I don't want to read too much into this week's Tracker charts as stock allocations didn't shift enough to try and draw any major conclusions, but on a more subtle level the Top 50 pulled back a bit, while the Total Tracker charts show the herd took a more bullish position in spite of some worrisome market movements (dollar, commodities, oil, treasuries).

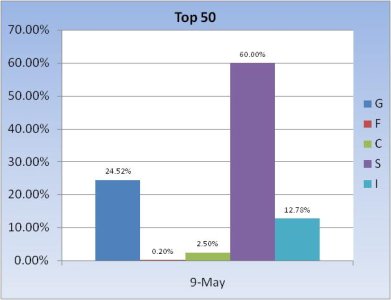

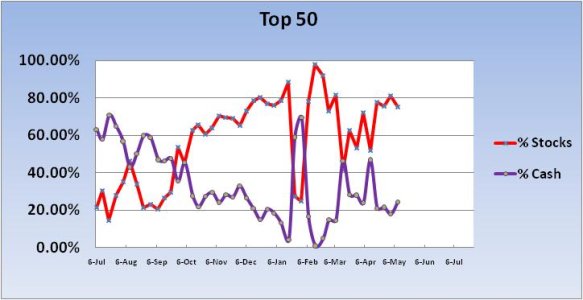

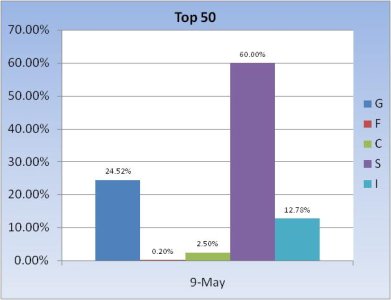

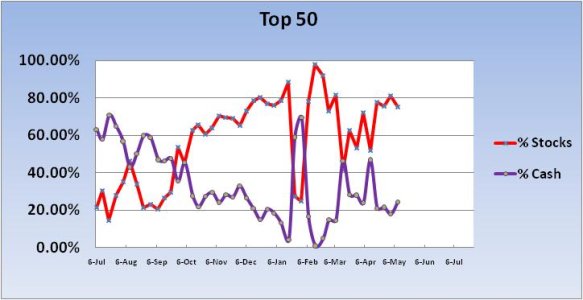

As you can see, the Top 50 backed off their stock allocations a bit (-6.10% to be exact). That's not a particularly big shift, but it's an indication that some in this group became defensive.

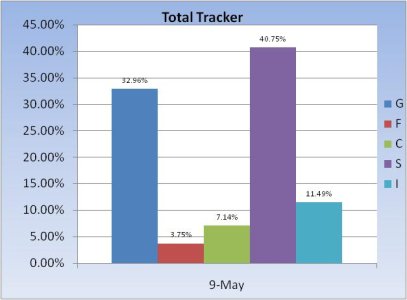

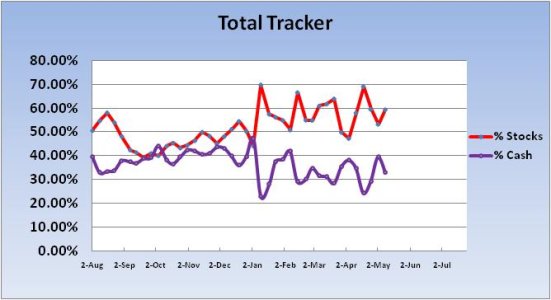

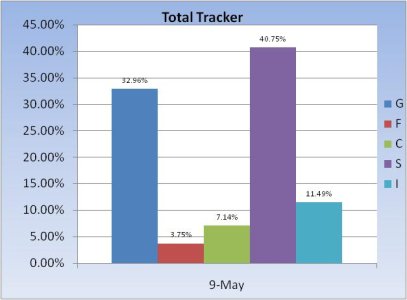

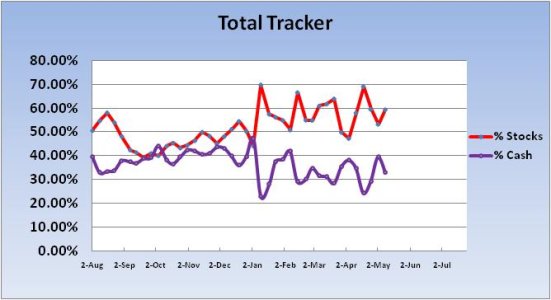

On the other hand, we (the herd) increased our collective stock allocations by 6.14%. That's more meaningful in my eyes as this group tends to move in smaller shifts. Anything over 5% is notable. They were correct last week when they had dropped their stock allocation by more than 6% and the market fell hard. It's a tough call this week though as the past 5 times this group increased their stock allocation by more than 5% they were correct 3 of 5 times. That's since the first week of July 2010.

Our sentiment survey went to a buy for this week, so that's supportive of this bullish shift in allocations.

I'm thinking the market still has some downside left in it, but that we could hit that low by mid-week and rally from there. That's my prediction for this week.

As you can see, the Top 50 backed off their stock allocations a bit (-6.10% to be exact). That's not a particularly big shift, but it's an indication that some in this group became defensive.

On the other hand, we (the herd) increased our collective stock allocations by 6.14%. That's more meaningful in my eyes as this group tends to move in smaller shifts. Anything over 5% is notable. They were correct last week when they had dropped their stock allocation by more than 6% and the market fell hard. It's a tough call this week though as the past 5 times this group increased their stock allocation by more than 5% they were correct 3 of 5 times. That's since the first week of July 2010.

Our sentiment survey went to a buy for this week, so that's supportive of this bullish shift in allocations.

I'm thinking the market still has some downside left in it, but that we could hit that low by mid-week and rally from there. That's my prediction for this week.