The average G-fund allocation among TSP Talk AutoTracker members is more than 35% and growing. This makes the G-fund the most held TSP fund among members, with the S-fund the second most held with an average allocation of 27%.

Last week was the second consecutive week where the G-fund was the main destination for members who spent an IFT.

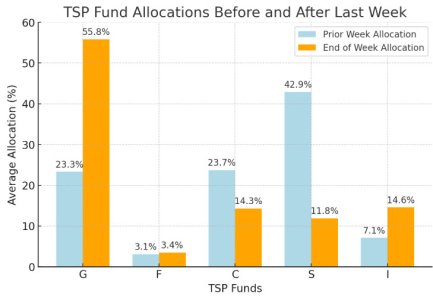

Forty-five non-premium TSP Talk AutoTracker members made IFTs, significantly shifting their allocations. By the end of the week, their average G-fund allocation had risen to 55.8%, up from 23.3% at the start—a jump of 32.6 percentage points. The biggest reduction was in the S-fund, which fell from 42.9% to 11.8%, a decrease of 31.1 percentage points. Meanwhile, the I-fund more than doubled, rising from 7.1% to 14.6%. This highlights a strong shift toward the safety of the G-fund and increased interest in the I-fund, while allocations to riskier stock funds, particularly the S-fund, saw steep declines.

This latest preference for the G-fund is most prominent among the best performing TSP Talk AutoTracker members of 2025. Coming into today, 11 AutoTracker members are outperforming the I-fund for the year. The average allocation of these top 11 is:

Among the top 100 returns of 2025, the average G-fund allocation is 60.8%, while the I-fund is the most held TSP stock fund with an average of 17.7%. Meanwhile, these top 100 hold a mere 4.9% of the S-fund.

Last week the S-fund lost over 3% in value and dragged its investors down the TSP Talk AutoTracker standings. TSP investors who have held onto the fund must decide whether to lock in those losses and join their peers in the safety in the G-fund or to continue to hold the S-fund with expectations it will bounce back.

Investors who have been sitting in the G-fund may be wanting to catch that potential bounce as well. Our TSP investment community has a lot of cash waiting to be invested, and I wonder how this compares to cash levels in the broader market.

If you find TSP Talk AutoTracker trends valuable, a subscription to the Last Look Report could be a great resource. Every morning, 30 minutes before the TSP trade deadline, we analyze the latest AutoTracker moves and market activity to help you make informed investment decisions. Create a Premium Service Account and subscribe for a month of the Last Look Report for only $10.

Here was today's Last Look Report.

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last week was the second consecutive week where the G-fund was the main destination for members who spent an IFT.

Forty-five non-premium TSP Talk AutoTracker members made IFTs, significantly shifting their allocations. By the end of the week, their average G-fund allocation had risen to 55.8%, up from 23.3% at the start—a jump of 32.6 percentage points. The biggest reduction was in the S-fund, which fell from 42.9% to 11.8%, a decrease of 31.1 percentage points. Meanwhile, the I-fund more than doubled, rising from 7.1% to 14.6%. This highlights a strong shift toward the safety of the G-fund and increased interest in the I-fund, while allocations to riskier stock funds, particularly the S-fund, saw steep declines.

This latest preference for the G-fund is most prominent among the best performing TSP Talk AutoTracker members of 2025. Coming into today, 11 AutoTracker members are outperforming the I-fund for the year. The average allocation of these top 11 is:

G: 81.8%, F: 0.0%, C: 4.5%, S: 13.6%, I: 0.0%

Among the top 100 returns of 2025, the average G-fund allocation is 60.8%, while the I-fund is the most held TSP stock fund with an average of 17.7%. Meanwhile, these top 100 hold a mere 4.9% of the S-fund.

Last week the S-fund lost over 3% in value and dragged its investors down the TSP Talk AutoTracker standings. TSP investors who have held onto the fund must decide whether to lock in those losses and join their peers in the safety in the G-fund or to continue to hold the S-fund with expectations it will bounce back.

Investors who have been sitting in the G-fund may be wanting to catch that potential bounce as well. Our TSP investment community has a lot of cash waiting to be invested, and I wonder how this compares to cash levels in the broader market.

If you find TSP Talk AutoTracker trends valuable, a subscription to the Last Look Report could be a great resource. Every morning, 30 minutes before the TSP trade deadline, we analyze the latest AutoTracker moves and market activity to help you make informed investment decisions. Create a Premium Service Account and subscribe for a month of the Last Look Report for only $10.

Here was today's Last Look Report.

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.