Here's a Weekly Chart, illustrating where price resides within the 13-Week Linear Regression Channel.

Why is this important?

From 1962 to today, the 13-Week Standard Deviation 3 Support has only been pierced 26 times and we currently rank 37.

To put this into context, Week-10 of 2025 currently ranks 37th in the bottom 1.1%, of 3,297 weeks.

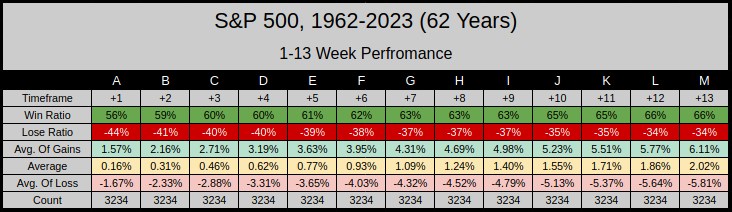

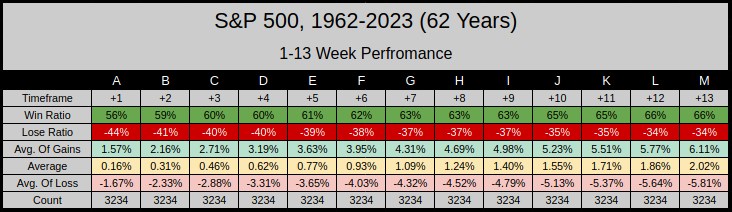

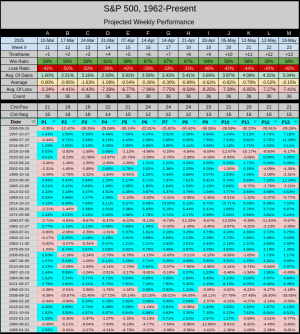

For comparison here's 62 years of 1-13 week performance.

From Column C-M the 3-13 Week Performance has a win ratio 60% or higher.

Column M is a combined 13 weeks of performance (these are not single weeks)

As previous said, we currently rank 37.

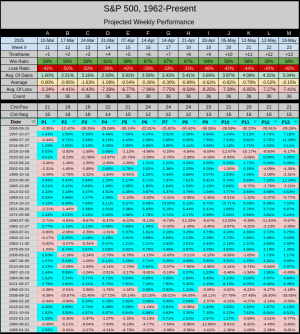

Listed below is the 1-13 week performance after the worst 36 events.

I've added an overlay of 2025's calendar for some perceptive.

The first 3 historical weeks (columns A-C) are the weakest, each below the 60% win ratio.

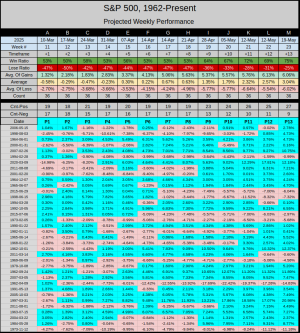

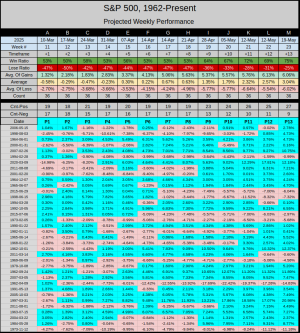

To be fair, since I posted the 1-13 week performance of the 36 worst events...and we currently rank 37,

I'll post the 36 events that were better than 37. So events 38-73, where event 73 ranks in the bottom 2.2%

Generally speaking we're looking for win ratios above 60% and this doesn't happen until Column I.

In summary, historically speaking we look to be in a state of statistical weakness for the next 1-8 weeks.

___The good news, we haven't lost that much on the index.

______Our current worst 3-Week performance is -4.45% ranking in the bottom 7.9%

Cheers...Jason

Why is this important?

From 1962 to today, the 13-Week Standard Deviation 3 Support has only been pierced 26 times and we currently rank 37.

To put this into context, Week-10 of 2025 currently ranks 37th in the bottom 1.1%, of 3,297 weeks.

For comparison here's 62 years of 1-13 week performance.

From Column C-M the 3-13 Week Performance has a win ratio 60% or higher.

Column M is a combined 13 weeks of performance (these are not single weeks)

As previous said, we currently rank 37.

Listed below is the 1-13 week performance after the worst 36 events.

I've added an overlay of 2025's calendar for some perceptive.

The first 3 historical weeks (columns A-C) are the weakest, each below the 60% win ratio.

To be fair, since I posted the 1-13 week performance of the 36 worst events...and we currently rank 37,

I'll post the 36 events that were better than 37. So events 38-73, where event 73 ranks in the bottom 2.2%

Generally speaking we're looking for win ratios above 60% and this doesn't happen until Column I.

In summary, historically speaking we look to be in a state of statistical weakness for the next 1-8 weeks.

___The good news, we haven't lost that much on the index.

______Our current worst 3-Week performance is -4.45% ranking in the bottom 7.9%

Cheers...Jason

Last edited: