-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Polarbear's Account Talk

- Thread starter polarbear

- Start date

polarbear

Market Tracker

- Reaction score

- 8

Things are starting to get interesting in Europe, discussionwise:

http://www.welt.de/politik/ausland/...botieren-deutsch-franzoesische-EU-Plaene.html

"The Brits are sabotaging German-French EU plans"

Interesting ending remark of second Reader's Commentary: "The EU summit will have a result that is entirely different from what Merkel & Co. are dreaming of." I think a sort of brouhaha may be in the making. And maybe not. I no longer feel I can predict _anything_ that's going in Europe or with our Fed (puppets of our big banks?). They are two peas out of the same pod. Follow the money trail. Or step aside! This is so unstable. I am not ready to touch this until it clarifies. I don't care how it clarifies, I have no crystal ball. Just until it clarifies. Tricks and surprises, of which Nov.30 was probably not the last. Others can be more brave.

http://www.welt.de/politik/ausland/...botieren-deutsch-franzoesische-EU-Plaene.html

"The Brits are sabotaging German-French EU plans"

Interesting ending remark of second Reader's Commentary: "The EU summit will have a result that is entirely different from what Merkel & Co. are dreaming of." I think a sort of brouhaha may be in the making. And maybe not. I no longer feel I can predict _anything_ that's going in Europe or with our Fed (puppets of our big banks?). They are two peas out of the same pod. Follow the money trail. Or step aside! This is so unstable. I am not ready to touch this until it clarifies. I don't care how it clarifies, I have no crystal ball. Just until it clarifies. Tricks and surprises, of which Nov.30 was probably not the last. Others can be more brave.

polarbear

Market Tracker

- Reaction score

- 8

John Markham in MarketWatch, on-the-mark commentary:

http://www.marketwatch.com/story/end-times-for-the-euro-zone-2011-12-07?link=kiosk

http://www.marketwatch.com/story/end-times-for-the-euro-zone-2011-12-07?link=kiosk

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 78

Things are starting to get interesting in Europe, discussionwise:

http://www.welt.de/politik/ausland/...botieren-deutsch-franzoesische-EU-Plaene.html

"The Brits are sabotaging German-French EU plans"

Interesting ending remark of second Reader's Commentary: "The EU summit will have a result that is entirely different from what Merkel & Co. are dreaming of." I think a sort of brouhaha may be in the making. And maybe not. I no longer feel I can predict _anything_ that's going in Europe or with our Fed (puppets of our big banks?). They are two peas out of the same pod. Follow the money trail. Or step aside! This is so unstable. I am not ready to touch this until it clarifies. I don't care how it clarifies, I have no crystal ball. Just until it clarifies. Tricks and surprises, of which Nov.30 was probably not the last. Others can be more brave.

Interesting, I actually wrote about the possibility of the BOE raising rates tomorrow to fight inflation in yesterday's commentary. Wouldn't this stir the pot a little bit..............:blink:

polarbear

Market Tracker

- Reaction score

- 8

1-24-2012TU. Here are some interesting articles:

1. The Wall Street Journal. 1-24-2012. EU Crisis Road Map: Key Milestones Ahead

2. MarketWatch. 1-24-2012. Best growth and income stock. Bill Gunderson, about KMP.

3. Barrons, 1-24-2012. Yahoo! Finance. from Barrons: Stocks with Growing Dividends.

4. Gains, Pains & Capital (Phoenix Capital Research) publishing@gainspainscapital.com 1-24-2011 [sic]. Sorry Folks... Europe's Not Fine... Not Even Close

5. safehaven.com 1-24-2012. Bad News just Around the Corner? by Marty Chenard cool chart: descending diagonal on the VIX.

6. The Wall Street Journal. 1-24-2012. Some Euro-Zone Bears Still Unrepentently Bearish. Interesting.

7. safehaven.com 1-24-2012. Governments will want much, much higher gold prices soon! Here's why, by Arnold Bock (?)

8. safehaven.com 1-24-2012. Sovereigns declar war on US dollar, by Chris Blasi (?)

It seems there are countervailing forces acting on the dollar now -- it's about to rally as a safe haven, and this . . .

Chris Ciovacco in safehaven.com had an interesting article a day ago 1-23-2012 The last time bullishness hit these levels . . .

http://www.safehaven.com/article/24094/last-time-bullishness-hit-these-levels

Some of the ones above:

http://www.safehaven.com/article/24108/bad-news-just-around-the-corner

http://www.safehaven.com/ in general and go from there

http://www.marketwatch.com/

Also, from a few days ago, also Marty Chenard on safehaven.com 1-11-2012: Could this turn into an important alert?

http://www.safehaven.com/article/23961/could-this-turn-into-an-important-alert

Yeah, it kinda looks like the market is topping and getting ready for a small-to-moderate pullback into February, after which some people think it will be a buying opportunity. The next few days should be interesting. Wed-Fri of last week, plus yesterday, for that matter, were not kind to bonds. Maybe they are bottoming. Look at AGG on www.finance.yahoo.com 5-day, it looks like it may be bottoming.

Thanks, Kona Kathy and friends, for the music videos. As Suze Orman says, people first, then money. Or to paraphrase: life first, then money.

1. The Wall Street Journal. 1-24-2012. EU Crisis Road Map: Key Milestones Ahead

2. MarketWatch. 1-24-2012. Best growth and income stock. Bill Gunderson, about KMP.

3. Barrons, 1-24-2012. Yahoo! Finance. from Barrons: Stocks with Growing Dividends.

4. Gains, Pains & Capital (Phoenix Capital Research) publishing@gainspainscapital.com 1-24-2011 [sic]. Sorry Folks... Europe's Not Fine... Not Even Close

5. safehaven.com 1-24-2012. Bad News just Around the Corner? by Marty Chenard cool chart: descending diagonal on the VIX.

6. The Wall Street Journal. 1-24-2012. Some Euro-Zone Bears Still Unrepentently Bearish. Interesting.

7. safehaven.com 1-24-2012. Governments will want much, much higher gold prices soon! Here's why, by Arnold Bock (?)

8. safehaven.com 1-24-2012. Sovereigns declar war on US dollar, by Chris Blasi (?)

It seems there are countervailing forces acting on the dollar now -- it's about to rally as a safe haven, and this . . .

Chris Ciovacco in safehaven.com had an interesting article a day ago 1-23-2012 The last time bullishness hit these levels . . .

http://www.safehaven.com/article/24094/last-time-bullishness-hit-these-levels

Some of the ones above:

http://www.safehaven.com/article/24108/bad-news-just-around-the-corner

http://www.safehaven.com/ in general and go from there

http://www.marketwatch.com/

Also, from a few days ago, also Marty Chenard on safehaven.com 1-11-2012: Could this turn into an important alert?

http://www.safehaven.com/article/23961/could-this-turn-into-an-important-alert

Yeah, it kinda looks like the market is topping and getting ready for a small-to-moderate pullback into February, after which some people think it will be a buying opportunity. The next few days should be interesting. Wed-Fri of last week, plus yesterday, for that matter, were not kind to bonds. Maybe they are bottoming. Look at AGG on www.finance.yahoo.com 5-day, it looks like it may be bottoming.

Thanks, Kona Kathy and friends, for the music videos. As Suze Orman says, people first, then money. Or to paraphrase: life first, then money.

Last edited:

polarbear

Market Tracker

- Reaction score

- 8

One opinion in line with Uptrend's:

Marker Report: Bulls Find Their Footing | Nouf | Safehaven.com

Next week will be interesting. I notice a huge mass of members at the top of AutoTracker going 100%S now plus only three deciding to play it safe just right now (G).

Marker Report: Bulls Find Their Footing | Nouf | Safehaven.com

Next week will be interesting. I notice a huge mass of members at the top of AutoTracker going 100%S now plus only three deciding to play it safe just right now (G).

polarbear

Market Tracker

- Reaction score

- 8

I was tempted to go in today. Looks good, like a bottom or almost. DailyFX from Yahoo Finance EURUSD, shows EURUSD: Holding Short into French, Greek Elections, expecting the euro to do down further on Monday.

EURUSD: Holding Short into French, Greek Elections - Yahoo! Finance (Ilya Spivak)

But on the other hand, US Dollar struggling after NPR numbers:

USD Struggles On Disappointing NFPs, EUR To Consolidate On Elections - Yahoo! Finance (David Song)

"Talking points: Euro consolidates within bearish formation -- Gk, Fr elections in focus"

But go to INO.com Markets - Chart for U.S $ INDEX (NYBOT X) for the USDX chart,

X) for the USDX chart,

it's been on a tear since 9:50am EST, 79.484 (+0.38%) -- doesn't look like it's struggling to me, and he writes "after NPR numbers", so I don't get it.

Bottom line, even though I didn't go in today, it looks like it wasn't such a bad idea for those who did.

EURUSD: Holding Short into French, Greek Elections - Yahoo! Finance (Ilya Spivak)

But on the other hand, US Dollar struggling after NPR numbers:

USD Struggles On Disappointing NFPs, EUR To Consolidate On Elections - Yahoo! Finance (David Song)

"Talking points: Euro consolidates within bearish formation -- Gk, Fr elections in focus"

But go to INO.com Markets - Chart for U.S $ INDEX (NYBOT

it's been on a tear since 9:50am EST, 79.484 (+0.38%) -- doesn't look like it's struggling to me, and he writes "after NPR numbers", so I don't get it.

Bottom line, even though I didn't go in today, it looks like it wasn't such a bad idea for those who did.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

On Squawk Box, CNBC TV, an hour ago, with Mark Wappner, the following comment: Europe this weekend, investors don't seem to want to get in front of that train, more pain ahead. Oh no, Mr. Bill. Hm, whatever, probably not a straight line.

Wow, welcome back. You have doubled your posts this year in just one day

polarbear

Market Tracker

- Reaction score

- 8

FWIW, Mr. Market seems to have more important things on his mind than the upcoming Facebook IPO, in the words of TheWaveTrading, "as deaf as a post" to that and other things. In the face of what's going on in Europe and how that can and will affect US stocks, . . . I did not even imagine today's market action so far (to this minute 12:11 EST) this morning. It looks like it will be over when it's over. Mr. Market knows the answer to that, and we don't.

polarbear

Market Tracker

- Reaction score

- 8

Today's price action is a bit remarkable, not very unexpected, but some: if you look at the 5-day chart and do a straight-line curve fit with your eyes, it's rather striking how you have a fairly straight 3-day trendline playing out today from Wednesday. Either a moving average or fit a straight line or connect the highs with the highs and the lows with the lows.

S&P 500 Index, SPX Index Quote - (SNC) SPX, S&P 500 Index Index Price

I would say, this market just wants to go down. Uncertainty lowers stock prices. Global economic (Europe) and geopolitical (Iran) concerns have this market spoooked.

This young fellow, Michael Gayed, seems to have woken up and smelled the coffee: his "two days" would be three together with today.

http://www.marketwatch.com/story/forget-facebook-stocks-are-at-serious-risk-2012-05-18?link=kiosk

S&P 500 Index, SPX Index Quote - (SNC) SPX, S&P 500 Index Index Price

I would say, this market just wants to go down. Uncertainty lowers stock prices. Global economic (Europe) and geopolitical (Iran) concerns have this market spoooked.

This young fellow, Michael Gayed, seems to have woken up and smelled the coffee: his "two days" would be three together with today.

http://www.marketwatch.com/story/forget-facebook-stocks-are-at-serious-risk-2012-05-18?link=kiosk

polarbear

Market Tracker

- Reaction score

- 8

I'm just sticking with my old thread here. I don't know what the market will do now. But it's summer and there is a lot of wisdom in stepping aside between May and October unless Ben initiates QE3, and he's given every indication it will be a while before that happens. Which may mean he'll do it when he does it. I don't see that happening anytime soon.

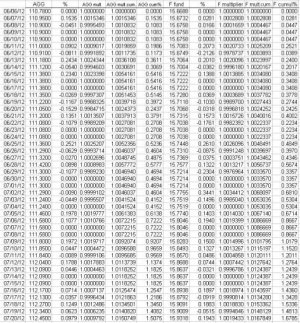

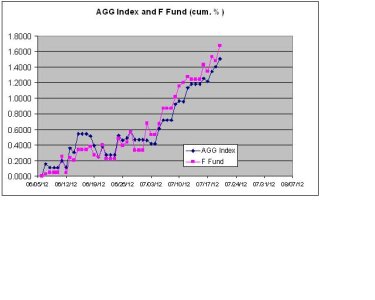

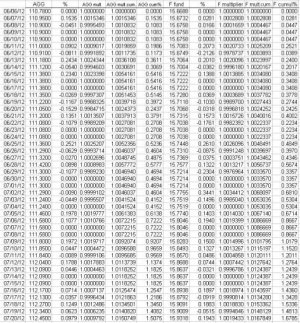

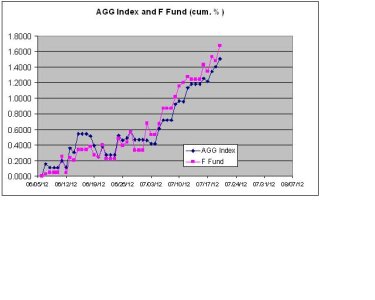

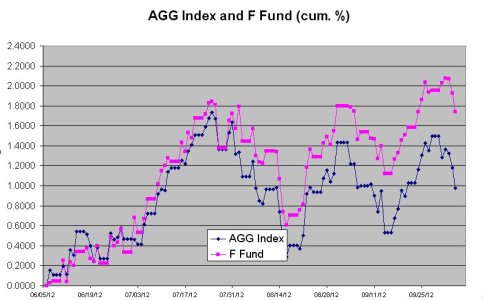

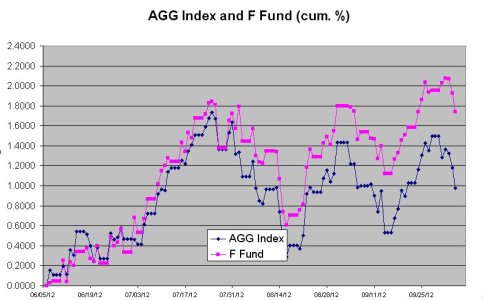

The wisdom of going into the F Fund is that it goes up nicely when the market goes down and it goes up and down a little, but with an upward bias even when the market goes up. Kind of a win-win situation. Look at its performance over the last two weeks, smartly up two weeks ago, weakly up during the last week. Here is a table and a chart of the F Fund over the last two months for your convenience. The Barclays index (AGG) is less relevant now that Barclays has been replaced by BlackRock (WFBIX), but it's what I started with, so it's along for the ride.

The wisdom of going into the F Fund is that it goes up nicely when the market goes down and it goes up and down a little, but with an upward bias even when the market goes up. Kind of a win-win situation. Look at its performance over the last two weeks, smartly up two weeks ago, weakly up during the last week. Here is a table and a chart of the F Fund over the last two months for your convenience. The Barclays index (AGG) is less relevant now that Barclays has been replaced by BlackRock (WFBIX), but it's what I started with, so it's along for the ride.

polarbear

Market Tracker

- Reaction score

- 8

MW: "U.S. stocks leap on Draghi's words, data". But the bond market has hardly budged. Perhaps they are wearing antigravity shoes. Perhaps they have done the math and do not react emotionally. Maybe they hardly ever budge except when they're trending, maybe this is a rolling top, you know, dy/dx = 0 at the maximum. We'll see. Over five years AGG has followed a rough trendline up.

polarbear

Market Tracker

- Reaction score

- 8

I hear where you're coming from (sorry, I didn't check my thread until just now). But it's worth keeping an eye on, I guess as someone else here mentioned, it has its entry points too. But it has some risk associated with it too, because as I just remarked to clester, it's a medium-risk investment, not a low-risk one, and we just got a smart little black swan smack down out of the sky today. Whew! As for risk assets, I will have my eyes open come August 1. This IFT thing is diabolical.

polarbear

Market Tracker

- Reaction score

- 8

News from the web. Frankfurter Allgemeine Zeitung: www.faz.net : "Discussion on ESM, Berlin rejects more firepower for the rescue fund. The best crisis strategy in the struggle against the debt crisis remains contested. The Federal Finance Ministry and the Free Democratic Party completely rejected requirements for a bank license for the rescue fund, the Left also. Only the Green Party Chief Trittin sees it otherwise."

I wonder where Draghi will get what he needs, what he has promised. The next three days are going to be interesting. All of this to-and-fro is driving me nuts. I cannot make heads or tails of it.

I wonder where Draghi will get what he needs, what he has promised. The next three days are going to be interesting. All of this to-and-fro is driving me nuts. I cannot make heads or tails of it.

polarbear

Market Tracker

- Reaction score

- 8

The German constitutional court will give out their decision at 10am, so 3am CT here.

Rettungsschirm ESM: Karlsruhe macht es spannend | Finanzkrise*- Berliner Zeitung

It will be interesting.

Kommentar: Kein gutes Omen aus Karlsruhe | Meinung*- Berliner Zeitung

Interesting in this article linked to that one, "Not kennt kein Gebot", "Need knows no law". It reminds me of the one my mother told me so many times, "Not bricht Eisen", "Need breaks iron", with the softened version "Necessity is the mother of invention".

In a letter to my mother of 1949, my grandfather first quoted a Hungarian proverb, "... nincs lo, csak szomar jo" (if you don't have a horse, an ass will do", then rephrased it in his own words in German, "Selbst-Hilfe ist die billigste Hilfe", "Self-help is the cheapest help." Venturing far afield, it brings to mind the English proverb, "The law is an ass". Hmm, here, there. Tick tock, tick tock.

I am trying to be obscure here. I think I have succeeded. The other one mother liked to quote was "Geld regiert die Welt", "Money rules the world". Fun. The Bob Dylan version, Money doesn't talk, it swears. . .

Rettungsschirm ESM: Karlsruhe macht es spannend | Finanzkrise*- Berliner Zeitung

It will be interesting.

Kommentar: Kein gutes Omen aus Karlsruhe | Meinung*- Berliner Zeitung

Interesting in this article linked to that one, "Not kennt kein Gebot", "Need knows no law". It reminds me of the one my mother told me so many times, "Not bricht Eisen", "Need breaks iron", with the softened version "Necessity is the mother of invention".

In a letter to my mother of 1949, my grandfather first quoted a Hungarian proverb, "... nincs lo, csak szomar jo" (if you don't have a horse, an ass will do", then rephrased it in his own words in German, "Selbst-Hilfe ist die billigste Hilfe", "Self-help is the cheapest help." Venturing far afield, it brings to mind the English proverb, "The law is an ass". Hmm, here, there. Tick tock, tick tock.

I am trying to be obscure here. I think I have succeeded. The other one mother liked to quote was "Geld regiert die Welt", "Money rules the world". Fun. The Bob Dylan version, Money doesn't talk, it swears. . .

polarbear

Market Tracker

- Reaction score

- 8

This market is so Zen! I got in one day too soon (Sept.27) to be in already to start the new month. I thot that Spanish budget would have momentum into the next day. I was wrong. Jack-in-the-box Europe, like the planet Krypton, whatever you think is right, is wrong! Dammit! It took four days of crumminess to recoup my loss. When you recoup your loss, the fact that you make gains on top of it is incidental. It's the principle of the thing!

So then what? Expecting Friday to be a honey after nice Thursday? Guess again. Another crummy day in crummy-day-market land. @#@$#$#. But the Jack-in-the-box completely out of left field I Fund came thru for me, totally unexpectedly. No one could ever have predicted that. It even makes Europe look like an amateur at unpredictability. I was feeling crummy over maybe a $200 loss, but my buddy the I Fund gave me a net gain more than twice that on the way out and into 50G50F. Good. And on top of that, look at the chart, it seems like a good day to get into F. We'll see.

2008 had something else going on besides the election, but I went back and looked. Down into 3rd wk October then up into election day. I wonder how the rest of this month will go. It looks like a tired rally, topping to me, but it could be just a really jerky climb continuing for a while, but it's got to slam into something in the next week or two or so. The Europeans are promising something wonderful this month regarding Spain, Oct. 21, Germany, yada yada. I really don't want to play coin-toss with them right now.

So then what? Expecting Friday to be a honey after nice Thursday? Guess again. Another crummy day in crummy-day-market land. @#@$#$#. But the Jack-in-the-box completely out of left field I Fund came thru for me, totally unexpectedly. No one could ever have predicted that. It even makes Europe look like an amateur at unpredictability. I was feeling crummy over maybe a $200 loss, but my buddy the I Fund gave me a net gain more than twice that on the way out and into 50G50F. Good. And on top of that, look at the chart, it seems like a good day to get into F. We'll see.

2008 had something else going on besides the election, but I went back and looked. Down into 3rd wk October then up into election day. I wonder how the rest of this month will go. It looks like a tired rally, topping to me, but it could be just a really jerky climb continuing for a while, but it's got to slam into something in the next week or two or so. The Europeans are promising something wonderful this month regarding Spain, Oct. 21, Germany, yada yada. I really don't want to play coin-toss with them right now.

Similar threads

- Replies

- 0

- Views

- 34

- Replies

- 7

- Views

- 347