2010: One tool in the shed won't build a house. The myth of moving average crossovers.

Moving average crossovers are a unique tool within the realm of technical analysis. While many of us are led to believe they are effective, over the course of thousands of scans I've come to believe differently.

One thing about moving average crossovers is how some work better during certain periods, while others work better for others. The thing is there isn't one that works better then others over multiple periods of time.

Case in point, here is one example of many I've come across. Using End Of Day Prices I'll do an optimized scan using numbers 1-50 for an SMA crossover during the year 2000. During that time a 36/10 contrarian SMA shows up as the most profitable. The very next year, a 36/10 SMA doesn't even show up in the top 1000.

Moving on: Here is the S&P 500 chart from 12 September 1996 to 6 March 2009. I chose this period of time because it was roughly a 666 to 666 price over 12 years representing two distinct Bull & Bear markets.

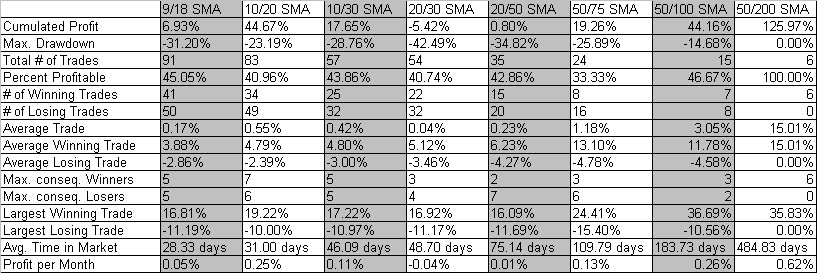

Now here are some scans I've done using commonly used SMA crossovers. I've added in a few rules such as buy/sell signals are produced based on End of day prices and delayed an extra day. This keeps the scans within TSP's EOB rules, but I should point out I didn't filter in the two IFT limit we are under. And here are the results.

The Golden Cross 50/200 SMA was the most profitable with 125.97% using just 6 trades and averaging .62% a month, or just 8.16% a year.

Point of this blog being, by itself SMA crossovers can be ineffective. While I do like using moving averages as a tool, I consider them to be one of many tools needed within technical analysis.

Cheers...Jason