The bulls were not in evidence today as the broader market gapped down at the open and stayed down throughout the session.

Once again there was no shortage of issues to focus on, but now we have a new one. That issue being a heightened military tension between the two Korea's. The distrustful nature of that relationship took a decided turn for the worse as artillery fire was exchanged between the two countries overnight. That helped set the tone for today's action.

Today's losses were significant, with the Dow plunging below the 11,000 mark before settling on its 50-day moving average with a loss of 1.9%, while the the S&P 500 shed more than 1.4%.

The Korean military exchange didn't obscure the continuing concerns out of the EU regarding the fragile financial affairs of several of its member states. Ireland has still not completed a bailout package and continues to be a concern, while Portugal, Spain, Italy and Greece simmer in the background.

The I fund was particularly hit hard again as the dollar soared another 1.3% hitting its highest level in two months.

Economic data released today included third quarter GDP, which came in a 2.5%. This was higher than most analysts expectations, but did little to quell market jitters.

The FOMC meeting minutes were released this afternoon. They indicated much division between the FOMC members on where the economy was headed as well as what measures were needed to improve it. In the end I'm sure the indecisiveness that was conveyed in those minutes left market participants even more uncertain on where we're headed than they were before.

Here's today's charts:

No surprise that NAMO and NYMO remained in a sell condition today.

Both NAHL and NYHL flipped back to sells.

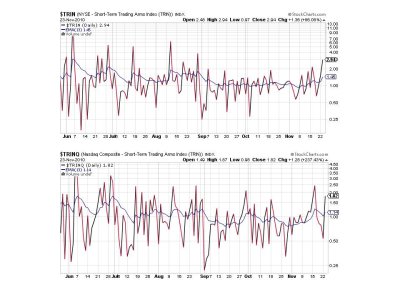

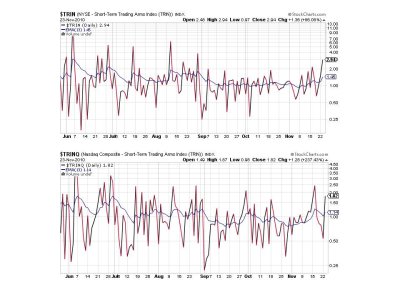

TRIN and TRINQ are also flashing sells. But they are also indicating oversold conditions, which means we may bounce very soon.

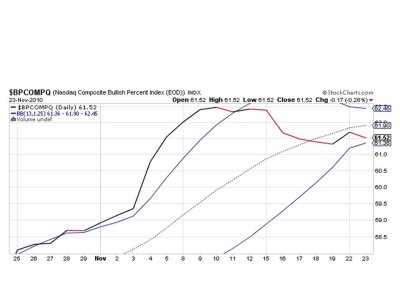

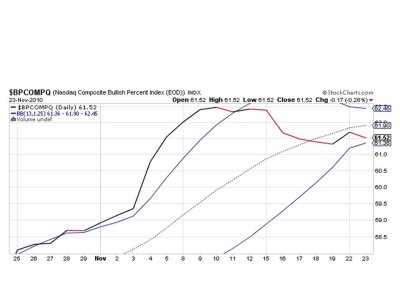

BPCOMPQ remains on a sell.

So all seven signals are in a sell condition, but we are oversold in the very short term, which suggests we'll bounce soon.

So far the Seven Sentinels have sidestepped this downward action and remain on a solid sell. And having our sentiment survey as a backup indicator raises my confidence level that we have not seen the bottom as yet.

Once again there was no shortage of issues to focus on, but now we have a new one. That issue being a heightened military tension between the two Korea's. The distrustful nature of that relationship took a decided turn for the worse as artillery fire was exchanged between the two countries overnight. That helped set the tone for today's action.

Today's losses were significant, with the Dow plunging below the 11,000 mark before settling on its 50-day moving average with a loss of 1.9%, while the the S&P 500 shed more than 1.4%.

The Korean military exchange didn't obscure the continuing concerns out of the EU regarding the fragile financial affairs of several of its member states. Ireland has still not completed a bailout package and continues to be a concern, while Portugal, Spain, Italy and Greece simmer in the background.

The I fund was particularly hit hard again as the dollar soared another 1.3% hitting its highest level in two months.

Economic data released today included third quarter GDP, which came in a 2.5%. This was higher than most analysts expectations, but did little to quell market jitters.

The FOMC meeting minutes were released this afternoon. They indicated much division between the FOMC members on where the economy was headed as well as what measures were needed to improve it. In the end I'm sure the indecisiveness that was conveyed in those minutes left market participants even more uncertain on where we're headed than they were before.

Here's today's charts:

No surprise that NAMO and NYMO remained in a sell condition today.

Both NAHL and NYHL flipped back to sells.

TRIN and TRINQ are also flashing sells. But they are also indicating oversold conditions, which means we may bounce very soon.

BPCOMPQ remains on a sell.

So all seven signals are in a sell condition, but we are oversold in the very short term, which suggests we'll bounce soon.

So far the Seven Sentinels have sidestepped this downward action and remain on a solid sell. And having our sentiment survey as a backup indicator raises my confidence level that we have not seen the bottom as yet.