12/19/25

It was one of the more frustrating 53-point gains for the S&P 500 that we've seen in a while, and that's because the highs of the day were made in early trading; 41-points higher, and the stock market spent the afternoon giving mush of those gains back. There was a lot of green in the indices but we may have a set up for a retest of Wednesday's lows before next week "official" Santa Claus rally gets underway.

Micron's earnings and 10% gain did perk up the tech sector as the Nasdaq led with a gain of 1.4% yesterday, but that was well off the highs similar to the other indices.

This is an options expiration week so some of the volatility could be related. And of course next week starts the bullish Santa Claus rally period, which officially goes into the first few days of January.

The CPI inflation data came in much cooler than expected, but like the jobs data may have been artificially low because of the government shutdown, some argue this inflation data was also impacted by the shutdown and was also "artificially low."

That could be why the knee-jerk reaction was a strong pop higher in morning trading, but once they started circulating the shutdown theory, we saw selling kick in, and the intraday chart on Thursday looks rather lackluster despite the impressive daily gain, and the sharp 20-point decline into the final minutes of trading was alarming.

That said, rents have declined four months in a row, and that sounds like a pattern, so maybe this data is getting better with or without the shutdown?

If the S&P 500 (C-fund) daily chart closed near the highs, I would be a lot more confident about calling for a right shoulder low, but it almost turned into a negative reversal day, although not quite because of the big gain, but if we look at other recent smack down days that closed on the lows, like we saw on Wednesday, we do see another test of those lows before the market eventually moved higher. See the red and blue arrows below.

On the other hand, that would be fine, a retest, as long as it holds, and the stochastic indicator (Fast STO) that I showed the other day, has turned up like those other lows, so perhaps a little patience is needed. The problem is, the Santa Claus rally is due next week and some of us may be running out of patience.

I don't know what happened with bitcoin yesterday. I was seeing some good signs that it could be stabilizing, then yesterday, after a big overnight rally and just before 4 PM GMT (11 AM ET: bitcoin trades 24/7), it started to tumble and stocks followed suit.

Dow component Nike was tumbling after releasing earnings Thursday evening, and FedEx was trading higher after hours post earnings.

We will get some homes sales data today, plus the Michigan Consumer Sentiment data. Today is also an expiration Friday and trading volume should be quite high.

The DWCPF Index (S-Fund) had a nice gain, but the chart suggests it wasn't as pretty as the gains would imply. It was a negative reversal day, and like I have said above, it may need another test of the lows on this expiration Friday. Of course those lows really need hold to keep the bullish end of year outlook alive.

ACWX (I-fund) gained nearly 1% on the day, but again a negative reversal on the chart tarnishes those gains to some degree. The old broken support line of the F-flag is acting was resistance for a second straight day. That resistance is rising, however.

BND (bonds / F-fund) rallied on the cool inflation data and it is now comfortably above the support lines, after struggling for a couple of weeks above and below it. There is an open gap overhead that may be a target for now, and a new gap was opened below near 74.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

It was one of the more frustrating 53-point gains for the S&P 500 that we've seen in a while, and that's because the highs of the day were made in early trading; 41-points higher, and the stock market spent the afternoon giving mush of those gains back. There was a lot of green in the indices but we may have a set up for a retest of Wednesday's lows before next week "official" Santa Claus rally gets underway.

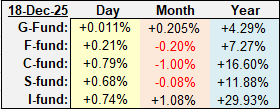

| Daily TSP Funds Return More returns More returns |

Micron's earnings and 10% gain did perk up the tech sector as the Nasdaq led with a gain of 1.4% yesterday, but that was well off the highs similar to the other indices.

This is an options expiration week so some of the volatility could be related. And of course next week starts the bullish Santa Claus rally period, which officially goes into the first few days of January.

The CPI inflation data came in much cooler than expected, but like the jobs data may have been artificially low because of the government shutdown, some argue this inflation data was also impacted by the shutdown and was also "artificially low."

That could be why the knee-jerk reaction was a strong pop higher in morning trading, but once they started circulating the shutdown theory, we saw selling kick in, and the intraday chart on Thursday looks rather lackluster despite the impressive daily gain, and the sharp 20-point decline into the final minutes of trading was alarming.

That said, rents have declined four months in a row, and that sounds like a pattern, so maybe this data is getting better with or without the shutdown?

If the S&P 500 (C-fund) daily chart closed near the highs, I would be a lot more confident about calling for a right shoulder low, but it almost turned into a negative reversal day, although not quite because of the big gain, but if we look at other recent smack down days that closed on the lows, like we saw on Wednesday, we do see another test of those lows before the market eventually moved higher. See the red and blue arrows below.

On the other hand, that would be fine, a retest, as long as it holds, and the stochastic indicator (Fast STO) that I showed the other day, has turned up like those other lows, so perhaps a little patience is needed. The problem is, the Santa Claus rally is due next week and some of us may be running out of patience.

I don't know what happened with bitcoin yesterday. I was seeing some good signs that it could be stabilizing, then yesterday, after a big overnight rally and just before 4 PM GMT (11 AM ET: bitcoin trades 24/7), it started to tumble and stocks followed suit.

Dow component Nike was tumbling after releasing earnings Thursday evening, and FedEx was trading higher after hours post earnings.

We will get some homes sales data today, plus the Michigan Consumer Sentiment data. Today is also an expiration Friday and trading volume should be quite high.

The DWCPF Index (S-Fund) had a nice gain, but the chart suggests it wasn't as pretty as the gains would imply. It was a negative reversal day, and like I have said above, it may need another test of the lows on this expiration Friday. Of course those lows really need hold to keep the bullish end of year outlook alive.

ACWX (I-fund) gained nearly 1% on the day, but again a negative reversal on the chart tarnishes those gains to some degree. The old broken support line of the F-flag is acting was resistance for a second straight day. That resistance is rising, however.

BND (bonds / F-fund) rallied on the cool inflation data and it is now comfortably above the support lines, after struggling for a couple of weeks above and below it. There is an open gap overhead that may be a target for now, and a new gap was opened below near 74.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.