- Reaction score

- 2,496

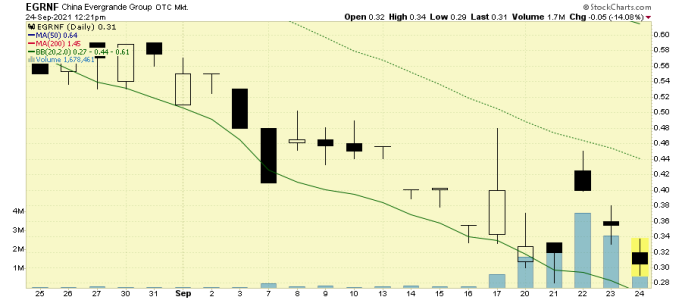

China’s embattled developer Evergrande is on the brink of default. Here’s why it matters

https://www.cnbc.com/2021/09/17/chi...t-crisis-bond-default-and-investor-risks.html

KEY POINTS

Snowed under its crushing debt of $300 billion, Evergrande is so huge that the fallout from any failure could hurt not just China’s economy. Contagion could spread to markets beyond China.

Here’s how big Evergrande is, how bad its debt problems are, and what’s next.

"Evergrande’s collapse would be the biggest test that China’s financial system has faced in years."

Mark Williams

CAPITAL ECONOMICS, CHIEF ASIA ECONOMIST

https://www.cnbc.com/2021/09/17/chi...t-crisis-bond-default-and-investor-risks.html