Bullitt

Market Veteran

- Reaction score

- 75

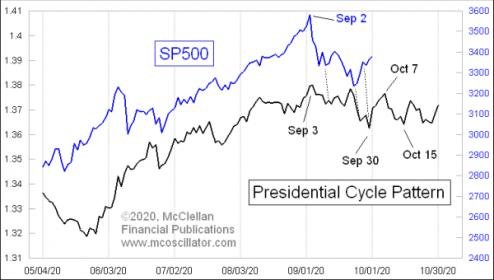

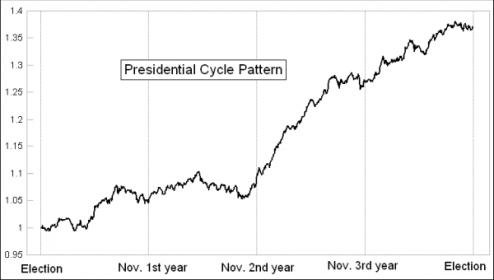

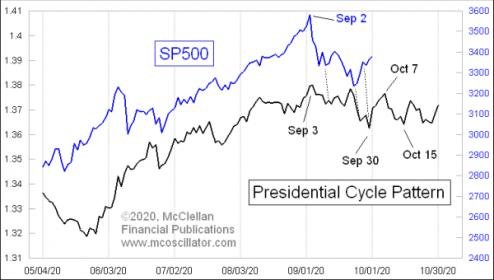

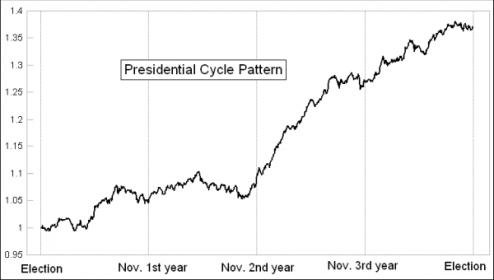

From Tom McClellan.

My take = get in now because it doesn't really matter who's in after year two. The traffic now is just noise.

https://www.mcoscillator.com/learni...ntial_cycle_pattern_calls_for_choppy_october/

My take = get in now because it doesn't really matter who's in after year two. The traffic now is just noise.

https://www.mcoscillator.com/learni...ntial_cycle_pattern_calls_for_choppy_october/