I don't normally post other peoples blogs within my own unless it's something I think can benifit the average TSP investor such as ourselves. Below is Tom Bulkowski's blog from Tuesday. Considering our TSP trading restrictions, I thought you might enjoy some useful information on gaps.

Cheers...Jason

Used with permission

Copyright notice: Unless noted otherwise, all information on this website, including charts, graphs, documents, spreadsheets, web pages, and other media are copyright © 2005-2009 by Thomas N. Bulkowski. All rights reserved. Duplicating any information from this site without permission violates United States law and international copyright treaties. Ask for permission to use the media instead of stealing it.

Cheers...Jason

Used with permission

Copyright notice: Unless noted otherwise, all information on this website, including charts, graphs, documents, spreadsheets, web pages, and other media are copyright © 2005-2009 by Thomas N. Bulkowski. All rights reserved. Duplicating any information from this site without permission violates United States law and international copyright treaties. Ask for permission to use the media instead of stealing it.

In candle speak, a gap is called a rising window or falling window, depending on whether the trend is upward or downward. Thus, I had an opportunity to test gaps in my book, Encyclopedia of Candlestick Charts

, pictured on the left.

, pictured on the left.

I found that they don't work very well as support or resistance zones despite what candle lovers claim. Gaps in an uptrend (rising windows) show underlying support 20% of the time in a bull market and 16% of the time in a bear market. In other words, when price drops and stumbles upon a gap that happened in a prior up trend, price will reverse at or within the gap 20% of the time.

For downtrends (falling windows), price hits overhead resistance setup by a prior gap 25% of the time in a bull market and 33% of the time in a bear market. That means price gaps lower (a downtrend) then curls around and tries to move higher but runs into the gap and reverses.

Let's talk about the types of gaps. There are several. An ex-dividend gap occurs when a company such as an electric utility issues a dividend. Price gaps lower by the amount of the dividend and if price does not move back up to cover the gap, you will see it on the daily chart. It's rare that an ex-dividend gap appears without price closing the gap by day's end.

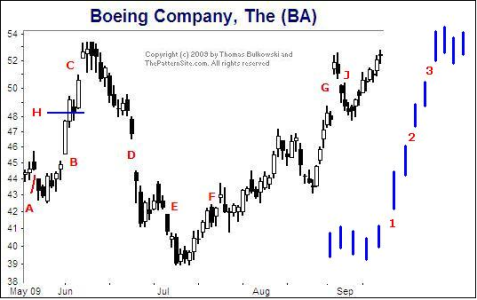

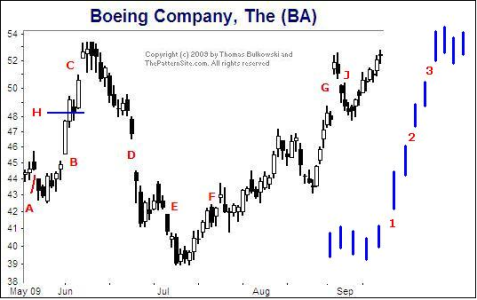

If you are a gap expert, then take this quiz. The chart of Boeing appears on the daily scale. Four gap types appear on the chart: area or common or pattern, breakaway, continuation or measuring or runaway, and exhaustion. Identify which names apply to which gap on the chart and include gaps 1, 2, and 3.

Area Gaps

I found that they don't work very well as support or resistance zones despite what candle lovers claim. Gaps in an uptrend (rising windows) show underlying support 20% of the time in a bull market and 16% of the time in a bear market. In other words, when price drops and stumbles upon a gap that happened in a prior up trend, price will reverse at or within the gap 20% of the time.

For downtrends (falling windows), price hits overhead resistance setup by a prior gap 25% of the time in a bull market and 33% of the time in a bear market. That means price gaps lower (a downtrend) then curls around and tries to move higher but runs into the gap and reverses.

Let's talk about the types of gaps. There are several. An ex-dividend gap occurs when a company such as an electric utility issues a dividend. Price gaps lower by the amount of the dividend and if price does not move back up to cover the gap, you will see it on the daily chart. It's rare that an ex-dividend gap appears without price closing the gap by day's end.

If you are a gap expert, then take this quiz. The chart of Boeing appears on the daily scale. Four gap types appear on the chart: area or common or pattern, breakaway, continuation or measuring or runaway, and exhaustion. Identify which names apply to which gap on the chart and include gaps 1, 2, and 3.

Area Gaps

Area gaps occur frequently, but price really doesn't move very far. On the chart, A and F are area gaps. F is the best example. Price gaps upward and the next day, price retraces and closes or fills the gap. Gap A could be a breakaway gap but price just doesn't move far. It doesn't trend like you see in breakaway gaps.

Breakaway Gaps

Breakaway Gaps

Speaking of breakaway gaps, what are they? These are key players on the gap scene. They appear when price breaks away from a congestion area. On the chart, B and E are breakaway gaps. Look at B. Price leaves an area where there was lots of price overlap. In that congestion region, price moved sideways without really establishing a trend. The B gaps changed that. It began a straight-line move higher.

Exhaustion Gap

Exhaustion Gap

Exhaustion gaps frequently occur after a breakaway gap has begun a trend. Exhaustion gaps signal an end of the trend. After one appears, price tends to fill the gap within a few days, forming a congestion region. Examples of this are gaps C, D, and G.

G is a good example of an exhaustion gap. Price gaps higher then curls around, forming a breakaway gap (J) and price moves lower, filling the gap at G.

Why is gap D an exhaustion gap? Often very tall gaps will be exhaustion gaps. That makes sense because traders want to take profits after a large gap, which causes price to reverse and fill the gap or attempt to do so. Large gaps may not fill due to their size. D is an exhaustion gap because of its size and because it runs into a congestion area in a few days.

Continuation Gaps

G is a good example of an exhaustion gap. Price gaps higher then curls around, forming a breakaway gap (J) and price moves lower, filling the gap at G.

Why is gap D an exhaustion gap? Often very tall gaps will be exhaustion gaps. That makes sense because traders want to take profits after a large gap, which causes price to reverse and fill the gap or attempt to do so. Large gaps may not fill due to their size. D is an exhaustion gap because of its size and because it runs into a congestion area in a few days.

Continuation Gaps

You could argue that D is a continuation gap (because price continues lower for two more days). Continuation gaps occur when price breaks out of a congestion zone, often in a 3 gap sequence: breakaway, continuation, exhaustion. If D is a continuation gap, the downtrend should have begun with a breakaway gap (but not always, so allow flexibility here) and the gap should be located about midway along the trend. A good location for a continuation gap would be at H. The trend begins with a breakaway gap and ends with an exhaustion gap. Unfortunately, no continuation gap appears on the price chart. They are rare.

I show a continuation gap at 2. Price breaks out of congestion at 1 in a breakaway gap, then a continuation gap appears about midway along the trend, followed by an exhaustion gap at 3. If you see a breakaway gap followed by another gap that does not close in a day or two, then it's probably a continuation gap. Measure the move from the breakaway gap to the continuation gap and project it in the trend direction to get an estimate of where price will likely stall. A third gap along the chain often means the trend is ending.

If you want more details about gaps, such as how soon they close, then consult pages 362 to 373 in my book, Encyclopedia of Chart Patterns, second edition

, pictured on the right.

, pictured on the right.

For traders, gaps are handy. When price gaps out of a congestion area, that often means price will continue higher in a breakaway gap especially if accompanied by high volume.

Continuation gaps occur in the middle of trends and help you predict how long the trend will last.

Exhaustion gaps occur after a trend is in progress. They end the trend.

Area gaps are just a pain in the ass because they look like breakaway gaps and fool you into thinking a trend has started. Be cautious.

-- Thomas Bulkowski

I show a continuation gap at 2. Price breaks out of congestion at 1 in a breakaway gap, then a continuation gap appears about midway along the trend, followed by an exhaustion gap at 3. If you see a breakaway gap followed by another gap that does not close in a day or two, then it's probably a continuation gap. Measure the move from the breakaway gap to the continuation gap and project it in the trend direction to get an estimate of where price will likely stall. A third gap along the chain often means the trend is ending.

If you want more details about gaps, such as how soon they close, then consult pages 362 to 373 in my book, Encyclopedia of Chart Patterns, second edition

For traders, gaps are handy. When price gaps out of a congestion area, that often means price will continue higher in a breakaway gap especially if accompanied by high volume.

Continuation gaps occur in the middle of trends and help you predict how long the trend will last.

Exhaustion gaps occur after a trend is in progress. They end the trend.

Area gaps are just a pain in the ass because they look like breakaway gaps and fool you into thinking a trend has started. Be cautious.

-- Thomas Bulkowski