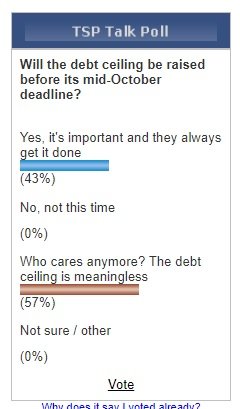

Hi FWM. I don't think I worded the poll very well. I actually reworded choice 3 before I saw this post...

From: "Who cares anymore? The debt ceiling is meaningless"

To: "Why do we even have a debt ceiling if we keep raising it?"

The debt ceiling is obviously important because of the ramifications if we can't legally pay our debts, but the fact that they raise it every year makes it kind of a lark.

Sorry if the poll started a political discussion, but I figured this one can be agreed on by most people since both parties are out of control with spending.

I know how much many of you want to talk politics, but I'd be left to clean up the mess. There are other places for that. So I'll close this thread since we know how it will end up.

Thanks.

From: "Who cares anymore? The debt ceiling is meaningless"

To: "Why do we even have a debt ceiling if we keep raising it?"

The debt ceiling is obviously important because of the ramifications if we can't legally pay our debts, but the fact that they raise it every year makes it kind of a lark.

Sorry if the poll started a political discussion, but I figured this one can be agreed on by most people since both parties are out of control with spending.

I know how much many of you want to talk politics, but I'd be left to clean up the mess. There are other places for that. So I'll close this thread since we know how it will end up.

Thanks.