James48843

TSP Talk Royalty

- Reaction score

- 905

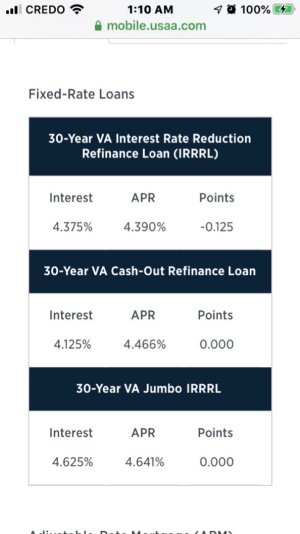

Just an FYI- This morning with the rate cut, that's going to affect Home Mortgage interest rates as well.

I just bought a second home last summer at a 30 year fixed VA loan of 3.65%. And today, it looks like VA 30 year refinance rates are going to fall below 3%.

Might be a good time to asses whether or not a refinance makes sense for you- I am old enough to remember >20% HOME MORTGAGE RATES in early 1980's. I watch rates carefully now to see what might be possible. Just saying. USAA refinance rate yesterday was 3.01%. What will it be tomorrow?

I just bought a second home last summer at a 30 year fixed VA loan of 3.65%. And today, it looks like VA 30 year refinance rates are going to fall below 3%.

Might be a good time to asses whether or not a refinance makes sense for you- I am old enough to remember >20% HOME MORTGAGE RATES in early 1980's. I watch rates carefully now to see what might be possible. Just saying. USAA refinance rate yesterday was 3.01%. What will it be tomorrow?