Axial-Drifter Update for 20 Dec 2009

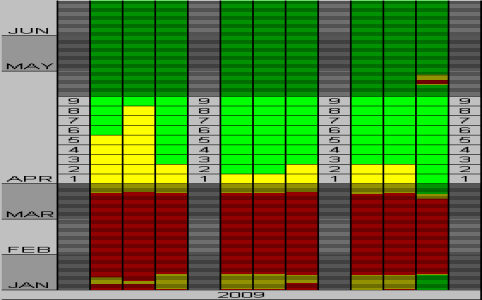

If you recall, this is a 2 out of 3 system. If 2 signals within a fund go into a sell the fund goes into a sell. If two funds go into a sell the entire systems exits to the G-Fund.

For now CSI funds remain on a buy. While both the S3 and I3 signals are on a sell, without confirmation from their counterparts the S & I funds themselves remain on a buy.

The C-Fund's C1 & C2 are establishing a pullback while C3 has pulled far ahead of the other two.

The S-Fund's S1 & S2 are in a healthy uptrend while S3 has been in a flat state of <link rel="File-List" href="file:///C:%5CDOCUME%7E1%5CAdmun%5CLOCALS%7E1%5CTemp%5Cmsohtml1%5C01%5Cclip_filelist.xml"><!--[if gte mso 9]><xml> <w:WordDocument> <w:View>Normal</w:View> <w:Zoom>0</w:Zoom> <w

Both the I-Fund's I1 and I2 signals are declining rapidly. If the overseas markets don't turn around then I'd expect the I1 signal to go into a sell in a week or two. I3 is on a strong sell.