Bullitt

Market Veteran

- Reaction score

- 75

Seems more anecdotal than evidence based than me. What is more important is what their holdings are, and that's something they will never tell you. Don't forget, it took buy-in from hedge funds to move this market higher. It wasn't all mom and pop buying the dip.

https://www.ft.com/content/e1e1c3ef-1849-46bc-a472-2af8c0aabe5b

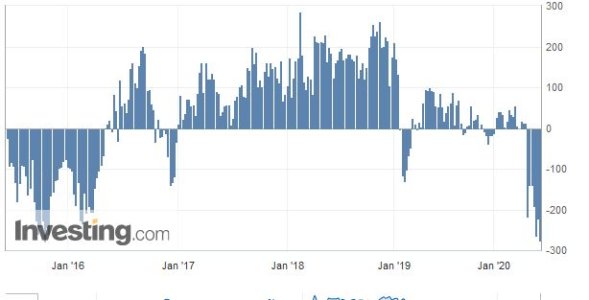

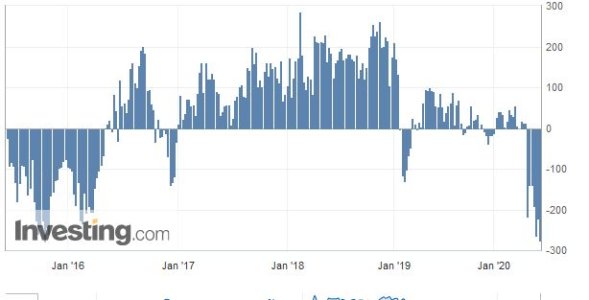

The Commodity Futures Trading Commission's (CFTC) weekly Commitments of Traders (COT) report provides a breakdown of the net positions for "non-commercial" (speculative) traders in U.S. futures markets.

Right now, speculators are net short, same as they were in March.

Hedge funds are getting ready for another slump in stock markets after growing uneasy that surging prices do not reflect the economic problems ahead.

Morgan Stanley said in a recent note that its hedge-fund clients hold a net short position of about $40bn in Euro Stoxx 50 futures. Global macro hedge funds have sharply reduced their exposures to stocks this year, according to JPMorgan Cazenove.

https://www.ft.com/content/e1e1c3ef-1849-46bc-a472-2af8c0aabe5b

The Commodity Futures Trading Commission's (CFTC) weekly Commitments of Traders (COT) report provides a breakdown of the net positions for "non-commercial" (speculative) traders in U.S. futures markets.

Right now, speculators are net short, same as they were in March.