Spiking Portuguese debt yields, more sovereign debt downgrades after the bell last Friday and continued chatter about the building frustration over Greece’s continued inability to come to any agreement with its debtors were all cited as reasons for an ugly open today. As I’ve been saying, the fact that the market kept floating higher without much underlying support meant that market players would need to be on guard should we run into an air pocket. That happened this morning, but I’ve also been saying that the dip buyers would be a big determinant in how aggressive any profit-taking might be, and they once again behaved admirably.

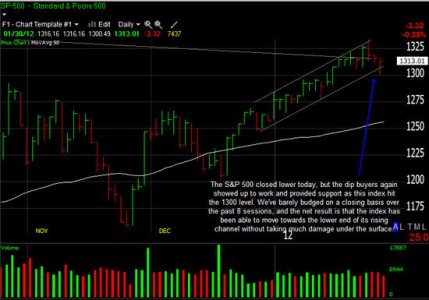

After gapping lower to start the day, buyers stepped up to the plate just as the S&P 500 fell to the important 1300 level (which has acted as an important support/resistance line over the past year). They weren’t able to get the indices back above the flat-line, but we once again finished well off lows and despite a fair amount of intraday up-and-down over the past 8 trading sessions, we’ve barely budged on a closing basis. The question is if that’s allowed the market to work off enough of its overbought conditions to pave the way for another upleg or if it’s a sign that the troops are running out of steam. We’ll see, but for the time-being, this is the bulls’ game to lose, and until we see their dip-buying efforts thwarted, I’ll continue to lean towards the long-side of the ledger.

After gapping lower to start the day, buyers stepped up to the plate just as the S&P 500 fell to the important 1300 level (which has acted as an important support/resistance line over the past year). They weren’t able to get the indices back above the flat-line, but we once again finished well off lows and despite a fair amount of intraday up-and-down over the past 8 trading sessions, we’ve barely budged on a closing basis. The question is if that’s allowed the market to work off enough of its overbought conditions to pave the way for another upleg or if it’s a sign that the troops are running out of steam. We’ll see, but for the time-being, this is the bulls’ game to lose, and until we see their dip-buying efforts thwarted, I’ll continue to lean towards the long-side of the ledger.