FireWeatherMet

Market Veteran

- Reaction score

- 239

- AutoTracker

If anyone hasn't noticed, we've had a massive runup in equities, Up 13% (C) to 16% (S),

That doesn't happen just to random chance, so you do have to take an honest look around and see whats going on,

Biggest "Fear Factor" on stocks is INFLATION. It leads to Fed jacking rates, and that leads to Recession.

Inflation + Recession = Stagflation.

But...what happened at the start of this meteoric stock rise in late June?

OPEC, free from its 2 year agreement with then President Trump to drastically CUT oil production (Yes that happened, April 2020), have announced they will be increasing production.

Demand for Oil, given the high prices, began to wane.

Law of Supply & Demand (Capitalism 101) kicked in, and the price of Oil has plummeted in the past 1 1/2 months.

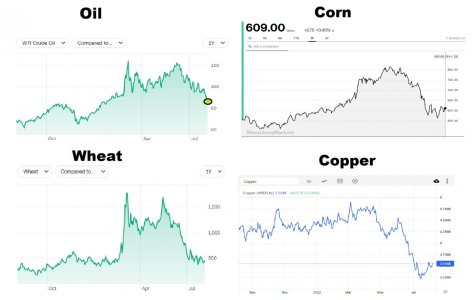

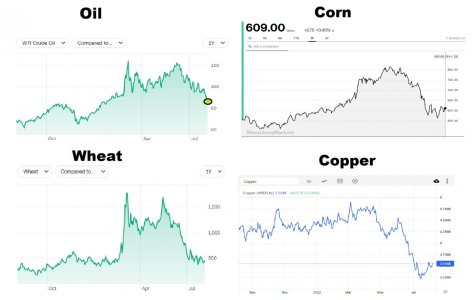

And since sharply rising oil prices led to rising commodity prices, we are now seeing the opposite...commodities are crashing as well.

So if you take a look at Oil and other commodities on the charts below...you will see that we very likely have reached "Peak Inflation".

The "Smart Money" sees that...and have participated in this latest rally.

The "Dumb Money" is still shell-shocked, "Fox Shocked" etc, and have ignored these very significant signals, and keep muttering Gloom & Doom headlines from May-June.

That doesn't happen just to random chance, so you do have to take an honest look around and see whats going on,

Biggest "Fear Factor" on stocks is INFLATION. It leads to Fed jacking rates, and that leads to Recession.

Inflation + Recession = Stagflation.

But...what happened at the start of this meteoric stock rise in late June?

OPEC, free from its 2 year agreement with then President Trump to drastically CUT oil production (Yes that happened, April 2020), have announced they will be increasing production.

Demand for Oil, given the high prices, began to wane.

Law of Supply & Demand (Capitalism 101) kicked in, and the price of Oil has plummeted in the past 1 1/2 months.

And since sharply rising oil prices led to rising commodity prices, we are now seeing the opposite...commodities are crashing as well.

So if you take a look at Oil and other commodities on the charts below...you will see that we very likely have reached "Peak Inflation".

The "Smart Money" sees that...and have participated in this latest rally.

The "Dumb Money" is still shell-shocked, "Fox Shocked" etc, and have ignored these very significant signals, and keep muttering Gloom & Doom headlines from May-June.