A quick review of February, then a deep dive into March's performance.

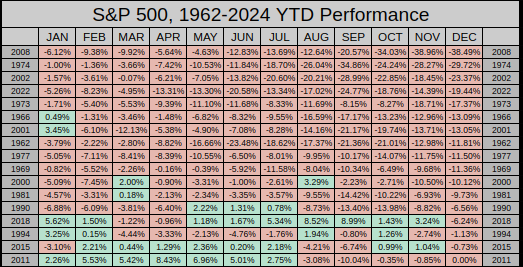

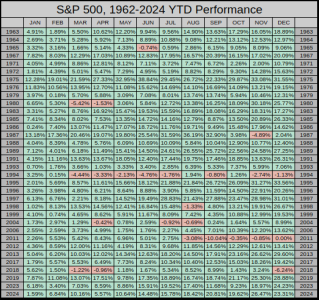

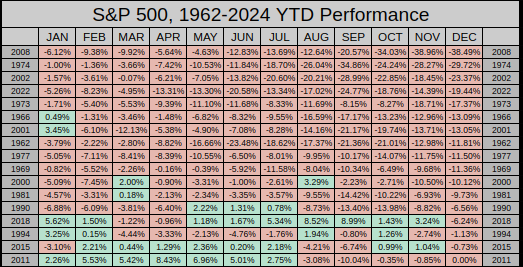

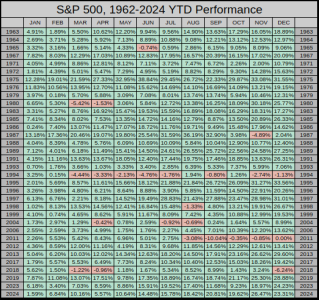

Feb-2025 ranked 40th best of 64 February. Not impressive (although February has never been an impressive month).

On the brighter side, of the 30 February which closed down, Feb-2025 ranked 6th best.

This is not the case for Jan/Feb 2025, but of the 17 years the Index closed down, a common theme is present, 168 of 204 months were down YTD.

For down years, the majority of those months on the YTD timeframe stayed in the red.

For 2025, both Jan & Feb are positive YTD, under those circumstances the index closed positive 31 of 34 times.

Let's forget (for a moment) that February closed down and we have a somewhat dire news cycle.

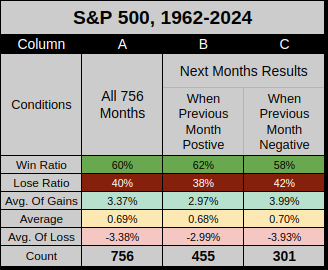

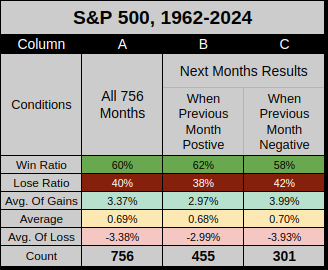

The baseline win ratio for all 756 months is 60%, but here's what's interesting.

___If the previous month closes positive the win ratio increases to 62%

___If the previous month closes negative the win ratio decreases to 58%

___Regardless of how any given month closes, there's only a 2% difference in the next month's win ratio.

Even if I cherry picked the worst months, it's still not that bad.

___From the Bottom-20 worst months, the next month had a 55% win ratio.

___From the Bottom 20% (worst 151 months) the next month had a 54% win ratio.

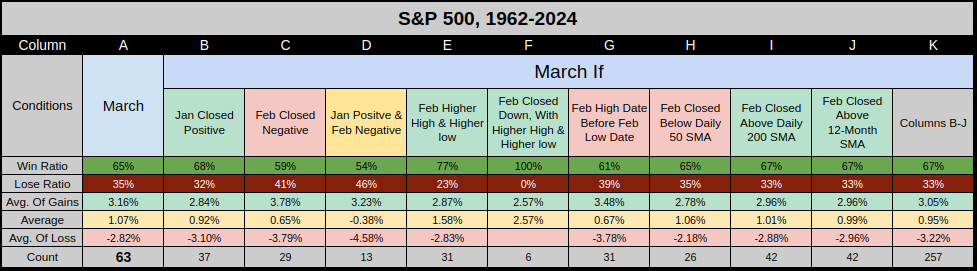

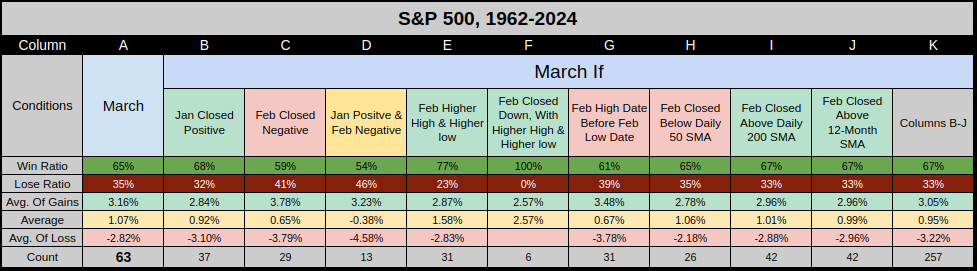

Going into the Month of March, here are the present conditions.

Column A shows March has a 65% baseline win ratio.

___From columns B-J, six of nine are = to or > than 65%.

___This is subjective, but I would view Column E as the most statistically relevant, as Feb-2025 did make a higher monthly high & low.

___But I'm also interested in Column G, where Feb's Monthly High was before the monthly low.

___The least relevant data would be column F, which has only happened 6 times.

Column K consolidates columns B-J, giving us an estimated 67% win ratio using 257 points of filtered data.

Lastly we have 3 pieces of data which are interesting, but not important.

___The last 4 March have closed positive with an average gain of 3.61%

___March was the yearly low 6 times, (the 3rd worst) behind Jan @ 26, and Oct @ 7

___We've just completed 6 alternating up/down months, Sep-Up, Oct-Dwn, Nov-Up, Dec-Dwn, Jan-Up, Feb-Dwn.

That's it, have a great month... Jason

Feb-2025 ranked 40th best of 64 February. Not impressive (although February has never been an impressive month).

On the brighter side, of the 30 February which closed down, Feb-2025 ranked 6th best.

This is not the case for Jan/Feb 2025, but of the 17 years the Index closed down, a common theme is present, 168 of 204 months were down YTD.

For down years, the majority of those months on the YTD timeframe stayed in the red.

For 2025, both Jan & Feb are positive YTD, under those circumstances the index closed positive 31 of 34 times.

Let's forget (for a moment) that February closed down and we have a somewhat dire news cycle.

The baseline win ratio for all 756 months is 60%, but here's what's interesting.

___If the previous month closes positive the win ratio increases to 62%

___If the previous month closes negative the win ratio decreases to 58%

___Regardless of how any given month closes, there's only a 2% difference in the next month's win ratio.

Even if I cherry picked the worst months, it's still not that bad.

___From the Bottom-20 worst months, the next month had a 55% win ratio.

___From the Bottom 20% (worst 151 months) the next month had a 54% win ratio.

Going into the Month of March, here are the present conditions.

Column A shows March has a 65% baseline win ratio.

___From columns B-J, six of nine are = to or > than 65%.

___This is subjective, but I would view Column E as the most statistically relevant, as Feb-2025 did make a higher monthly high & low.

___But I'm also interested in Column G, where Feb's Monthly High was before the monthly low.

___The least relevant data would be column F, which has only happened 6 times.

Column K consolidates columns B-J, giving us an estimated 67% win ratio using 257 points of filtered data.

Lastly we have 3 pieces of data which are interesting, but not important.

___The last 4 March have closed positive with an average gain of 3.61%

___March was the yearly low 6 times, (the 3rd worst) behind Jan @ 26, and Oct @ 7

___We've just completed 6 alternating up/down months, Sep-Up, Oct-Dwn, Nov-Up, Dec-Dwn, Jan-Up, Feb-Dwn.

That's it, have a great month... Jason