-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

namor's Vegas Boxer Account Talk

- Thread starter tsptalk

- Start date

G

Guest

Guest

imported post

Sorry about that F fund yesterday namor, good luck with the S today........

Sorry about that F fund yesterday namor, good luck with the S today........

imported post

I'm right with you Namor, except I'm thinking this market might drop all week. I got burned on this deal back in April when the market peaked then went down 40+ cents in 3 days. I'm thinking this might drop real quick and scare everyone out then come shooting up again. Currently 100% G and smiling! If only we had that crystalball.

If only we had that crystalball.

I'm right with you Namor, except I'm thinking this market might drop all week. I got burned on this deal back in April when the market peaked then went down 40+ cents in 3 days. I'm thinking this might drop real quick and scare everyone out then come shooting up again. Currently 100% G and smiling!

imported post

I know what you mean I'm going to set out I have anice gain and will preserve my funds. The funds have peaked and if C can hold 1115 tomorrow then I might make a play other wise I'll let the bears eat! Nothing worse then a hungry Bear. Good Luck to you!:^

I know what you mean I'm going to set out I have anice gain and will preserve my funds. The funds have peaked and if C can hold 1115 tomorrow then I might make a play other wise I'll let the bears eat! Nothing worse then a hungry Bear. Good Luck to you!:^

Mike

TSP Pro

- Reaction score

- 8

imported post

We might lose a lot more than 1% if this continues. :shock:

Strange. I made a last-minute decision against all my better judgment and requested an interfund transfer to 50 F / 50 G. I don't know if I was able to sneak it in before the deadline or not - it was close. Now I don't expect more long-term weakness this fall - I'm just hoping to capitalize on a short-term plunge to buy back my stock fund shares at a much lower price.

We might lose a lot more than 1% if this continues. :shock:

Strange. I made a last-minute decision against all my better judgment and requested an interfund transfer to 50 F / 50 G. I don't know if I was able to sneak it in before the deadline or not - it was close. Now I don't expect more long-term weakness this fall - I'm just hoping to capitalize on a short-term plunge to buy back my stock fund shares at a much lower price.

FundSurfer

TSP Pro

- Reaction score

- 39

imported post

Can someone check my math? (The reason I'm asking is because I'm using a modified version of Tom's spreadsheet and the trade date is important. I think I've got it straight but wanted to make sure. namors account is a good check cause he has tracked his trades well and has made a bunch of them.)

For the month, I've got namor at 1.13%

For the month, I've got 0.28% G, 0.68% F, 0.68% C, 2.07% S, & 1.29% I. (If you compare my numbers to tspmoney.com I'm right on except they start the month from 8/31 and I started calculating for namor on 9/1...If I started from 8/31 my numbers match tspmoney.com.)

namor, how about giving us a little bit of a clue as to your decision making process.

Can someone check my math? (The reason I'm asking is because I'm using a modified version of Tom's spreadsheet and the trade date is important. I think I've got it straight but wanted to make sure. namors account is a good check cause he has tracked his trades well and has made a bunch of them.)

For the month, I've got namor at 1.13%

For the month, I've got 0.28% G, 0.68% F, 0.68% C, 2.07% S, & 1.29% I. (If you compare my numbers to tspmoney.com I'm right on except they start the month from 8/31 and I started calculating for namor on 9/1...If I started from 8/31 my numbers match tspmoney.com.)

namor, how about giving us a little bit of a clue as to your decision making process.

imported post

Fundsurfer:

I am not tracking my percentage, but I know from my daily balance how well I am doing.

I posted my strategy earlier in the Short Term Strategies category:

"I never stay more thana couple days in a single fund. I retreat to G and F if I feel that I need to wait and see. If a fund goes down for more than two days, I try to play the bounce. Rarely do the funds drop day after day after day, so if you get lucky and time things right, you can come out ahead of any single fund."

That is why I termed my strategy Vegas/Boxer. . . its a gambler's strategy of looking at fluctuations. I look at all the funds. If one drops a little more than the others, then I will try to play its 'bounce.' I check the price of oil, whether there is earnings news, Fed news, any reports coming up and try to time it right, kind of like looking over a Daily Racing Form before a big stakes race.

Its not really a system. Its more of a calculated gamble.

Good luck in your investment decisions.

Fundsurfer:

I am not tracking my percentage, but I know from my daily balance how well I am doing.

I posted my strategy earlier in the Short Term Strategies category:

"I never stay more thana couple days in a single fund. I retreat to G and F if I feel that I need to wait and see. If a fund goes down for more than two days, I try to play the bounce. Rarely do the funds drop day after day after day, so if you get lucky and time things right, you can come out ahead of any single fund."

That is why I termed my strategy Vegas/Boxer. . . its a gambler's strategy of looking at fluctuations. I look at all the funds. If one drops a little more than the others, then I will try to play its 'bounce.' I check the price of oil, whether there is earnings news, Fed news, any reports coming up and try to time it right, kind of like looking over a Daily Racing Form before a big stakes race.

Its not really a system. Its more of a calculated gamble.

Good luck in your investment decisions.

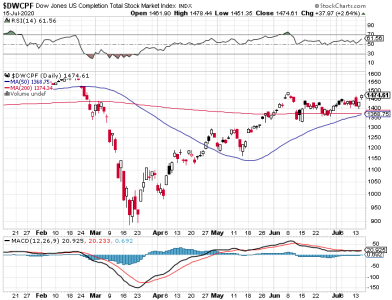

Attachments

imported post

Between rounds:

Cmon, namor, don't let him keep hitting you with that left! Throw some more punches!

:*

OKay, I am going back out there for more!(I left it in the S Fund)

S Fund, be good to me. :h

Between rounds:

Cmon, namor, don't let him keep hitting you with that left! Throw some more punches!

:*

OKay, I am going back out there for more!(I left it in the S Fund)

S Fund, be good to me. :h

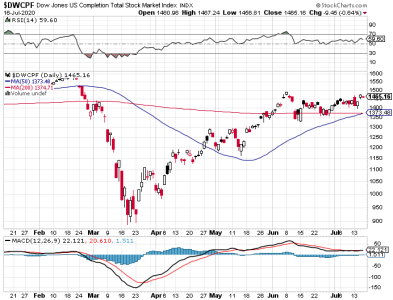

Attachments

imported post

The I fund has been knocked around for most of the week, so I am betting that it does a rebound Monday. It's a gamble, because there are two weekend days that world events could affect it.

This, of course, is only my opinion. There are no guarantees.

Good luck to you.

The I fund has been knocked around for most of the week, so I am betting that it does a rebound Monday. It's a gamble, because there are two weekend days that world events could affect it.

This, of course, is only my opinion. There are no guarantees.

Good luck to you.

T

TheProphet

Guest

T

TheProphet

Guest

imported post

My position and short comment is on my freepersonal webpage...

http://www.geocities.com/earn100kplus/TSP.html?1096036971578

Leon

My position and short comment is on my freepersonal webpage...

http://www.geocities.com/earn100kplus/TSP.html?1096036971578

Leon

Attachments

imported post

lkatteng wrote:

Each of us has their own strategy. As for the comment in the transaction account (where no comments are supposed to be made, btw according to tsptalk's 'rules') about never taking a loss, you could be losing by waiting for a gain while other markets are fluctuating. For those who play fluctuations, staying put can lose you money.

Sometimes you have to takea punch to land two.

Sometimes you have to have to take a seven out on a point that is fourto hit the next point with better odds.(dice talk)

I will post my monthly 'statement' on October 1.

Good luck to you in your investments.

lkatteng wrote:

For me F funds is a waste... G is more secure...

C, S and I more profitables whenbullish time comes...

Leon

Each of us has their own strategy. As for the comment in the transaction account (where no comments are supposed to be made, btw according to tsptalk's 'rules') about never taking a loss, you could be losing by waiting for a gain while other markets are fluctuating. For those who play fluctuations, staying put can lose you money.

Sometimes you have to takea punch to land two.

Sometimes you have to have to take a seven out on a point that is fourto hit the next point with better odds.(dice talk)

I will post my monthly 'statement' on October 1.

Good luck to you in your investments.

T

TheProphet

Guest

imported post

You are right everyone has different strategies...

for different situations... Etc...

Good Luck in your investments too...

You are right everyone has different strategies...

for different situations... Etc...

Good Luck in your investments too...

Similar threads

- Replies

- 7

- Views

- 348