Bullitt

Market Veteran

- Reaction score

- 73

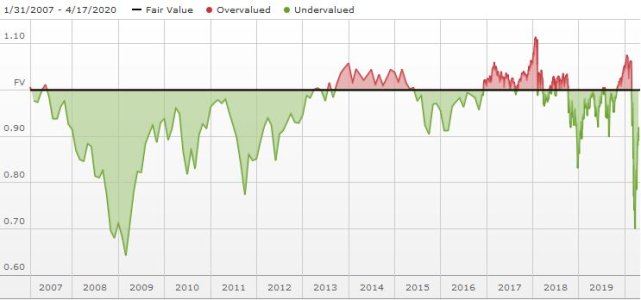

According to Morningstar the universe of stocks they cover is slightly overvalued at 1.04. To put this in perspective, they had a ratio of -.85 (undervalued) in June 2012.

Multpl has a current PE of 18.47 on the S&P, a bit above the median of 14.5. Keep in mind we never got much lower than 14 though at the 2009 nadir.

This guy says US markets and bond markets are generally mid-overbought. Interesting how his charts show GLD still past the mid point of 40.

I don't see an advantage to either the bulls or bears at this juncture.

Multpl has a current PE of 18.47 on the S&P, a bit above the median of 14.5. Keep in mind we never got much lower than 14 though at the 2009 nadir.

This guy says US markets and bond markets are generally mid-overbought. Interesting how his charts show GLD still past the mid point of 40.

I don't see an advantage to either the bulls or bears at this juncture.