April, with an average return of 14% over six months.

And here is a chart of the average midterm election year, versus the other years. The S&P 500 peaked on January 30th, and has since been moving sideways.

Source: https://www.capitalgroup.com/advisor/insights/articles/midterm-elections-markets-5-charts.html

The S&P 500 (C-fund) has been in a 200+ point range between 6775 and 7000, and if we take out the close on December 17, the range goes back to Thanksgiving week. Yesterday it closed 15-points below the 50-day average and just below the red trading channel. That's now four of the last five trading days for each. That's not a great sign, but it is closer the bottom of the range where buyers have stepped up each time.

The 10-Year Treasury Yield was up sharply early on Thursday after better than expected jobless claims numbers were released, but they eased down, perhaps on the threat of a military conflict.

The Dow Transportation Index was slammed yesterday, giving back all of Wednesday's large gain. It remains approximately in the middle of its rising trading channel.

The price of oil has been rising as the tensions over Iran increase. Yesterday it broke out above a bull flag.

Longer-term however, this area has been where the price of oil has hit some resistance, as it has been trending lower since its peak in late 2023.

Additional TSP Fund Charts:

The DWCPF (S-fund) posted a small gain, as small caps continue to outperform big tech. The 2600- 2620 area is once again an area of resistance to watch.

The ACWX (I fund) was down slightly but if we want to get picky, it is down testing the bottom of its narrow channel again, before it made a higher high over the peak near 74. But support held again.

BND (bonds / F-fund) was down early but yields reversed midday and the gap, while partially closed, remains open. This has some wiggle room, and may want to continue to pullback, but any military conflict could make bonds a safety trade.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

It is getting tougher and tougher to write about this stock market which has been stuck in a range for months. Yesterday it was a narrow range of trading on the downside - almost an inverse image of Wednesday's action. Stocks were down but battled back late to keep the losses moderate. Small caps led with a small gain, and bonds were flat after a positive reversal.

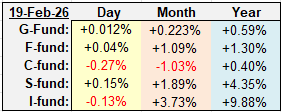

| Daily TSP Funds Return More returns |

Perhaps it is just that everyone knows that there is a lot at stake in the next week. The PCE Prices inflation data today is important, but perhaps the least influential of what is coming. The US is potentially on the brink of another conflict with Iran. Trump's State of the Union speech is next week, and from what I understand, the Supreme Court will not release a decision on tariffs on any of the upcoming suspected dates of 2/20, 2/23 or 2/24 because of that speech being on the night of the 24th. Also next week Nvidia will be the last Magnificent 7 company to release their quarterly earnings report.

That's a lot going on, and could be why stocks are churning sideways.

Well, there could be another reason. That is, it is a midterm election year and this is actually par for the course. As you will see below, midterm years are usually very good for the stock market, but they can also be very volatile with large drawdowns, so many investors and / or traders may be just in waiting mode.

What does AI say about these midterm years of the Presidential Cycle?

Midterm Election Years and S&P 500 Performance:

Historically, midterm election years have been marked by increased market volatility and average intra-year drawdowns of 18%, with the S&P 500 typically declining at some point before November. Since 1957, midterm years have seen the index fall into correction territory (a drop of 10% or more) in approximately 70% of cases.

Despite these short-term declines, midterm years have delivered positive full-year returns in about 87% of cases, with an average annual return exceeding 19%. This pattern reflects a common trend: market weakness in the first half of the year due to political uncertainty—especially when the sitting president’s party loses seats in Congress—is often followed by a strong rebound in the second half.

Key Historical Patterns:

Average intra-year drawdown: -18%

Average full-year return: Over 19%

Positive year frequency: ~87%

Strongest period post-midterm: November through April, with an average return of 14% over six months.

And here is a chart of the average midterm election year, versus the other years. The S&P 500 peaked on January 30th, and has since been moving sideways.

Source: https://www.capitalgroup.com/advisor/insights/articles/midterm-elections-markets-5-charts.html

The S&P 500 (C-fund) has been in a 200+ point range between 6775 and 7000, and if we take out the close on December 17, the range goes back to Thanksgiving week. Yesterday it closed 15-points below the 50-day average and just below the red trading channel. That's now four of the last five trading days for each. That's not a great sign, but it is closer the bottom of the range where buyers have stepped up each time.

The 10-Year Treasury Yield was up sharply early on Thursday after better than expected jobless claims numbers were released, but they eased down, perhaps on the threat of a military conflict.

The Dow Transportation Index was slammed yesterday, giving back all of Wednesday's large gain. It remains approximately in the middle of its rising trading channel.

The price of oil has been rising as the tensions over Iran increase. Yesterday it broke out above a bull flag.

Longer-term however, this area has been where the price of oil has hit some resistance, as it has been trending lower since its peak in late 2023.

Additional TSP Fund Charts:

The DWCPF (S-fund) posted a small gain, as small caps continue to outperform big tech. The 2600- 2620 area is once again an area of resistance to watch.

The ACWX (I fund) was down slightly but if we want to get picky, it is down testing the bottom of its narrow channel again, before it made a higher high over the peak near 74. But support held again.

BND (bonds / F-fund) was down early but yields reversed midday and the gap, while partially closed, remains open. This has some wiggle room, and may want to continue to pullback, but any military conflict could make bonds a safety trade.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.