Making money with unconventional thinking?

The short answer is yes, but the real question is can you stick with a system though through thick & thin going against what everyone believes to be true? I myself don't have the patience for a system such as this, but this doesn't mean it shouldn't merit consideration from someone who does, so here it is in all its glory. On the daily S&P 500, year to date, given a simple moving average range of 1-50, the 45/27 SMA is the most profitable gaining 18.66%

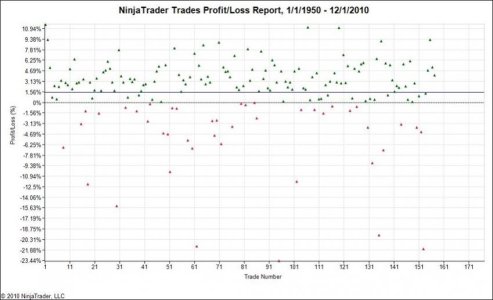

Ok that's cool but does it hold up over time? Here are the yearly averages over multiple time frames. These are tested from Dec 1 2010 working backwards. I took the cumulative profit from each time frame, and divided it by the number of years covered.

5Yr 1.80%

10Yr 1.57%

15Yr 4.99%

20Yr 6.27%

30Yr 8.81%

60Yr 15.60%

Note: Buy/Sell signals were triggered by closing prices, and orders were filled on the next days open (not like TSP's end of day prices.)

Take care and trade safe... Jason