Nightly Routine

With the Autotracker broken I feel like I'm missing a key component to my nightly routine. It's sad really how I've grown accustomed to our little bloated excel buddy. The funny thing is this may be the highest I'll be in the tracker this year, but I'll never get to see it.

You may have noticed the huge .44% gain in the F-Fund today. Monday the Bond Quilt was all in red, but not today. Some interesting stuff is going on in the bond markets and with AGG. The top 3 charts are the 5, 10, & 30 year yields. When they go down, bond price goes up. All 3 left their embedded conditions and have changed to Yellow. AGG put in a higher high today, surpassing the previous swing high. But before I get short-term bullish, I'd like to see if we can follow-up with a higher swing low. Youtube's Ira Epstein uses swingline studies to identify changes in trend direction. If you're new to charting I recommend you watch his daily videos where he teaches some foundational technical analysis. Also, check out Poolman's thread, he's the King of great Youtube links.

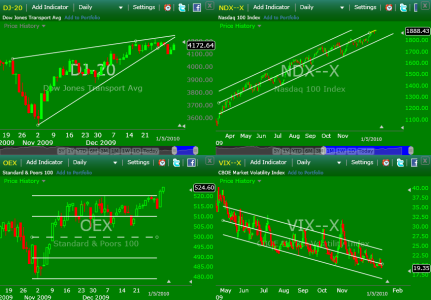

The Transports have proven they aren't ready to throw in the towel by outperforming all others with a 1.01% gain. What I saw today was the large/mid caps outperforming the small/micro caps. Check out the NASDAQ 100's rising channel going back to April 2009. Also check out the S&P 100 closing off its highs. Then check out the Volatility Index closing off its lows. These are all signs of a bull market. If this is the case, then we might expect the C-Fund to out perform the S-fund for the rest of the week. Note: I do expect a sell-off once the jobs report breaks this Friday.

Now for the the I-Fund's Currencies. The Dollar did gain strength today, but it wasn't a homerun, more sort of a flat day. Funny thing is when I watch CNBC they say the dollar will go up. Thing about CNBC is they are using puppets to push their agenda. If they say the dollars going up, I'd rather be on the other side of that trade. As for Bloomberg I've heard mixed reports on the dollar. If you're going to be stupid like me and watch market news, you will get a more realistic view from Bloomberg after midnight when the overseas markets are in mid-stride.

The overseas Quilt remains unchanged, but I do want to point out the FTSE-100 closed above the long-term 61.8% Fibonacci level today. A break above the October 2008 swing high could be really bullish and take us up to 6,000.

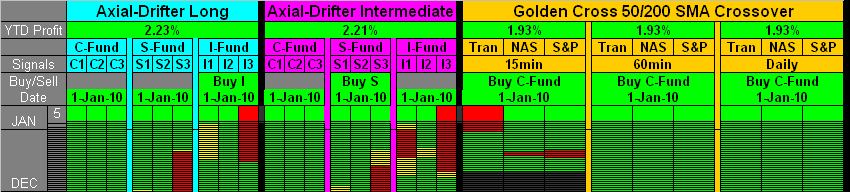

No changes in the Triad today, although I did do some more tweaking to try and make it an easier read. The ADL remains in the I-Fund and the ADI remains in the S-Fund till the end of the month. The Big-3 Golden Cross remains in the C-fund on all 3 time frames.

Thank you for your feedback, you are always welcome to comment, or challenge anything you notice. I do find I make charting mistakes from time to time, feel free to point them out before I change them. I also find sometimes I learn more from the questions others ask me because it forces me to think & substantiate my positions.

Thanks again.... Jason